Mergers and acquisitions are complex business deals that bring two companies together to create new opportunities, expand their market influence, and achieve strategic goals. Whatever your purpose, the key to successful outcomes is the proper transaction structure.

Read on to explore the essentials and get the answers to the following questions:

- What is a merger and acquisition deal structure?

- What are the basic terms of M&A deal structuring?

- What are common deal structures in M&A?

- What are considerations in choosing the right deal structure?

- How to structure an M&A deal?

What is an M&A deal structure?

A merger and acquisition deal structure is a binding agreement between merger and acquisition parties specifying their entitlements and obligations in the transaction. It covers provisions detailing how the purchase price will be paid, compliance with legal and regulatory standards, and the distribution of risks and rewards between a buyer and a seller.

Why understanding deal structure matters for a buyer and target company

Knowing the ins and outs of M&A structuring is essential for both buyers and sellers to optimize their potential for success. Here is how it impacts both parties:

- Buyer

A well-structured deal can enhance profitability by minimizing risks and maximizing operational synergies. It allows acquirers to negotiate favorable transaction terms, secure financing efficiently, and integrate acquired assets smoothly into their existing operations.

- Seller

Effective structuring can attract more competitive offers, optimize tax implications, and ensure a seamless transition that safeguards the target’s interests post-sale. Moreover, the right deal structuring enables sellers to maintain control over the process, mitigate potential liabilities, and achieve their desired financial and strategic goals.

Whether you are a buyer or a target company, understanding deal structuring allows you to navigate negotiations confidently, capitalize on opportunities, and achieve a more favorable outcome aligning with your long-term objectives.

Basic terms of M&A deal structuring

The following terms and concepts are fundamental to shaping the financial, operational, and strategic aspects of the deal cycle M&A:

| Term | Definition | Relevance |

| Equity |

Ownership interest in a company represented by shares of stock. |

🔸 Determines ownership structure post-acquisition 🔸 Influences control and voting rights 🔸 Can be used as a consideration in M&A transactions |

| Debt |

Funds borrowed by a company with the obligation to repay the principal amount plus interest over time. |

🔸 Impacts capital structure 🔸 Affects cash flow management and the financial health of the acquiring company |

| Earnouts |

Contingent payments based on achieving specific performance metrics or milestones post-acquisition. |

🔸 Aligns interests of both companies involved 🔸 Bridges valuation gaps 🔸 Incentivizes sellers to achieve agreed-upon business goals after the transaction |

| Escrow |

Funds or assets held by a third party during the transaction to secure obligations such as indemnification claims or purchase price adjustments. |

🔸 Provides security to both parties by ensuring that financial obligations are met 🔸 Reduces risks related to post-closing disputes or liabilities |

| Valuation |

Process of determining the economic value of a company or its assets. |

🔸 Shapes pricing negotiations 🔸 Determines the fairness and economic viability of the transaction for both parties |

| Due diligence |

A comprehensive investigation conducted by the buyer to assess the financial, legal, operational, and strategic aspects of the target company. |

🔸 Enables informed decision-making 🔸 Identifies risks and opportunities 🔸 Reduces potential post-acquisition disputes |

Now that you understand the concept of deal structure, let’s explore its forms.

Types of merger deal structures

Here are some common types of structuring a merger or acquisition deal, with their advantages and disadvantages:

1. Asset acquisition

An asset purchase is a deal where the purchaser buys specific assets or business divisions of the target company. The purchaser solely obtains the necessary assets for running the business, including intellectual property, equipment, and real estate. The seller keeps ownership of the remaining assets, such as liabilities and responsibilities.

Pros

- Selective acquisition of assets

- Potential tax benefits

- Simpler approval process

Cons

- Complex asset transfers

- Higher legal and administrative costs

- Potential tax liabilities for the seller

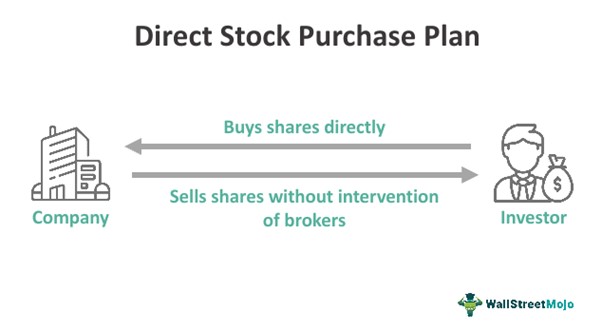

2. Stock purchase

Unlike an asset acquisition, a stock purchase acquisition is a deal where the buyer acquires all or a controlling interest in the target company’s stock. The purchaser gains control over the entire business, including its assets, debts, and obligations. Typically, these deals are structured as cash transactions or a combination of cash and shares.

Pros

- Complete control over the entire business

- Continuity of operations

- Simple taxation

Cons

- Complex due diligence

- Potential shareholder issues

- Assumption of all liabilities

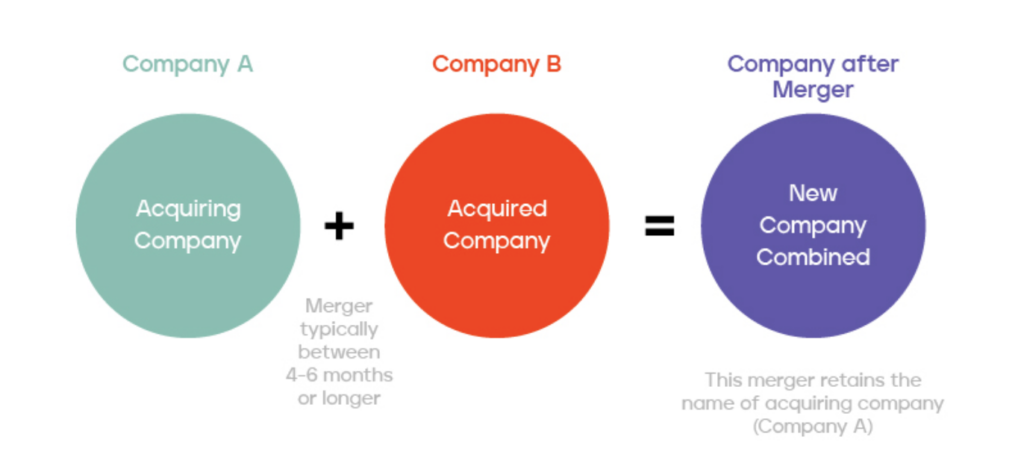

3. Merger

A merger is a deal in which two or more companies combine to establish a new business entity. The merging organizations consolidate their assets, liabilities, and activities. This transaction can be structured as a stock-for-stock exchange, cash-for-stock exchange, or a combination.

Pros

- Synergy benefits and cost savings

- Simplified operations

- Strategic growth and market access

Cons

- Culture integration challenges

- May require regulatory approval

- Dilution of control for shareholders

| 👁️🗨️ Learn more about mergers: What is a reverse triangular merger? |

4. Leveraged buyout

A leveraged buyout is a deal in which the purchaser relies on borrowed funds to acquire the target company. The buyer takes out a loan to cover the purchase price, and the debt is settled using the target company’s cash flow. Typically, the acquirer uses the target company’s assets as collateral for debt.

Pros

- Enables acquisitions with minimal upfront capital

- Potential for high returns if performance improves

- Tax benefits from deductible interest payments

Cons

- High financial risk due to debt

- Operational pressure to generate sufficient cash flow

- Risk of asset stripping

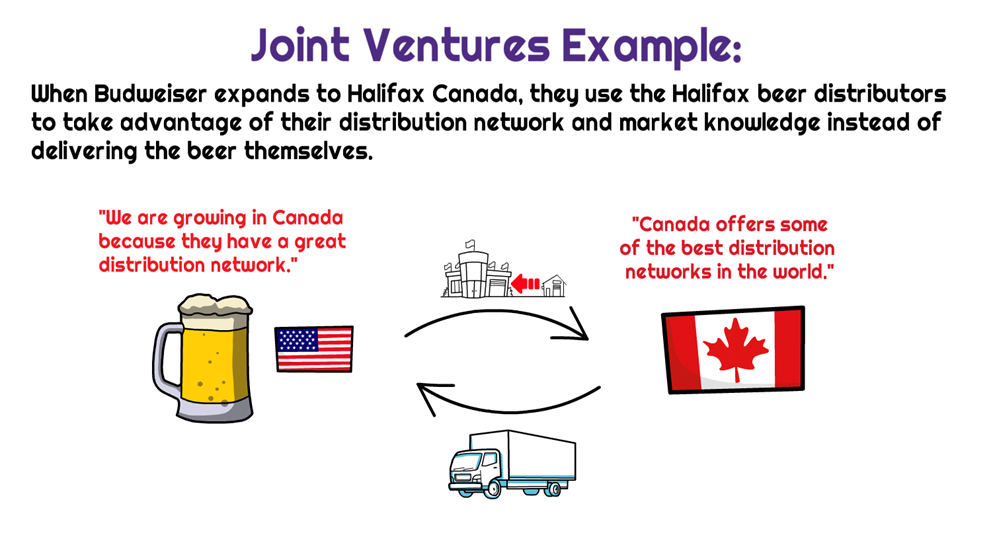

5. Joint venture

A joint venture is a deal in which two or more organizations collaborate to establish a new entity. The parties contribute assets or resources to the joint venture, which operates separately. Joint ventures can be formed as partnerships or limited liability companies.

Pros

- Shared risk and cost

- Uses complementary strengths

Cons

- Reduced individual returns due to shared profit

- Requires contribution agreements

Each deal structure has advantages and considerations that can significantly impact the transaction’s outcome and long-term success. That’s why our next step is to help you select the best option for your case.

Considerations in choosing the right deal structure

Follow the steps below to choose the best deal structure:

1. Define your financial objectives

Determine whether you prioritize immediate cash flow, long-term profitability, or a combination of both. Consider if you are open to deferred payments like earnouts, which link payments to future performance metrics. Your financial objectives will guide the type of deal structure that best aligns with your goals.

2. Assess tax implications

Evaluate how each structure could impact your tax liabilities immediately and over the long term. Consider capital gains taxes, tax deductions on interest payments (in leveraged buyouts), and potential tax benefits from asset acquisitions. Consulting with tax experts is advisable to optimize tax efficiency and compliance.

3. Evaluate business assets and liabilities

Asset-heavy businesses may find asset purchase structures advantageous, as they can selectively acquire desired assets while avoiding unwanted liabilities. On the other hand, service-based companies may benefit more from stock purchases or mergers that consolidate operations and client bases. Choose a deal structure that aligns with your business’s asset profile to optimize value acquisition and mitigate unnecessary liabilities.

4. Determine your risk tolerance

Some structures, like leveraged buyouts, involve higher financial risk due to increased debt levels. Others, such as joint ventures, distribute risks among partners but require shared decision-making and profit sharing. Understanding your risk tolerance is essential for mitigating uncertainties.

5. Clarify post-sale involvement

Mergers or joint ventures may allow for continued management roles or board positions post-transaction. Other structures, such as asset purchases, often result in a more straightforward transition where the seller may have limited or no ongoing involvement. So, determine your post-sale involvement preferences to ensure the chosen structure supports your strategic objectives.

Keep these points in mind when choosing the most suitable deal structure.

Next, we invite you to explore the most effective ways to structure your M&A deal.

Best practices for structuring M&A deals

Here are practical tips on mergers and acquisitions deal structure you can put into action right away:

- Define your strategic objectives for the deal, whether you are a buyer seeking growth or a seller looking to maximize value and exit smoothly.

- Perform comprehensive due diligence to assess the target company’s financial, operational, legal, and cultural aspects. Rely on the list of M&A documents for a thorough review.

- Evaluate the cultural fit between the merging entities to facilitate integration and improve post-merger synergy.

- Negotiate fair and mutually beneficial terms for both parties. Clarify price adjustments, earnouts, and warranties to mitigate risks.

- Develop a detailed integration plan that outlines milestones, responsibilities, and timelines.

- Communicate transparently with employees, customers, suppliers, and investors. Address concerns and manage expectations to maintain trust and support.

- Engage experienced advisors, including financial experts and industry specialists. Their expertise can provide critical insights and promote a smoother transaction.

- Stay informed about regulatory compliance and legal implications. Anticipate potential challenges related to antitrust laws, intellectual property rights, and contractual obligations.

👁️🗨️ Deepen your knowledge by exploring the resources below:

| Common deal structures | Common deal structures | United States of America | Global Private M&A Guide – Limited External Content |

| Compliance industry m&a | Compliance in M&A Transactions [Requirements & Best Practices] |

| M&A considerations | Tips & Considerations for a Successful M&A Integration |

| Definitive purchase agreement | Definitive Purchase Agreement – Types, Limitations |

| M&A pitfalls | Avoiding M&A Pitfalls: Common Mistakes to Watch Out For |

Conclusions

- A merger and acquisition deal structure is a formal agreement that outlines the parties’ rights and responsibilities in a transaction.

- The most common deal structures M&A are stock purchase, asset acquisition method, merger, leveraged buyout, and joint venture.

- When choosing the best deal structure, define your financial objectives, assess tax implications, evaluate business assets, determine risk tolerance, and clarify post-sale involvement.