M&A is a complex game with plenty of issues — 50% of businesses never achieve their M&A goals, while 70% – 90% of deals fail at some point in the deal life cycle. This article breaks down the M&A process into actionable steps to help you alleviate issues at every stage of the M&A lifecycle. In this article, you will learn about:

- Four steps to set realistic M&A goals

- Five key M&A players

- Five key M&A process steps

- M&A KPIs

- Three common M&A challenges with industry-best mitigation practices

Identifying strategic goals for M&A in 4 steps

Forty-seven percent of U.S. executives consider a clear acquisition strategy the biggest success factor in financial transactions. A detailed M&A plan becomes a solid foundation for further steps on the M&A timeline.

| Four steps to set strategic goals |

Example |

| #1 Revise strategic growth plans. |

Increase market share by 15% |

|

Reduce production costs by 25% |

|

|

Establish three cross-selling revenue streams |

|

|

Increase total revenue by 30% through diversification |

|

| #2 To increase market share by 15%, сompany A needs to: |

Acquire talent |

|

Acquire customers |

|

|

Scale products and services |

|

|

Reduce competition |

|

| #3 Pick a corresponding M&A strategy. |

It’s reasonable for Company A to acquire a company in the same industry to reduce competition, scale products and services, and acquire customers and talent. |

| #4 Understand which businesses to acquire. The target company must have: |

200,000 regular customers |

|

Five product lines |

|

|

Easy-to-integrate products and services |

|

|

Positive profit margins |

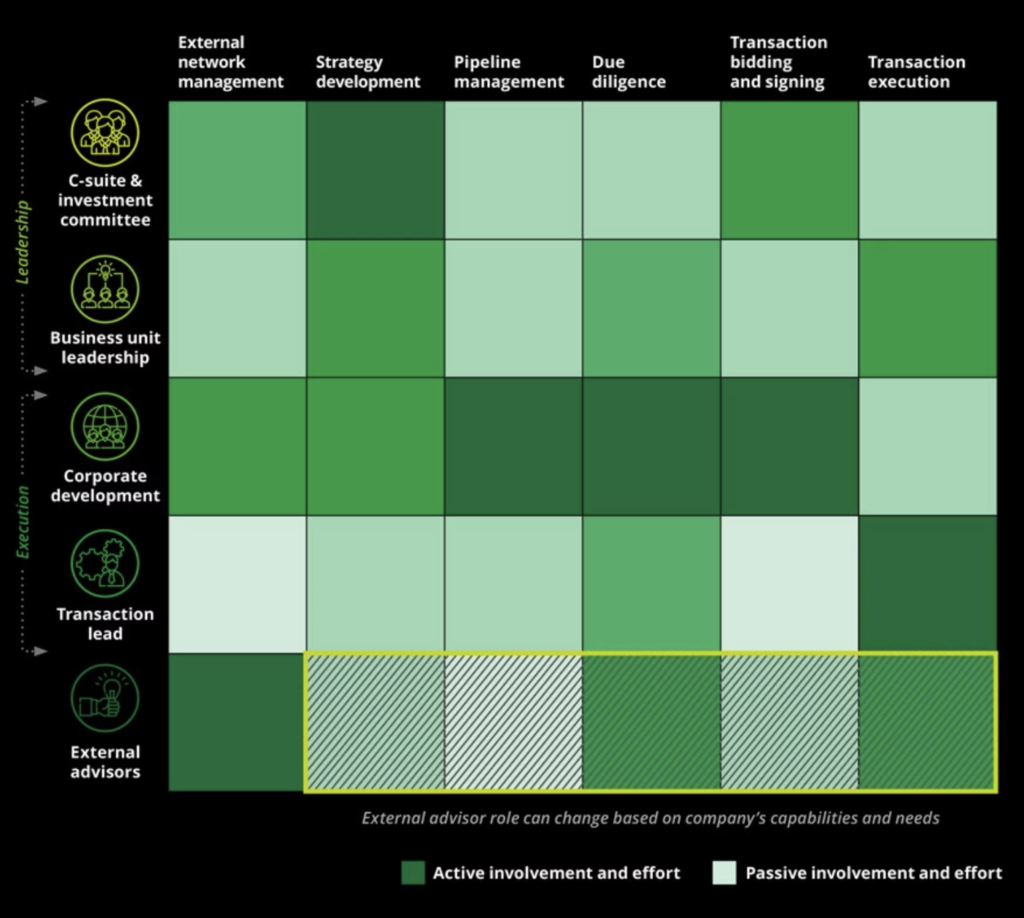

5 key players in the M&A deal cycle

The number of people participating in the M&A deal varies depending on its complexity and the size of companies involved. A large M&A team may consist of 30-40 key stakeholders in five groups:

- M&A committee & C-suite

- Business unit leadership

- Corporate development team

- Transaction lead

- External advisors

M&A committee and C-suite

The M&A committee consists of board directors and C-suite executives, including the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Operating Officer (COO). It’s responsible for the M&A process overview and, therefore, the entire transaction’s success. The key M&A committee duties include the following:

- Acquisition planning. It develops M&A plans, reviews M&A opportunities, and partakes in high-level negotiations with the sellers (or potential buyers in sell-side M&A).

- Pressure-testing. It evaluates the viability of M&A deals, ensuring they fit into strategic objectives financially and operationally.

- M&A deal flow supervision. It approves acquisition process steps and ensures the right people complete the right tasks.

| Check three key questions to ask when your company is being acquired. |

Corporate development team

The corporate development team executes M&A deals, doing the most work in the M&A lifecycle. It consists of high-level executives, including senior directors, management teams, and analysts assigned to different tasks on the M&A timeline. The corporate development team has the following duties:

- Deal sourcing. It seeks M&A opportunities fitting into the company’s growth strategy. It coordinates market assessments, SWOT analysis, and data reviews.

- Pipeline development. It develops M&A steps and supervises appropriate execution teams.

- Due diligence. It coordinates and executes the due diligence process, including planning, negotiations, reviews, and analyses.

- Negotiations. It develops deal terms and negotiates with deal parties and external advisors at each M&A stage, from sourcing to transaction signing.

Business unit (BU)

The business unit is involved in all phases of M&A while contributing the most effort at late deal stages. It consists of department managers and post-merger integration professionals running the business post-acquisition. The BU has the following roles:

- Support the M&A committee. It actively tracks business competitors and engages in strategic development, suggesting the best M&A timing.

- Project deal outcomes. The BU leadership seeks M&A opportunities beneficial for particular business units and builds synergy and financial projections of ongoing and anticipated acquisitions.

- Support due diligence and PMI. It supervises the processes and addresses arising issues due to expert knowledge in post-deal business management.

Transaction lead

The transaction lead deals primarily with M&A closing and post-merger integration. It is an employee with solid due diligence and cross-functional management experience to fulfill the following duties:

- Support PMI due diligence. They engage in late due diligence stages to understand the upcoming integration’s risks, challenges, and opportunities.

- Engage in integration planning. They develop PMI plans and timelines with the M&A committee and business units.

- Coordinate PMI execution. They supervise cross-functional teams, ensure smooth post-deal integration, monitor risks, and communicate with key stakeholders.

| Check four types of mergers and acquisitions risk based on real-life case studies. |

External advisors

The external advisory group may include legal teams, M&A, due diligence, financial, and investment banking industry professionals. External advisors support the mergers and acquisitions process with the following activities:

- Deal sourcing. They recommend the best M&A opportunities, provide access to target databases, and suggest optimal M&A strategies in specific market conditions.

- Negotiations. They provide legal assistance, evaluate deal terms, mark issues in deal contracts, and partake in M&A negotiations.

- Due diligence. They offer industry-specific experience to reveal hidden risks and opportunities, helping acquirers build realistic deal projections.

- Integration. They support deal execution and PMI efforts to maximize positive outcomes.

M&A process checklist: 5 key stages

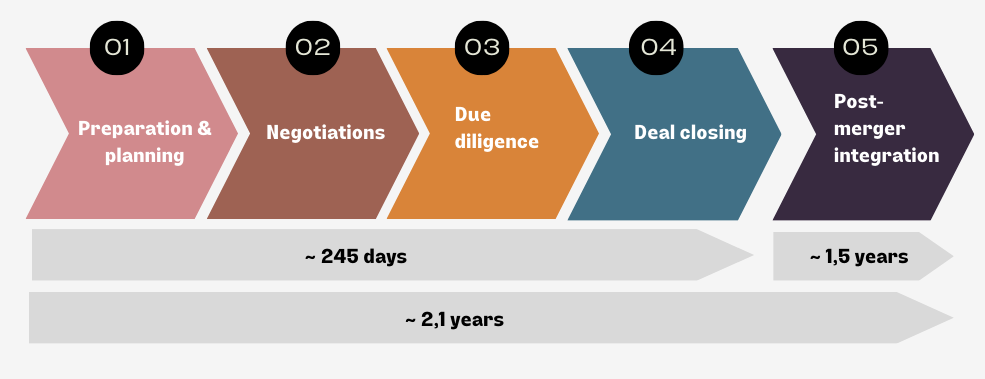

Many private equity firms, investment banks, and global consulting firms differentiate five stages in the M&A process timeline which takes an average of 2.1 years to complete:

- Preparation and planning

- Negotiations

- Due diligence

- Deal closing

- Post-merger integration (PMI)

Preparation and planning

In the M&A strategic planning phase, an acquiring company develops an M&A strategy that aligns with its long-term business goals. Here are the crucial steps during this stage:

- Assemble a deal team. Create an M&A committee and assign deal professionals to the corporate development team and within business units.

- Finalize the M&A plan. Decide on the M&A strategy and develop M&A criteria for screening target companies. Make a SWOT analysis and thoroughly research market trends to ensure your M&A strategy meets your business capabilities and objectives.

- Source M&A targets. Find potential target companies and screen them against your strategic fit criteria.

- Make an initial target assessment. Initiate preliminary due diligence (DD) on the final M&A target.

Negotiations

Upon initial screening, merging companies negotiate transaction terms, evaluate and review contracts, and consider the regulatory implications of the proposed deal. Negotiation tactics of key stakeholders and external advisors help formulate a beneficial letter of intent (LOI) that signifies the start of the due diligence phase. Here are the initial negotiation steps:

- Negotiate deal terms. Specify the transaction’s nature and conditions, including the purchase price, cost structure, and due diligence scope.

- Consider M&A regulations. The two firms should evaluate anti-trust regulations if the deal exceeds $111.4 million.

- Consider deal prerequisites. Review tax implications, securities regulations, labor laws, ESG laws, and other matters to be cleared before full-scale due diligence.

Due diligence

Due diligence is a comprehensive evaluation of the acquisition target. At this point, companies usually sign a non-disclosure agreement to protect sensitive data. Here are the due diligence steps:

- Establish a due diligence team. Assign experts in the functional areas under investigation. External advisors help fill experience gaps in unknown industries.

- Analyze the target business. Perform valuation analysis. Identify synergies, cost-reduction opportunities, risks, and integration challenges.

- Review DD data. Finalize due diligence reports, including financial modeling projections, legal findings, synergy realization plans, and PMI considerations.

| Get a comprehensive list of M&A documents under investigation during due diligence. |

Deal closing

Once due diligence is complete, two companies prepare to close the transaction and sign a purchase agreement. Here are the deal-closing steps:

- Complete deal closure procedures before the final agreement. It may be financing agreements, shareholder and regulatory approvals, environmental permits, employee contracts, etc.

- Finalize the purchase and sale agreement. Review and approve deal terms in the definitive agreement. A potential buyer may renegotiate deal terms if they reveal critical issues or reevaluate expectations. It happens in 20% – 30% of transactions, according to Morgan & Westfield.

- Arrange the payment. An acquiring company may close an all-cash, all-stock, or a mixed payment. All-cash deals are typical amidst market uncertainty. For instance, all-cash deals comprised 73% of the 2020 deal volume.

- Complete change of control. Transfer assets, liabilities, intellectual property, and take leadership of the acquired company.

| It takes 245 days on average for mid-sized and big deals to close (post-merger integration excluded), according to Gartner’s M&A report. |

Post-merger integration (PMI)

At the post-merger integration stage, a company realizes synergies, increases cash flows, optimizes supply chains, and realizes other projected benefits of the merger. Here are the key integration steps:

- Develop a PMI program. It defines the transaction’s value drivers and outlines the ways to achieve merger benefits, such as technology and cultural integration, production efficiencies, HR optimizations, etc.

- Develop a PMI timeline & work plan. Create an integration timeline and outline milestones, KPIs, and deadlines.

- Complete PMI. Coordinate and supervise functional teams. Integrate the target company and execute restructuring strategies — join operations, consolidate technology, optimize human resources, merge finances, etc.

| Post-merger integration can take up to 1.5 years in successful acquirers, according to the PwC study. |

M&A performance indicators

M&A performance indicators allow businesses to track M&A progress, capture issues, and improve post-transaction outcomes.

| M&A area | KPI example |

| Financial |

Discounted cash flow (DCF) |

|

Net income growth rate (NIGR) |

|

|

Earnings per share (EPS) |

|

|

Debt-to-equity ratio |

|

|

Pre and post-merger cost-to-income ratio |

|

|

Return on investment (ROI) |

|

|

Accounts receivable turnover |

|

|

Accounts payable turnover |

|

|

Operating profit margin |

|

| Operational |

Customer retention rate |

|

Employee satisfaction rate |

|

|

Employee turnover |

|

|

Production rate |

|

| Integration |

Integration speed per business function |

|

Integration milestones achieved |

|

|

Cultural alignment index |

|

|

Pre-merger-to-post-merger synergy realization ratio |

Overcoming 3 common M&A transaction process challenges

A Deloitte M&A study reveals that 62% of deals don’t realize integration benefits. Poor M&A results come from the following M&A challenges:

- Improper target identification.

- Weak due diligence.

- Insufficient PMI oversight.

Improper target identification

Correct target identification and accurate valuations comprise 32% of M&A success factors, based on Deloitte’s M&A study. However, several challenges occur along the way.

| Target identification challenge | Primary cause |

| Strategic misalignment |

An acquiring company doesn’t understand how a target entity fits into its business. |

| Incorrect price valuation |

An acquirer overestimates M&A benefits while overlooking hidden risks and challenges. |

✅ Solution:

- Conduct a thorough self-assessment. Evaluate your weaknesses, strengths, and capabilities as part of M&A planning. Review your company’s competitive, legal, and regulatory landscape to ensure strategic alignment of the deal.

- Involve financial advisors early. Deal-sourcing assistance and integration cost evaluations from investment bankers are preferable at early M&A transaction phases. Advisors help an acquirer gauge a beneficial deal price.

Weak due diligence

According to Bain & Company’s M&A study, improper due diligence is the root cause of nearly 60% of M&A failures. Here are the most common DD challenges.

| Due diligence challenge | Primary cause |

| Low data quality |

DD teams make optimistic projections, overlook risks, and fail assessments due to poor data quality, especially in the private M&A deal process. |

| Time constraints |

Competing bidders, negotiation timelines, financing considerations, high deal complexity, and other inherent M&A factors impose short deadlines. |

| Lack of interconnectivity between findings |

Communication silos, tight deadlines, inaccurate data, and lack of supervision make DD findings highly fragmental. |

✅ Solution:

- Create a productive DD environment. Use a virtual data room for M&A to store, share, and analyze due diligence findings. The right software ensures seamless collaboration, boosts productivity, and cuts DD costs.

- Emphasize integrated due diligence. Ensure intense cross-functional collaboration to deliver interconnected, value-driven DD findings.

Insufficient PMI oversight

Up to 90% of mergers fail at the post-merger integration stage due to the following challenges.

| Integration challenge | Primary cause |

| Weak integration planning |

Executives can’t offer a unified PMI plan due to internal disputes. |

| Insufficient attention to daily business |

Executives don’t communicate the merger to the customers and overlook day-to-day business tasks. |

| Weak decision-making |

Integration lacks vertical decision-making and gets treated as a background process. |

✅ Solution:

- Facilitate continuous stakeholder communication. Weekly meetings are optimal for strategic units, such as M&A committees (integration committees). It helps executives address differences in strategic vision, conflicts of interest, and misunderstandings.

- Establish a dedicated PMI unit. It may include a managerial team and dedicated functional teams executing day-to-day integration tasks. It helps alleviate execution imbalances when a company prioritizes PMI over business continuity or vice versa.

Ensure M&A strategy success using virtual data rooms

Virtual data rooms (VDRs) are secure digital repositories with powerful M&A capabilities. VDRs enhance outcomes during all M&A process phases with the following benefits:

- Efficient decision-making. Q&A workflows, approval workflows, and activity dashboards allow deal parties and external advisors to communicate ideas and make decisions in one place. Collaborative roles make it easier to build a vertical decision-making structure and oversee M&A activities.

- Sound due diligence. VDRs provide unlimited data storage with bulk actions, automatic indexing, audit trail, reporting, version control, and full-text search. These capabilities simplify data collection and analytical tasks during due diligence.

- Ironclad cybersecurity. Zero-trust security with role-based access and information rights management (IRM) tools helps businesses stay compliant and reduce data breach risks. You can have full control of information rights across the workspaces and connected devices.

Based on our experience, dealmakers improve the VDR experience and reduce total M&A technology costs if they carefully choose M&A data room providers. Check our top five VDR profiles below.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

SmartRoom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

The bottom line

- There are five key steps in the M&A process: preparation, negotiations, due diligence, deal closing, and post-merger integration.

- Most deals fail due to incorrect target identification, weak due diligence, and poor integration.

- Thorough M&A planning, integrated due diligence, and well-coordinated effort of all stakeholders help businesses overcome common M&A challenges.

- Virtual data rooms are crucial for accurate due diligence, effective communication, and security compliance. Robust VDR security helps dealmakers comply with data management regulations.