According to Bain & Company, overall M&A transaction volume reached 3.8 trillion in 2022, with additional agreements expected by the end of 2023. This is the reason why the variety of mergers and acquisitions software has increased dramatically over the last decade.

Hence, when it comes to evaluating deal management software alternatives, which solutions would simplify the entire deal process and best fit the demands of your company?

This article explains how to choose the right software. It also explains what M&A documents are needed and why data security is important. By the end of this article, you’ll get a deep understanding of deal flow management tools and will be able to choose the best due diligence software and data room for M&A.

What is M&A software?

Software for mergers and acquisitions is a platform used by dealmakers for managing their workflows and M&A project tracking, offering a comprehensive digital collaboration environment. M&A deal software often includes components required for each step of a deal’s life cycle, from the due diligence process to post-merger integration.

The software platforms that your company chooses will affect the operations and stakeholder engagement in M&A. For example, pipeline management helps you expedite your dealmaking. It optimizes workflows, facilitates collaboration, integrates CRM, ensures compliance, and offers scalability.

Importance of M&A software

Mergers and acquisitions (M&A) are key components of company growth, and having the right tools may have a significant impact on their success. According to KPMG’s M&A cloud data research, over 40,000 firms now benefit from data management solutions such as virtual data rooms.

Based on our experience, mergers and acquisitions software solutions facilitate the different stages of M&A in the following ways:

- Better task management. They improve task management by identifying bottlenecks and ensuring operations are completed on schedule.

- Tailored report creation. The platform helps create custom company reports using the built-in templates.

- Centralized collaboration hub. The solution provides a central location for team members to share information and collaborate on assignments with real-time data access throughout the M&A process.

- Streamlined data transfers. Software M&A removes the need for time-consuming data transfers from Excel to PowerPoint, allowing for the development of real-time reports with a single click.

- Robust data management. Merger software features provide capabilities for data management, project progress tracking, and information sharing across departments.

- Integrated communication. The software platform seamlessly integrates board and committee communications into the working environment via discussion space and chats.

- Enhanced data security. Cross-border solutions strengthen secure data storage of sensitive M&A data with ISO 27001, encrypted backups, two-factor authentication, complicated passwords, and user-based permissions.

Types of software for M&A deals

Despite the majority of mergers gaining approval, up to 14% of deals exceeding $1 billion face cancellation due to antitrust concerns. In contrast, leveraging suitable software streamlines the deal-making process and reduces the risks of mergers and acquisitions. Based on our observations, different types of software provide distinctive features, including M&A automation, acquisition analysis, integration and collaboration tools, etc.

Therefore, the following types of software are recommended for M&A deals.

1. Virtual data room platform

Over 87% of companies successfully managed their deals over virtual channels, specifically virtual data rooms and M&A software solutions. A virtual data room or VDR is a secure online repository for storing working materials and sensitive information for board members. These rooms are essential for secure document sharing and collaboration since they offer robust security features.

They are ideal for businesses that handle sensitive customer data merger and acquisition process. By providing organized and secure access to sensitive documents, they facilitate the due diligence of target companies.

2. Deal sourcing platforms

Using deal sourcing platforms is a way for businesses to efficiently identify and engage with potential acquisition targets or investors. These platforms rely on advanced algorithms to match companies based on specific criteria, such as industry, size, and financial performance. In particular, investment banks and M&A advisory firms can benefit from this technology during their M&A activity.

3. Transaction management software

This type of software facilitates the M&A process by offering tools for project management capabilities, sell-side M&A process, workflow automation, and secure M&A communication. This software is useful for larger enterprises or consulting firms that manage several, complex transactions at the same time during the mergers and acquisitions process.

4. Financial analysis and modeling software

These tailored business solutions are critical in determining the financial ramifications of a transaction and deal flow. These technologies aid in the development of complex financial models for forecasting future performance and assessing target firms’ financial health. They are critical for financial analysts and investment professionals involved in mergers and acquisitions.

5. Compliance and regulatory software

This type of M&A SAAS guarantees comprehensive compliance tracking and regulatory standards. This sort of software is very important for companies in highly regulated areas such as banking, healthcare, enterprise software sector, and telecommunications.

Key features to look for in M&A software

When choosing the best M&A software, it’s critical to prioritize the following aspects.

1. Data security

The software adopted should go beyond simple encryption to provide enterprise cloud protection and speedy access to sensitive data. Secure data rooms should provide an unwavering commitment to information protection. It includes MFA, regulatory compliance (GDPR, HIPAA, ISO 27001), access controls, secure document viewing, and audit trails.

2. Collaboration tools

Look for a secure collaboration provider that offers features to facilitate communication channels, integration of a customer support team, document sharing, and version control. These collaborative tools are particularly valuable when teams are dispersed across different locations and when dealing with multiple stakeholders.

3. Integration capabilities

A significant factor of successful M&A software is its integration capabilities. The chosen software should seamlessly sync with current systems, avoiding data silos and facilitating a smooth interchange of multiple tools. In turn, it provides an identical framework through which data flows effortlessly, enabling the many aspects of M&A transactions.

4. Advanced analytics and reporting

Analytics and M&A reporting are critical for navigating the intricacies of M&A deals. These analytical tools enable real-time insights, which assist in comprehensive decision-making. It’s especially crucial throughout the dynamic phases of transaction review and negotiation.

5. Workflow automation

When you need to reduce manual activities, automate repetitive operations, and streamline workflows comes in handy. Aside from increasing operational efficiency, workflow management tools protect against mistakes, resulting in a more exact and systematic approach to dealmaking. In the context of due diligence, automated data input improves accuracy while freeing up crucial time for strategic decision-making.

6. Scalability

Deal structuring software recognizes the inherent variation in the scope and volume of M&A transactions. The M&A software should be capable of managing many transactions at the same time, providing flexibility for both small-scale operations and more sophisticated, large-scale activities. Thus, you can be sure that the software stays a dynamic and responsive tool, aligned with the precise requirements of each transaction.

Pricing and investment considerations in choosing M&A software

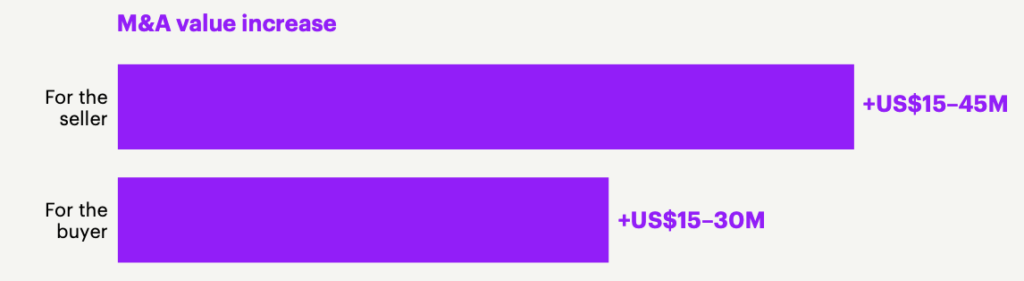

When it comes to integrating M&A software into business operations, the financial aspect plays a pivotal role. The Digitizing Mergers & Acquisitions (M&A) report states that companies can generate up to $45 million in additional value and close transitions three months faster by utilizing digital solutions such as virtual data rooms.

Although M&A software may seem like a substantial expense at first glance, investing in robust software significantly streamlines the business development efforts, leading to long-term cost savings and powerful business process automation.

From a financial perspective, such software enables more accurate valuation models, improved due diligence, and streamlined deal management, which collectively results in better investment decisions and increased profitability.

Other than that, the efficient management and analysis of large volumes of data significantly reduce the time and resources required for each deal, while also increasing the likelihood of successful strategic acquisition. Our analysis of this product showed that the advanced analytics and AI integration process in M&A software provides valuable insights into market trends and potential risks.

Top M&A software solutions for beginning of 2024

The year 2023 has witnessed an increase in the use of software solutions, each with its own set of features and benefits. Choosing the right platform depends on M&A software review and specific requirements such as deal complexity, budget, and security needs. To identify which software aligns best with your M&A strategy, it’s a good idea to take advantage of available trials or demos.

Here’s a comprehensive comparison of the top five M&A software solutions that help in creating structured processes.

Ideals

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Ansarada Data Room

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Citrix

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Intralinks

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Dealroom

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

1. Ideals

Known for its exceptional security features, Ideals stands out with its advanced data protection and user-friendly document management systems. Unlike competitor virtual data rooms, Ideals facilitates efficient due diligence and M&A managing user access and offering business advisory tools. In addition, they have comprehensive 24/7 customer support and a range of training resources. For those interested, Ideals offers insightful trials.

2. Ansarada

This solution leverages AI to provide predictive analytics and interactive Q&A tools for the corporate development life cycle and the M&A process. While its innovative AI tools are a major draw, they may present a steep learning curve for newcomers. Ansarada also offers round-the-clock support, emphasizing personalized service through dedicated account managers. Potential users can explore its capabilities through various trial options on Ansarada’s main website.

3. Citrix

Citrix focuses on secure file sharing and customizable workspaces, backed by integrated analytics. It’s highly scalable and suitable for various deal sizes, but some users might find inconsistencies in user experience across different platforms. Their support system includes online resources and live assistance, catering to diverse user needs. Learn more about functionality on the Citrix website.

4. Intralinks

This platform is revered for its advanced reporting tools and secure document exchange, making it ideal for large-scale transactions. Its interface might appear somewhat dated to some users despite offering a highly secure environment. Intralinks compensates for this with an extensive global support network, ensuring users have access to the help they need. Explore Intralinks’ website to learn more about demos and pricing plans.

5. Dealroom

Dealroom is a platform that allows real-time tracking of activity and audit reports. With Dealroom, you can manage multiple deals and deal execution processes. It features a range of analytics tools to provide comprehensive data insights. The platform is especially useful for deal sourcing, although it offers limited customization options. The support provided by Dealroom is robust, with a dedicated team and plenty of online tutorials and resources to help guide users. For those interested, visit their main website.

Upcoming Trends in M&A Software

According to the PWC M&A trends analysis, worldwide M&A transaction volume reached 3.8 trillion in 2022, with further agreements likely by the end of 2023. Upcoming M&A software developments are poised to change the way agreements are organized, negotiated, and implemented. As a result, looking at future trends in the M&A software market is an intriguing prospect.

- Integration of AI and machine learning. Currently, more than 30% of dealmakers believe that AI and machine learning will have a significant impact on M&A in the next five years. These technologies will improve predictive analytics and due diligence capabilities, making the transaction process more insightful.

- Focus on ESG factors. As companies increasingly focus on sustainability, ESG considerations are now a crucial part of M&A decision-making. In the future, M&A software is expected to have tools that enable the assessment and integration of ESG factors. This could include analytics tools that evaluate the ESG impact of acquisitions, helping companies align their M&A strategies with their broader sustainability goals.

- Enhanced cybersecurity features. Forecasts indicate that the financial toll of cyber attacks is poised to skyrocket to $10.5 trillion by 2025. In response, M&A software is expected to evolve, with stronger cybersecurity capabilities and an access control framework to prevent these more complex threats. Expectations include the integration of tools for secure data exchange, real-time threat monitoring, and comprehensive risk assessments.

Key takeaways

- M&A software plays a crucial role in managing deals by providing a comprehensive digital collaboration environment for deal-makers. It helps streamline workflows and keep track of M&A projects effectively.

- Choosing the right M&A software is essential for efficient business development and sustainable business growth. It enhances task management, fortifies data security, and streamlines workflows, making it a critical factor in the entire deal lifecycle.

- As the industry trends towards AI integration, focus on ESG factors, and heightened cybersecurity features, it becomes even more crucial to opt for adaptable and feature-rich software as a service.