Effective M&A communication is the cornerstone of post-merger success. McKinsey has found that companies that manage culture and communications effectively have 50% higher chances of achieving post-merger synergies.

Yet, creating a communications plan is a challenge for many. This blog post explores the best ways to craft an actionable M&A communications plan. Keep reading to discover the following:

- Five benefits of a well-thought-out M&A communication plan

- Six components of an actionable M&A communication plan

- Four steps to develop an M&A communications plan

- Four best practices for effective merger communications

What is an M&A communications plan?

An M&A communication plan conveys the timelines, tools, and specifics of informing stakeholders about the merger. It ensures a smooth transition and boosts employee morale amidst merger uncertainty.

Here are the benefits of a good communication strategy:

- High stakeholder confidence. It reassures stakeholders of the merged entity’s bright future. Thus, customers will be more confident in product quality, while employees will feel more secure about job stability.

- Talent retention. It addresses employee concerns and navigates them through management and reporting changes.

- Smooth transition. A good M&A plan communicates key operational changes. It helps departments stay focused and minimizes operational uncertainty among employees of two organizations.

- Cultural integration. It addresses cultural differences and communicates the cultural norms of a new entity.

- Better brand reputation. It informs customers and investors about upcoming changes and benefits of the merger. That translates into higher customer retention, stronger investor loyalty, and better brand reputation.

What if I don’t have an M&A communication plan?

Companies that don’t develop M&A communication strategies are more likely to experience major operational disruptions, talent loss, and failed synergies. However, even businesses equipped with communications strategies still encounter challenges.

For example, Bain & Company has revealed that 80% of mergers and acquisitions address cultural integrations during due diligence, but 75% still experience issues in the post-deal phase. They face talent loss, program delays, and other issues. So, keep reading about the components of an M&A plan to minimize the M&A risk.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

6 key components of an M&A communication plan

An effective acquisition communication plan template has the following components:

An effective acquisition communication plan template has the following components:

- Objectives

- Key audiences

- Key messages

- Communication channels

- Timeline

- M&A communication teams

Objectives

Here are the objectives of the M&A communication plan:

- Effectively communicating the merger to all employees, customers, investors, board directors, and partners.

- Addressing employee concerns, like layoffs, salary cuts, new schedules and reporting standards, new managers, etc.

- Addressing customer pain points, like bad service quality, product delays, changes in product lines, etc.

- Addressing shareholder concerns, like bad stock performance, revenue loss, ROI dips, and dividend distribution changes.

- Addressing trigger events and ensuring timely communication.

- Reducing data leaks, gossip, and reputation losses.

Key audiences

Identify internal and external stakeholders, the recipients of the M&A communications. Interaction occurs with the following audiences.

| Internal audiences |

|

| External audiences |

|

Key messages

Consistent messages should boost the company’s reputation and signal a robust merger plan and bright future.

| Key areas | Key topics |

| Strategic position |

🔸 Strategic vision 🔸 Merger purpose 🔸 Mission statement 🔸 Financial health 🔸 The merger’s benefits |

| Employee communication |

🔸 Job security 🔸 Financial stability 🔸 Role changes 🔸 Cultural integration |

| Shareholder impact |

🔸 Merger transparency 🔸 Financial benefits 🔸 Growth potential 🔸 Stock performance 🔸 Long-term shareholder value |

| Customer impact |

🔸 Service continuity 🔸 Quality assurance 🔸 Product and service improvements 🔸 The merger’s benefits to customers 🔸 Customer support opportunities |

| Supplies and partnerships |

🔸 Scaling opportunities 🔸 Partnership continuity 🔸 Contract changes 🔸 The merger’s benefits to suppliers |

| Regulatory compliance |

🔸 Strong compliance profile 🔸 ESG compliance 🔸 Environmental compliance 🔸 The merger’s benefits to the market 🔸 Job market benefits 🔸 Industry benefits |

Communication channels

Understand how best to announce the merger. Consider the following communication tools and their benefits.

| Channel | Audience | Benefits |

| Emails and newsletters |

Board directors, management, employees |

🔸 Personalized communication 🔸Easy preparations and distribution |

| M&A software solutions and data rooms |

Internal/external |

🔸 High data security 🔸 Personalized communication 🔸 Easy tracking 🔸 Easy coordination 🔸 Easy updates 🔸 Ongoing communication |

| Board meetings |

Board directors, senior management |

🔸 Face-to-face interaction 🔸 Trust building 🔸 Easy communication |

| One-on-one meetings |

Key personnel, C-suite, board directors |

🔸 Trust building 🔸 Confidential discussion 🔸 Possibility to address individual concerns |

| Town halls |

Internal |

🔸 Group participation 🔸 Immediate feedback 🔸 Trust building |

| Social media |

Customers, media, general public |

🔸 Real-time engagement 🔸 Broad reach |

| Press releases |

Investors, customers, media, general public |

🔸 Official company narrative 🔸 Broad reach |

| Company website |

Regulators, investors, customers, general public |

🔸 Central information hub 🔸 Official narrative 🔸 High accessibility 🔸 Multiformat 🔸 Broad reach |

| Webinars, interviews, and conferences |

Analysts, investors, regulators, key suppliers and customers |

🔸 Live feedback 🔸 Questions & answers 🔸 Detailed explanations 🔸 Highly interactive |

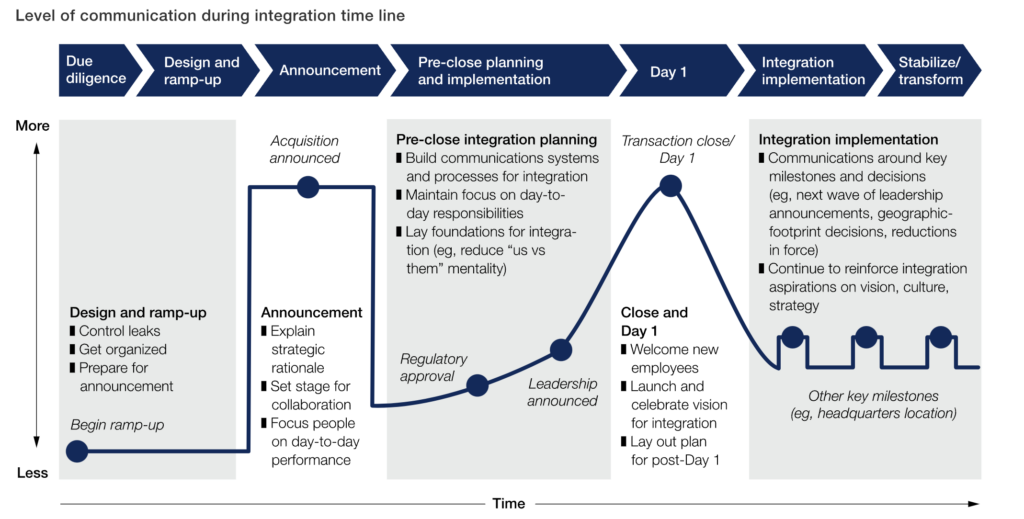

Timeline

The M&A communication timeline encompasses several elements, such as announcement, pre-closing preparations, Day 1, and the first week, month, quarter, and year after deal closing. The intensity of communications naturally spikes on the M&A process timeline.

Let’s explore activities during:

- Acquisition announcement

- Pre-close planning

- Day 1

- Ongoing communication

Acquisition announcement

Here is a checklist of actions to be taken at the announcement stage.

| Merger announcement stage | Actions to take |

| Pre-announcement planning |

|

| Official announcement day |

|

Pre-close planning

Companies take the following actions in the pre-close phase.

| Pre-close stage | Actions to take |

| Integration planning |

Develop and effectively communicate the integration strategy to internal stakeholders. |

| Internal communication |

|

| External communication |

Update customers, suppliers, and potential investors. |

Day 1

Taking the following communications efforts on Day 1 (transaction closing) is advisable.

| Day 1 | Actions to take |

| Internal communication |

|

| External communication |

|

Ongoing communication

Ongoing M&A communication supports the brand reputation and updates key stakeholders on the integration process.

| Ongoing communication | Actions to take |

| Internal communication |

|

| External communication |

|

M&A communication teams

Determine who communicates externally and internally. Let’s describe the leadership team involved in M&A communications:

- The CEO is the primary M&A spokesperson who leads internal and external M&A communications.

- Board directors assist the leadership teams and represent the company to the media, investors, and the general public.

- The internal communication director follows the communications calendar and coordinates the process.

- Senior managers handle communications with customers, partners, and supply chains.

- Middle managers communicate M&A to employees and handle cultural integrations.

Developing a merger and acquisition communication plan in 4 steps

Identify key stakeholders

List key stakeholders affected by an M&A and understand their concerns. The following self-assessment questions can help:

- What are the key employee groups affected by the M&A? Examples include C-suite, middle management, and frontline employees.

- Are there employees with unique concerns? Examples include remote employees and employees on leave.

- Who are our key shareholders?

- Who are our key customers, suppliers, and partners?

- What regulators will we deal with? Examples include FTC, DOJ, SEC, FCC, and CFIUS.

- What media should we target for the best coverage? Business Insider, Bloomberg, MarketWatch, and CNBC.

Establish communication leadership

Establish an M&A communications workstream and clarify the roles and responsibilities of the communications teams. Consider the following:

- M&A governance. M&A communication falls under the responsibilities of the M&A steering committee and the integration management office (IMO).

- Cross-functional teams. Ensure M&A communications occur smoothly between departments. Assign department and regional leaders to avoid delays and misinformation.

- Communications protocols. Outline the vertical communication flow and approval procedures to retain a unified narrative across all parts of the business.

- Communication channels. It is easier to communicate through existing intranet channels. Leverage the network for external communications.

Develop an M&A narrative

The core M&A narrative should communicate the expected benefits for employees, customers, partners, suppliers, and markets. Build communications around the following:

- Value drivers: Opportunities for innovation, growth, and long-term value to various stakeholders, shareholders, and the industry.

- Employee benefits: Career growth, job security, and work-life balance. Employees are the cornerstone of merger success.

- Change story: Upcoming integration changes are depicted positively and aligned with value drivers.

- Personalization: Core messages are personalized for employees, customers, suppliers, and other stakeholders.

Identify milestones and trigger events

Develop step-by-step plans for M&A announcement, pre-closing, Day 1, and ongoing communication. Understand to whom, when, and what to say at each stage. Also, develop response plans for trigger events:

- Regulatory approvals

- Shareholder approvals

- Transaction closing

- Media leaks

- Employee feedback (and concerns)

Effective corporate communications: 4 best practices

The following practices help manage communications more effectively:

- Start communications early

- Establish two-way communication

- Use secure communication channels

- Leverage advisory services

Start communications early

Mergers often shake labor markets with massive layoffs. When AT&T acquired Time Warner, over 45,000 employees lost their jobs. Address those concerns as soon as you have a merger on the horizon. It’s advisable to start communications planning during due diligence and begin intense communications during the M&A announcement.

Establish two-way communication

Ensure stakeholders have feedback opportunities. Here are tips for organizing effective two-way communications:

- Promote transparency in M&A communications. Demonstrate commitment to stakeholders and recognize their concerns. Implement feedback mechanisms, like surveys and town hall meetings.

- Research evolving stakeholder concerns. Understand how stakeholders change their perception of the merger process and address arising issues.

- Speak numbers. Support your deal narrative with KPIs, like financial stats, employee benefits, and operational efficiency. Also, personalize M&A data for each stakeholder group.

Use secure communication channels

Security risks, like accidental NDA breaches, data leaks, or rumor-induced cyber attacks, persist during M&A communications. Over 30% of data breaches are linked to mergers and acquisitions.

Using virtual data rooms (VDRs) substantially improves the security of internal and external communications. Our findings indicate that VDRs provide the following benefits for merger communications:

- Access control. Role-based document permissions allow you to maintain privacy while exchanging M&A transaction documents with each stakeholder group.

- Responsive communications. Built-in FAQ sections and Q&A workflows automate stakeholder communications and provide intuitive feedback mechanisms.

- Security compliance. Virtual data rooms support watermarking, 256-bit encryption, access permissions, and IRM security. Security compliance helps to maintain confidentiality in M&A interactions with customers, suppliers, partners, and regulators. Most VDRs are ISO 27001, CCPA, HIPAA, GDPR, and SOC 1/2/3 certified.

Leverage advisory services

Companies spend almost $40 billion on M&A advisors annually, and such services indeed help them achieve desired outcomes. Based on our experience, hiring a PR agency may be valuable for external M&A communications.

The bottom line

- An acquisition communications plan covers stakeholders, M&A narrative, timelines, trigger events, communication governance, and communication channels.

- Successful acquirers develop M&A communication plans early, actively engage with stakeholders, and leverage advisory services.

- Virtual data rooms ensure consistent messaging, feedback automation, and bank-grade data security in merger communications.