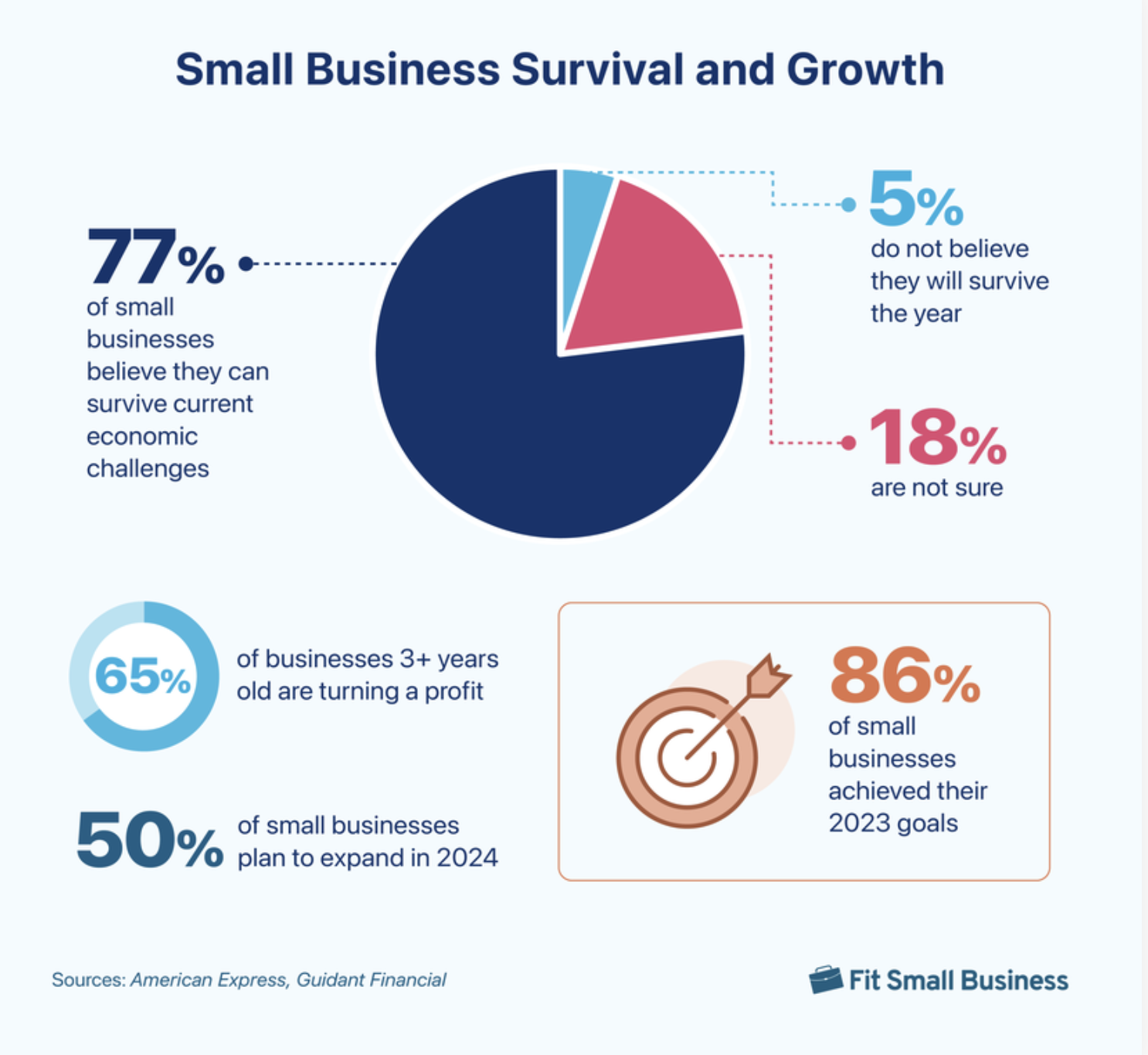

Although small companies may seem like minor players, they actually have the power to bring about meaningful change and make significant economic contributions. For instance, there are 33.2 million small businesses in America, which make up 99.9% of all U.S. businesses and account for 97.3% of all exporters. Furthermore, small and medium-sized enterprises (MSMEs) comprise 90% of all companies globally, contribute 60 to 70% of total employment, and represent 50% of the global GDP. The forecasts for 2024 are also quite optimistic.

Given their substantial impact, it’s no surprise that small company acquisitions have become a strategic focus for larger corporations. This business takeover offers big advantages, including access to innovative products and services, entry into niche markets, and enhanced agility.

This post explores the motivations behind acquiring a small business, provides a guide for the acquisition process, and reviews legal considerations. This information will help to make informed decisions, maximize the deal’s benefits, and ensure a smooth and successful integration.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Why acquire a small business?

Small business acquisition can be a strategic decision with numerous benefits and opportunities. In particular, most businesses do it to reach the following goals:

1. Market expansion

Purchasing a company in a different region or country provides instant entry into the market, bypassing the time-consuming task of establishing a presence from scratch. Additionally, it enables access to an existing customer base, creating prospects for expansion and cross-selling.

Pro tip: Before you break into new markets through small business mergers and acquisitions, conduct thorough market research and acquisition due diligence to ensure alignment with your strategic objectives and minimize risk. Evaluate cultural nuances, regulatory requirements, competitive landscape, and market saturation to make informed decisions.

2. Diversification

Larger companies can expand their portfolio by acquiring a business that offers complementary or entirely new products or services. It is a good way to reduce reliance on a single revenue stream. Moreover, diversification through acquisition helps spread risk across various markets or product lines to protect against market volatility.

3. Competitive advantage

Acquiring a competitor increases market share, reduces competition, and potentially allows for higher pricing power. Besides, small business mergers can save costs through economies of scale, improved efficiencies, and shared resources.

4. Talent acquisition

Access to a target team with specific skills, expertise, and industry knowledge significantly enhances the acquirer’s capabilities and strengthens the executive team.

Real-life example: Google’s acquisition of the small AI startup DeepMind Technologies significantly enhanced Google’s AI capabilities, leading to advancements in products like Google Assistant and Google Search. The acquisition also showcased AI’s potential through achievements like the AlphaGo project. Finally, integrating DeepMind’s expertise improved Google’s data center efficiency and bolstered its leadership in AI development and innovation.

5. Financial benefits

Acquiring a profitable business immediately boosts revenue and profitability, enhancing financial stability. In addition, combining operations reduces costs by sharing resources and streamlining processes.

Once the benefits of an acquisition deal are understood, the next step is determining how to acquire a small business. Keep reading to get a better grasp of the process and gain practical knowledge.

Small business acquisition process: 10 easy steps

The deal may appear quite complex at first, but a thorough and consistent approach significantly increases the chances of success. To ensure that everything goes smoothly, follow the steps and recommendations outlined below.

Quick guidelines

- Compare and analyze corporate structures

- Determine the new company’s leadership

- Compare company cultures

- Determine the new company’s branding

- Analyze financial positions

- Determine operating costs

- Conduct due diligence

- Value all companies

- Maintain procedural transparency

- Sustain momentum

1. Compare and analyze corporate structures

Thoroughly examine each company’s structure to determine the most suitable approach for merging or acquiring the business. For instance, if a corporation plans to merge with a sole proprietorship, it might opt to acquire its assets. Conversely, if two businesses intend to merge, they might form a new entity through a consolidation deal. Here, the new corporation acquires all shares of the two pre-existing companies.

✔ Consider all perspectives when determining the legal structure to avoid the dissatisfaction of a small business owner or shareholder.

2. Determine the new company’s leadership

This step decides who will lead the new company. This involves setting up the leadership structure, appointing a board of directors, and electing corporate officers. It can be challenging as the leaders of both companies may want to take charge, and the new organizational chart may contradict the old companies’ cultures.

✔ Transparent communication and collaboration streamline the process. Holding open discussions and involving stakeholders from both companies in decision-making helps align leadership visions and mitigate conflicts. Additionally, conducting thorough assessments of leadership skills and cultural fit helps.

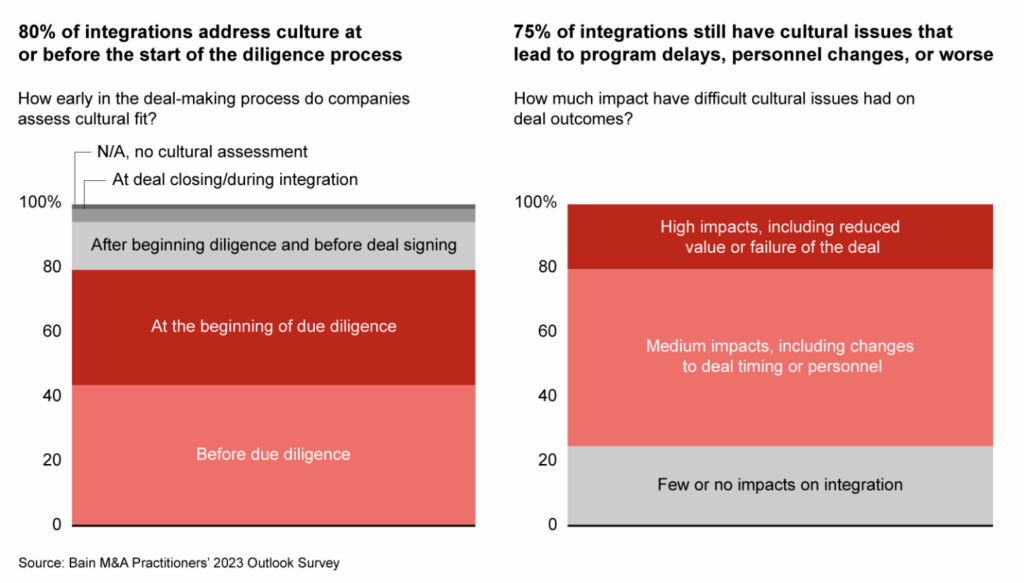

3. Compare company cultures

Company culture is an essential factor to consider before merging. Clashes lead to conflict, decreased morale, and higher turnover, undermining the deal’s objectives.

✔ Spend time at the company’s offices and talk to the founder and employees to gauge their openness to change, willingness to work under new leadership, and overall ease of collaboration.

4. Determine the new company’s branding

Like the leadership issue, new business branding stirs up many emotions among the companies’ leaders and employees. For example, one party might interpret any changes as a negative comment about their existing business.

✔ Ensure transparent and inclusive communication to mitigate emotional responses. Engage leaders and employees from both companies to foster a sense of ownership and respect for both legacies.

Real-life example: In one of the largest real estate M&A deals, Jones Lang Wootton and LaSalle Partners merged to create a new entity, branded as Jones Lang LaSalle (JLL). The new name honored the histories of both companies.

5. Analyze financial positions

The target company’s financial strength makes or breaks the merger. In particular, high debt or liabilities hinder success. Therefore, examining the company’s financials being merged is crucial and must be done well before any decision-making.

✔ Thoroughly examine the target’s financial statements, debt levels, and liabilities to identify red flags. Engage financial experts to assess financial health and develop strategies to manage and mitigate risk.

6. Determine operating costs

Examine a potential merger target’s balance sheet, recent income statements, and cash flow statements. This analysis reveals whether the company is struggling with high operating costs or an unusually high weighted average cost of capital. Identifying these types of pitfalls helps protect a merged entity’s productivity.

✔ Use financial analysis tools and consult with experts to ensure a deep understanding of the target’s operating costs and potential impact on the new entity’s performance.

Note: Before starting the due diligence process, determine if seller financing is an available option, as it could help reduce the financial challenges of securing a loan. Seller financing involves obtaining a loan directly from the business owner instead of an external lender. This type of financial support usually requires extensive documentation.

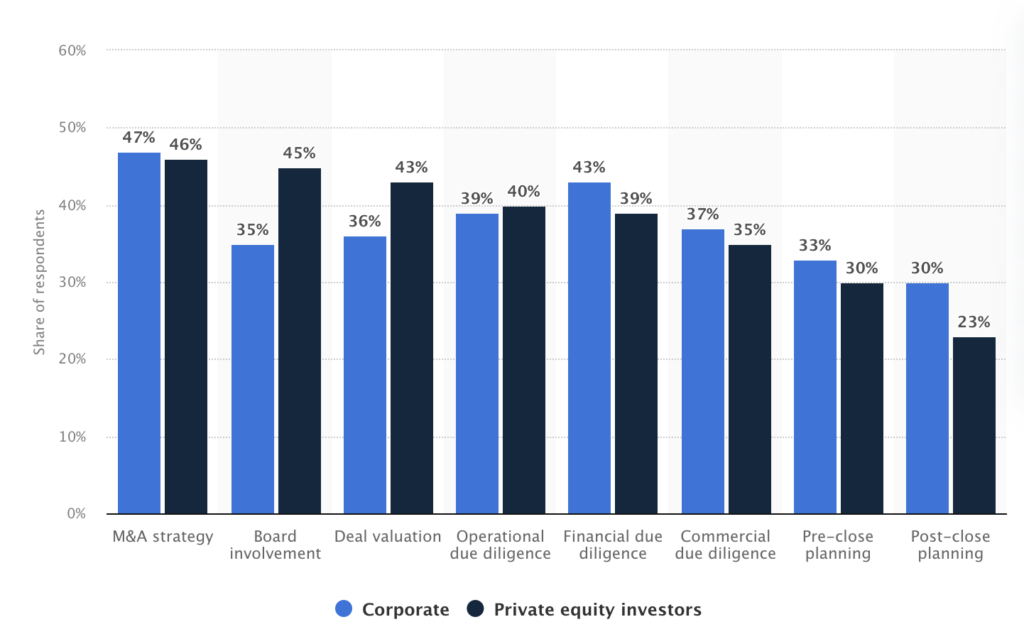

7. Conduct due diligence

Conduct thorough research on the potential merging partner. Depending on the type of transaction, the new entity may be responsible for merging company debts. Tax obligations, legal rulings, and claims on real or personal property could all become the new enterprise’s responsibilities. Therefore, a small business owner should carry out all necessary investigations to ensure nothing hinders the merger’s success.

Once this stage is finished, both parties work with their attorneys to draft, edit, and finalize a purchase agreement. Since the attorneys handle the purchase agreement edits, this process could take several weeks.

✔ Using M&A software helps streamline the process. Its features can help thoroughly analyze the merging company’s financials, legal obligations, and potential liabilities. By centralizing data and automating due diligence tasks, one can efficiently identify all risks or obstacles that could impact the merger.

| 👁️🗨️ Additional resources: List of M&A documents for a smooth due diligence process |

8. Value all companies

To ensure a fair distribution of shares of the newly established company to the owners of the existing business entities, it’s important to evaluate the value of each company. This process is similar to determining the value of a business before closing or selling it. Valuation methods vary depending on the situation. It’s advisable to seek the expertise of a valuation specialist for a third-party assessment.

✔ Consider using multiple valuation methods to triangulate the value of each party involved. This approach enhances accuracy by providing a comprehensive view of the company’s worth, minimizing the risk of under- or overvaluation.

9. Maintain procedural transparency

While certain information must stay confidential, it is crucial to keep employees informed for a smooth transition. When it involves people’s jobs, it’s best to minimize surprises as much as possible.

✔ Be as transparent as possible about the potential impact on salaries, the process for filling new positions, and any new criteria or policies.

10. Sustain momentum

During a merger or acquisition, the CEO must set clear goals and targets for the company’s leadership team and staff. Emphasizing key leader characteristics and holding everyone accountable helps keep the company on track for success during this busy time.

✔ A smooth transition relies on organization. Therefore, it is important to establish a standard of performance to which everyone will adhere.

Pro tip for acquirers: Explore the sell-side M&A process to understand the seller’s motivations, negotiate effectively, and streamline acquisition.

Acquiring an established small business can be an attractive opportunity. The seller is often experienced and motivated to sell, while the buyer benefits from the proven earnings track record and near-term sales potential. However, despite the appealing nature of the transaction, it’s essential to consider some legal points to ensure a secure process.

Top legal considerations of acquiring a small company

From understanding the business structure to planning the exit strategy, addressing the following elements early on paves the way for a smoother process and long-term success.

| Company structure | Determine if the business is registered as a corporation, LLC, sole proprietorship, or partnership. This point affects bylaws, operating agreements, and meeting minutes. |

| Purchase details | Decide if the buyer is acquiring assets or corporate stock/units, as this impacts control, liability, taxes, licenses, permits, and financing. |

| Buyer’s goals | The buyer must consider their involvement level, risk tolerance, and desire for growth or stability. Their goals influence the acquisition process and future business direction. |

| Seller’s role post-sale | Decide if the seller will stay on for a transition period. Some buyers prefer a turn-key handover, while others want the seller’s help to ensure a seamless transition. |

| Due diligence | Thoroughly assess the business’s strengths, weaknesses, and required changes. Assign responsibility and timelines for implementing necessary changes. |

| Acquisition financing | Most buyers, including those utilizing a search fund if needed to supplement the funds, will need a mix of personal funds, bank loans, and possibly SBA backing to cover the purchase price. Expect thorough scrutiny and conditions attached to financing. |

| Exit plan | Plan the buyer’s exit strategy from the start. This will influence legal and tax decisions and protect the buyer’s investment. |

By carefully considering each of these aspects, you can protect your existing business ownership, minimize potential legal and financial pitfalls, and set the stage for the future growth and stability of the merged entity.

Conclusion

Small business M&A has become a strategic focus for larger corporations. This business takeover offers big advantages, including market expansion, diversification, and competitive advantage. By following a systematic approach and carefully considering all aspects of the process, the acquiring company can maximize the transaction’s benefits. Overall, the deal represents a valuable growth strategy for corporations looking to strengthen their market position and drive long-term success.