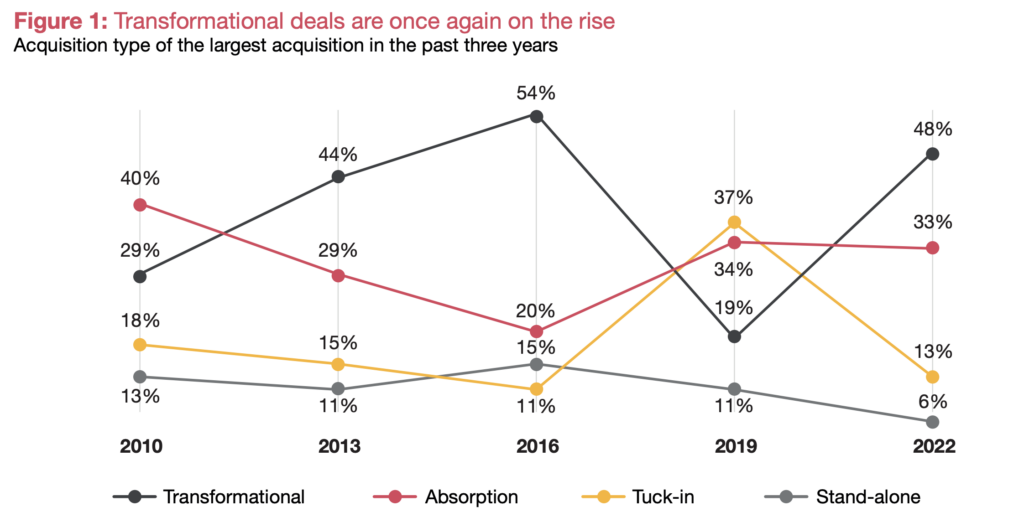

While bolt-on and tuck-in deals accounted for 46% of all M&A transactions executed in 2022, they are rarely advertised. Nevertheless, these deals are vital for expanding market share and strengthening a business’s position in a competitive landscape.

In this article, we will take a closer look at comparing tuck-in vs. bolt-on acquisitions, review their differences and similarities, and analyze the case studies to show the actual business value created from such an investment type.

What are tuck-in acquisitions?

A tuck-in acquisition involves the complete absorption of a smaller company by a larger company, often funded by private equity firms. Usually, the buyer and the acquired organization have a big disparity in size, while their industries of operation and business models are relatively the same. As a result, tuck-ins are attractive for investors because they immediately increase the market reach and revenue under the same brand, i.e., the acquirer’s brand.

What are bolt-on acquisitions?

As opposed to a tuck-in acquisition, in a bolt-on deal, the acquired organization becomes the acquirer’s subsidiary. A smaller company is “bolted on” to the larger company. This way, the acquired company preserves its own brand and identity, fully or partially operated by the acquiring company.

Difference between tuck-in and bolt-on acquisitions

The key difference between both M&A types is how much of the smaller company the larger absorbs.

Tuck-ins, or companies acquired in a tuck-in deal, are entirely absorbed by the buyer. A bolt-on company is partially absorbed, retaining certain structural aspects, such as brand name, customer relationships, distribution channels, and technologies.

Both types of deals benefit the acquiring company’s consolidation strategy, helping obtain new resources for growth, including intellectual property, talent, and supplies.

Compared to other types of acquisitions, bolt-on and tuck-in M&A deals provide less risky business expansion opportunities through diversifying investment to smaller companies.

When comparing two acquisition types from the perspective of a strategic vs. financial buyer, tuck-ins are usually conducted for revenue growth and to expand into new markets rather than for strategic reasons. On the contrary, bolt-on deals are mostly conducted for strategic reasons.

Differences in the integration process

The integration approach differs depending on the size and the target company’s strategic fit. Here is a short comparison of integration approaches toward acquired organizations.

- Cultural fit. In a tuck-in acquisition, both a platform company (buyer) and target entity may be similar in the organizational culture that simplifies cultural integration. With bolt-ons, often, the parties have different cultures, which makes integration more challenging. The appropriate integration plan helps address these issues.

- Synergies identification. In tuck-ins, the target company may have certain assets, intellectual property, and other assets that are particularly valuable for the acquirer. With bolt-ons, some resources in target and acquiring companies may overlap, and identifying those synergies can help get specific cost savings.

- Operational integration. With tuck-ins, the target entity is usually entirely integrated into an existing business unit. In a bolt-on acquisition, the target entity preserves its operations yet obtains management from the acquired entity. That’s why bolt-on deals imply producing the operations integration plan not to affect operational efficiency.

- Employee retention. With both deal types, the acquiring company may need to retain the target organization’s key employees to ensure a smooth transition and benefit from their expertise. In a bolt-on deal, such retention may cause resistance due to the lack of cultural fit between the acquirer and the target entity.

While smooth and efficient integration is less challenging in a tuck-in acquisition, bolt-on deals offer greater strategic potential for successful integration.

Tuck-in M&A: Pros and cons

There are a number of reasons why tuck-ins are appealing to investors, especially in industries where unique resources and capabilities form the key competitive advantage. With tuck-ins, companies can secure additional resources for strategic growth. Here are the key benefits of tuck-in acquisitions:

- Acquiring new resources. Targeting a smaller company with the desired resources helps the larger company fill the gaps in its own resource base, like intellectual property or distribution channels.

- Integration efficiency. There is no need to duplicate efforts while absorbing the purchased company’s operations into the platform company.

- Market dominance. In high-competition industries, where companies are fighting for customers, tuck-ins help a larger company absorb smaller competitors to increase market share.

- Diversification of product portfolio. By purchasing smaller companies, the acquirer can add new products and services to its portfolio, which facilitates market consolidation.

- Increased ROI. Often, investors expect to earn high investment returns when purchasing the company’s stock. The companies increase their market share and overall returns, which helps meet the shareholders’ expectations and increase the shareholder value of the acquiring company.

Besides bringing tangible benefits to the acquirer’s platform, tuck-in acquisitions come with certain challenges, including:

- Costly implementation. Executing tuck-ins incurs asset acquisition costs, legal, loan, and regulatory fees, and commissions.

- A poor match between the acquirer and the acquired entity. Sometimes, smaller companies cannot integrate into bigger ones due to differences in culture, structure, or other criteria.

Using a data room for due diligence with the ability to review all the target company’s documentation to ensure its structural and resource fit, financial state, and regulatory compliance significantly decreases the risk of failure in M&A transactions.

Bolt-on M&A: Pros and cons

Bolt-on deals bring numerous benefits to the acquirer, including:

- Market expansion. Bolt-on deals help expand the company’s geographical business presence and increase market share.

- Increased efficiency. Often, a bolt-on acquisition covers the acquirer’s needs in certain products or services that previously were outsourced. Producing them in-house helps speed up operations, save costs, and amplify better performance.

- Higher value. A bolt-on acquisition adds to the company’s value, making it more attractive to potential investors and partners. A private equity firm can use these deals to enhance its portfolio before the sale.

- Easier and faster integration. A bolt-on acquisition implies partial absorption, integrating only a part of the company’s systems. A smaller company is more willing to be acquired in a bolt-on approach, as it allows retaining their autonomy and original identity.

While bolt-on M&As are comparatively low-risk deals, some threats still exist, including:

- Talent and cultural conflicts. When a larger company acquires a startup, the startup may experience severe operational and corporate-culture changes.

- Loss in the company’s identity. A bolt-on acquisition outside the acquirer’s niche market may lead to losing its identity and unique market position in favor of rapid growth.

- Miscommunication and conflicts with employees. When employees from the purchased company join the acquirer’s team, there can be conflicts due to salary differences, responsibilities, and role changes.

These questions to ask during an acquisition help to clarify the blind spots in the target company’s profile and reveal potential risks.

Case studies for tuck-in and bolt-on acquisitions

Here are a few bolt-on acquisitions vs. tuck-in acquisitions success and failure stories to analyze and understand the criteria to consider when choosing the target for your own acquisitions.

Examples of bolt-on deals

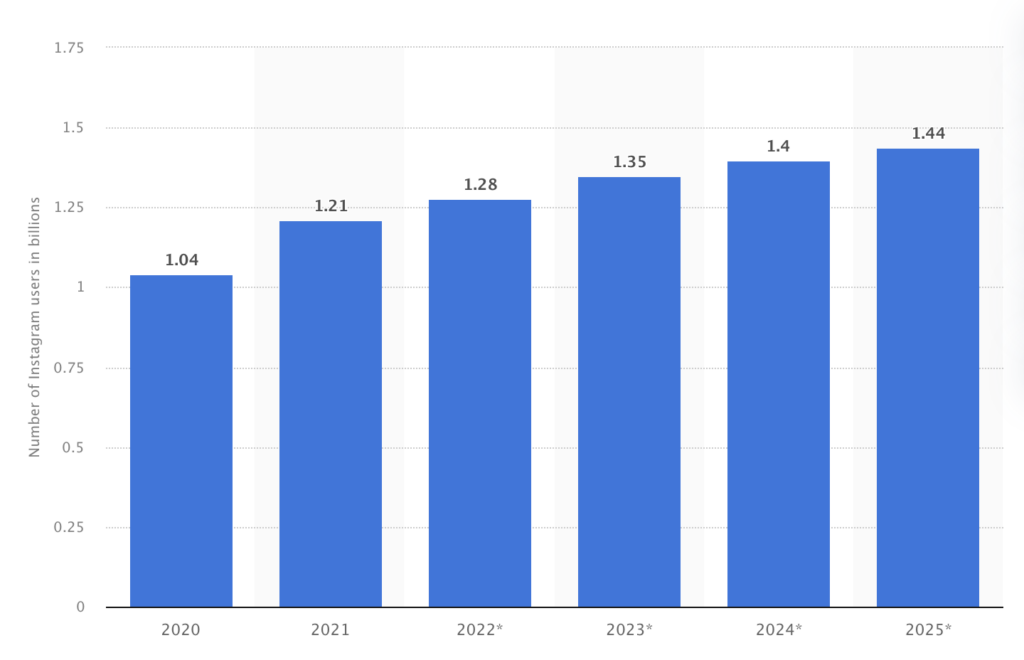

One of the most prominent examples of a successful bolt-on deal is Facebook’s acquisition of Instagram in 2012 — two years after Instagram launched. Facebook bought the photo-sharing app for $1 billion, which helped the social media giant expand its reach into mobile devices and attract a younger audience. Instagram also benefited from the deal by increasing the number of users to over 1.28 billion users by 2023:

The acquisition of Autonomy by Hewlett-Packard in 2011 was not that successful. The British software company Autonomy cost HP $11 billion and was supposed to help HP shift its focus to software and services. After the acquisition, it turned out that Autonomy’s financial results had been inflated. As a result, HP was forced to write down the value of the acquisition by $8.8 billion, which led to significant financial losses.

More thorough pre-deal due diligence using virtual data rooms for mergers and acquisitions could have prevented Hewlett-Packard from such a failure.

Examples of tuck-in deals

Oracle acquired NetSuite in 2016. The provider of cloud-based business management software was acquired for $9.3 billion. Oracle’s goal was to expand its reach in the cloud computing space, so NetSuite has become a crucial part of Oracle’s cloud offerings, with over 24,000 customers in 100+ countries globally.

Google’s acquisition of SageTV is one of the renowned examples of a failed tuck-in acquisition. Google purchased SageTV in 2011. This maker of software for recording and streaming TV shows was meant to help Google improve its Google TV platform. Unfortunately, SageTV’s technology never completely integrated into Google’s offerings, and eventually, the GoogleTV platform was shut down.

How businesses should choose between tuck-in and bolt-on acquisitions

Choosing between tuck-in and bolt-on acquisitions depends on multiple factors. Here are some considerations that can help a business decide which type of acquisition is most appropriate:

- Strategic fit. A tuck-in acquisition is generally more suitable for a smaller company with a product or service that complements the buyer’s existing offerings. Bolt-on deals are more appropriate when the buyer wants to enter a new market or acquire a new capability.

- Size of the target entity. A tuck-in acquisition is generally smaller and involves acquiring a smaller company that can be integrated easily. Bolt-on deals are typically larger and involve acquiring larger companies that may have their own established operations and culture.

- Integration complexity. A tuck-in acquisition involves integrating a small company with an existing business unit, which is often less complex than integrating a large company with multiple business units.

- Cultural fit. A tuck-in acquisition often involves a smaller company, making it easier to maintain cultural alignment between the two organizations. Bolt-on M&A can be more challenging in terms of maintaining cultural fit.

- Cost. Tuck-in acquisitions are typically less expensive than bolt-on investments, as they involve a smaller company and require fewer integration efforts.

- Timeframe. A tuck-in acquisition can be completed quicker than bolt-on acquisitions, as they involve a smaller company and require less due diligence and integration efforts.

Careful considerations through proper due diligence can help a business make an informed decision. These data room reviews will help you choose the appropriate tool for running due diligence securely and effectively.

Key takeaways

Being often confused, tuck-in and bolt-on acquisitions differ by the level of absorption of a purchased company. With tuck-ins, the acquirer completely absorbs the acquired entity, while in bolt-on transactions, the acquired entity preserves a certain level of identity.

Most risks associated with tuck-in and bolt-on acquisitions are related to poor due diligence and rush in closing the deal. Thorough pre-acquisition due diligence and negotiations can significantly reduce potential risks.

Check the data room for investors checklist to understand what documents should be included in the pre-acquisition audit to avoid failures in your M&A.