Dec 28 ‘23

47 min read

Many startups fail to conduct proper due diligence which leads to a high failure rate of 70% to 90% in acquisitions, according to Harvard Business Review. This is a crucial step that many founders overlook in the merger and acquisition process. Given the statistics, neglecting the due diligence process in startups weakens a startup’s foundation, leaving it vulnerable to disasters.

The route to gaining venture capital investment for each emerging business rests on a vital juncture: startup due diligence. This process thoroughly examines your scalable startup model, beyond your investment pitch, financial analysis, and corporate governance.

This article explores how to do due diligence on a startup, the role of a virtual data room for due diligence, and deeply explains why this is important for startup growth.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

SmartRoom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

What is startup due diligence, and why is it important

Due diligence refers to the thorough examination of a company conducted by angel investors or venture capital firms. This is done to determine whether the startup is a prospective investment. Therefore, it is crucial for any startup raising capital to have thorough due diligence in place.

Due diligence in a startup is a lengthy process for the company management. This process requires honesty about legal issues, protection of customer data, assessing disputes, partnership agreements, legal claims, employment agreements, and past business mistakes. The data speaks for itself: 80% of tech leaders prioritize data security and privacy as the ultimate indicator for investment opportunities.

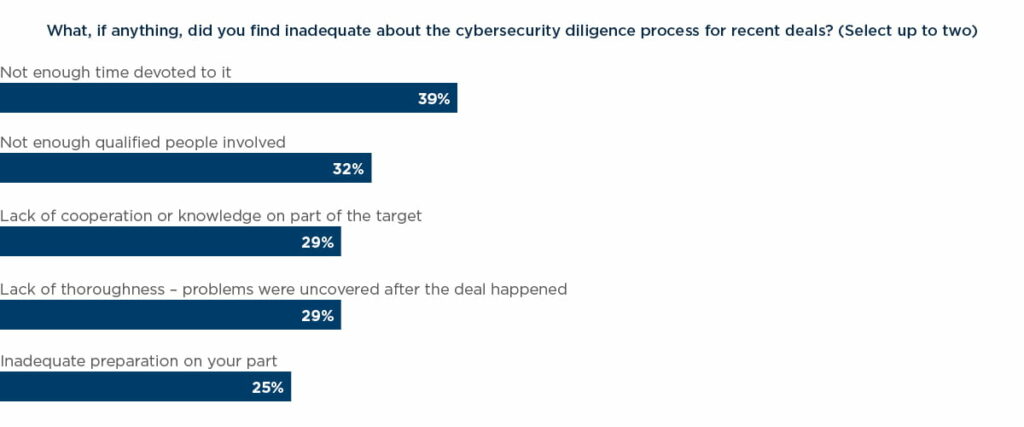

The survey by West Monroe Partners showed that 39% of executives were concerned about inadequate time devoted to cybersecurity due diligence in recent M&A deals.

The main goal is to establish trust between the startup and potential investors, streamlining the venture capital funding process. However, founders must recognize that VC investors will only partially rely on the information provided by the startup during investment preparation. Based on our experience, external and independent checks are commonplace, involving interviews with current and former workers, foreign employees, and partners. Sometimes, potential investor may even reach out to customers for feedback.

To sum up, due diligence workflow may be an exhaustive and time-consuming process, and the management team must be well-prepared and willing to commit sufficient time and resources. If due diligence fails, it can have profound consequences, significantly devaluing the investment negotiations. To prevent this, consider creating a virtual data room for startups and give access to all stakeholders and investors to relevant data.

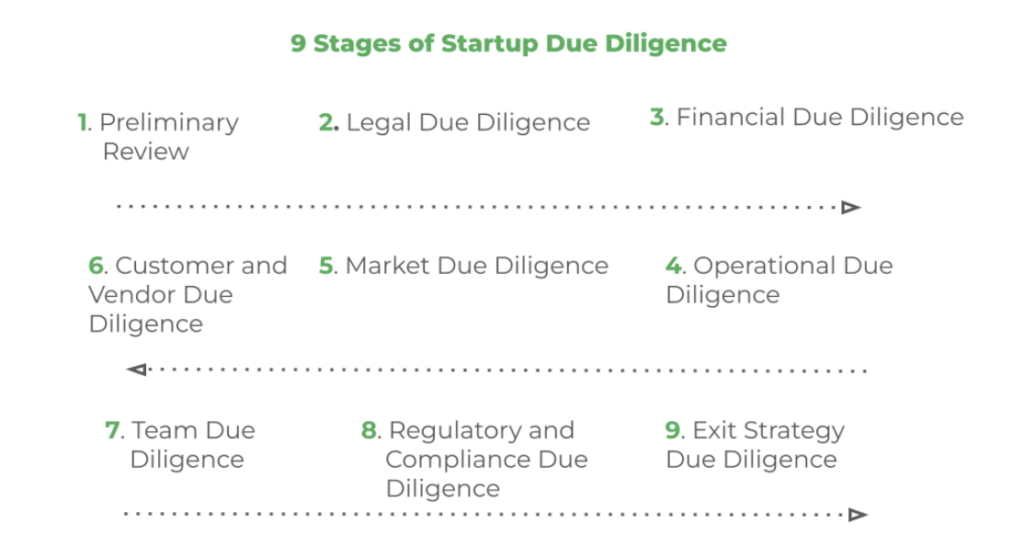

Nine stages of due diligence for startups

VC due diligence generally consists of many important steps that comprehensively analyze various parts of the startup. While the particular phases may differ based on the nature of the business and the investors’ preferences, the nine common stages of venture capital due diligence are the following.

Let’s delve into each of the nine stages of startup due diligence and explore what they involve.

- Preliminary review. Investors do an early assessment to understand the fundamentals of the company, such as its business plan, competitive advantage of product or service, and prospective market. This step frequently includes assessing the management team’s credentials and history to assess their knowledge and skills.

- Legal due diligence. A detailed analysis of the startup’s legal structure is required for legal due diligence. The diligence request list involves examining material contracts, agreements, and revenue streams for risk assessment. Many investors research intellectual property rights, such as patents and trademarks as with any existing or future legal conflicts.

- Financial due diligence. Early-stage investors examine financial statements, such as income statements, balance sheets, and cash flow statements. They review financial performance in the past, and prospects. Examining the accounting details in the due diligence report reveals hidden concerns about the value of the startup.

- Operational due diligence. A comprehensive evaluation of the startup’s day-to-day activities is part of operational due diligence. This involves assessing operational procedures, infrastructure, and scalability. Investors search for possible bottlenecks, flaws in supply chain management, and areas for operational improvement.

- Market due diligence. Investors do a thorough examination of the target market in which the business works. This involves assessing the market’s size, growth potential, and competitive environment. The market positioning, client base, and marketing methods of the startup are also taken into account.

- Customer and vendor due diligence. This stage focuses on confirming the startup’s relationships with its customers and providers. Investors evaluate customer satisfaction levels, client base variety, and any possible dangers linked with major customers.

- Team due diligence. Investors examine the management team of a startup’s competencies and expertise. This includes analyzing the team’s track record, determining their capacity to carry out the business strategy, and finding any skill shortages or potential conflicts of interest. The team’s strength is frequently a deciding factor in investment decisions.

- Regulatory and compliance due diligence. Regulatory due diligence entails verifying that the startup complies with applicable rules and regulations. Investors examine the regulatory landscape for any legal or regulatory issues. This stage allows investors to see how successfully the business has handled regulatory challenges.

- Exit strategy due diligence. Investors investigate the startup’s exit alternatives, such as acquisition or an initial public offering (IPO). This includes determining if the startup’s aims correspond with those of possible investors and comprehending the exit options in place.

What are the key components of due diligence for startups

For any ambitious entrepreneur, the spotlight of due diligence is exhilarating. However, this scrutiny holds the potential to either launch the startup to success or reveal unforeseen challenges. Therefore, it’s essential to know the key components that serve as a startup investment due diligence checklist.

- Market landscape. Investors always look for potential in a startup and want to understand its market position, size, and competition. They want to know if the startup is addressing a genuine need with a sizable target audience or competing in a saturated market. Analyzing the market opportunity and the startup’s position in it is crucial to determine its growth potential.

- Product evaluation. Product or service evaluation is one of the investor criteria and focuses on uniqueness, scalability, adaptability, and growth potential. Thus, investors seek innovative solutions with the potential to dominate their space.

- Team and management assessment. It is important to evaluate the team and management of a startup, focusing on their capabilities and experience. Are the right people leading the way? Do they have the necessary skills and experience to navigate the challenges of running a startup? Venture capitalists place great value on a strong and diverse team with a proven track record.

- Technology and IP due diligence. Technology startups require a deep understanding of technology and IP due diligence. Scalable tech, strong IP protection, and data privacy compliance are crucial for successful investor partnerships. Moreover, robust cybersecurity and data privacy compliance build trust and safeguard user information.

How can startups prepare for financial due diligence?

Investors have a set of criteria they use to evaluate potential deals. Proactively gather documents and information relevant to potential startup due diligence checklist. To do this, focus on the key areas that investors typically review.

1. Accurate and organized financial statements

Building trust starts with transparent, well-maintained financial records. Ensure your current and historical financial statements (income statement, balance sheet, cash flow statement) are:

- Accurate. Conform accounts regularly and address any deviations. Investors value integrity above all else.

- Organized. Present your statements clearly and consistently, using standard formats and terminology. Easy navigation builds confidence.

- Complemented by explanations. Don’t leave room for questions. Provide concise yet informative explanations for any unusual variances or trends.

2. Compelling and realistic projections

Investors aren’t just assessing your present; they’re betting on your future. Craft compelling, yet realistic, financial projections that showcase the growth potential of your emerging businesses. Remember:

- Grounded in reality. Base your projections on solid assumptions and historical data. Avoid overly optimistic figures that raise red flags.

- Scenario planning. Prepare multiple projections under different market conditions, demonstrating your ability to adapt to challenges.

- Clear communication. Explain your assumptions and methodologies clearly, giving investors confidence in your numbers.

3. Understanding key financial indicators

Don’t allow investors to become overwhelmed by numbers and bureaucracy when it comes to startup valuation. Focus on presenting key financial metrics that speak volumes about your financial health and potential. Be ready to discuss:

- Burn rate. It means how fast your company is spending its reserves and how long it can continue to operate with its current level of spending. It is an important metric to keep track of to ensure that the company remains financially stable and has enough funds to sustain its operations.

- Customer acquisition cost (CAC). The cost of acquiring each new customer, and its relationship to customer lifetime value.

- Revenue growth rate. Based on our observations, it demonstrates the ability to capture and retain market share.

- Unit economics. The profitability of each unit sold is a crucial indicator of scalability.

How do investors evaluate a startup’s market potential?

For investment pitch preparation, it is crucial to understand the various evaluation approaches investors use. By doing so, you can tailor your pitch to highlight the potential of your market, outperform your competitors, and identify areas for growth.

Beyond the gleam of your product or service, investors focus on one question: can you conquer a market worth conquering? To answer this, they evaluate the business aspects such as market size, competition, and growth potential.

1. Market size

Investors are always on the lookout for a large market with growth potential. The size of your target market will be closely examined by investors, who will assess its current customer base and potential for expansion. Is it a niche market with a small but loyal customer base, or a large and growing mass market that is ripe for disruption? The larger the market, the greater the potential for returns on investment.

2. Competition

Investors carefully evaluate your competitors by analyzing their strengths, weaknesses, and market share. They want to know whether your product or service can create a significant impact or just a minor change in a crowded marketplace. Can you outsmart the existing players or conquer a unique position? The more intense the competition, the more important it is to differentiate yourself.

3. Growth potential

A stagnant market is a dead-end road and investors are always looking for companies that show great growth potential. They want to see that your product or service has the potential to not only capture a significant market share but also expand into new markets. Your product should not have a short-term impact but rather serve as a foundation for expanding into related markets.

Communicating with investors during due diligence

A successful due diligence process isn’t just about mountains of paperwork and endless interviews; it’s about mastering the art of communication to build trust, avoid deal-sinking disagreements, and unlock the funding your venture needs to thrive. In turn, McKinsey & Company warns that a staggering 42% of large M&A deals fall apart due to price discrepancies, often caused by communication inefficiencies.

So, how do you navigate startup operational due diligence with clarity, honesty, and a compelling narrative that inspires confidence and secures the green light from investors? We would like to provide five strategies for presenting information to investors.

- Tailor your message. Understand each investor’s focus and tailor your pitch accordingly. Highlight aspects that align with their portfolio and investment thesis.

- Data-driven storytelling. Present compelling narratives built on solid data and financial projections. Use clear, concise language and avoid jargon.

- Visualize your pitch. Infographics, charts, and compelling visuals can make your presentation more engaging and impressive.

- Anticipate questions. Prepare for likely questions and demonstrate your knowledge of potential challenges and risks. Also, practice addressing concerns with confidence and solutions in place.

- Highlight the wow factor. Showcase your competitive advantage and unique value proposition that sets you apart from the competition.

What is the role of the founders in the due diligence process?

Founders can increase their chances of securing funding and building relationships with investors by taking an active and responsible role in due diligence. Founders are crucial since they serve as the company’s voice and ambassadors. Their tasks are the following:

- Preparation includes gathering and organizing required papers, creating presentations and financial models, and analyzing the questions and concerns.

- Active participation entails being available for interviews, meetings, and Q&A sessions with investors, as well as demonstrating a thorough understanding of the business and market.

- Demonstrating leadership includes displaying the vision, passion, and ability to guide the company to success.

- Addressing concerns entails responding to investor questions and concerns with candor and confidence, as well as offering solutions and mitigation strategies.

- Relationship building demands cultivating an atmosphere of trust and openness with possible investors, as well as actively engaging in open and honest communication.

Key takeaways

- Due diligence is crucial for establishing trust between startups and investors.

- A comprehensive due diligence checklist startup founders should follow delves deeper than just financial statements, encompassing legal issues, corporate governance, and market viability for a holistic assessment.

- Key components of due diligence are market landscape, product evaluation, team and management assessment, technology and IP due diligence are essential focus areas.

Category

Due diligenceUser checklistsFAQ

It can vary greatly depending on the complexity of the startup and the scope of the review. Expect 3-6 months on average, though simpler deals or experienced teams could be faster, while intricate ventures or red flags might extend the timeline.

Evaluate the startup's financial health, intellectual property, contracts, regulatory compliance, team qualifications, market positioning, and potential legal issues. Assess each area for risks and opportunities, ensuring a comprehensive understanding before making investment decisions.

By being systematic and setting up a data room, startups can prepare for the due diligence phase. They should organize all financial papers such as statements, tax records, business plan, personal property leases, profit and loss statements, and balance sheet. They should check that all financial records are up to date and correct. Financial projections and statements should be updated frequently.