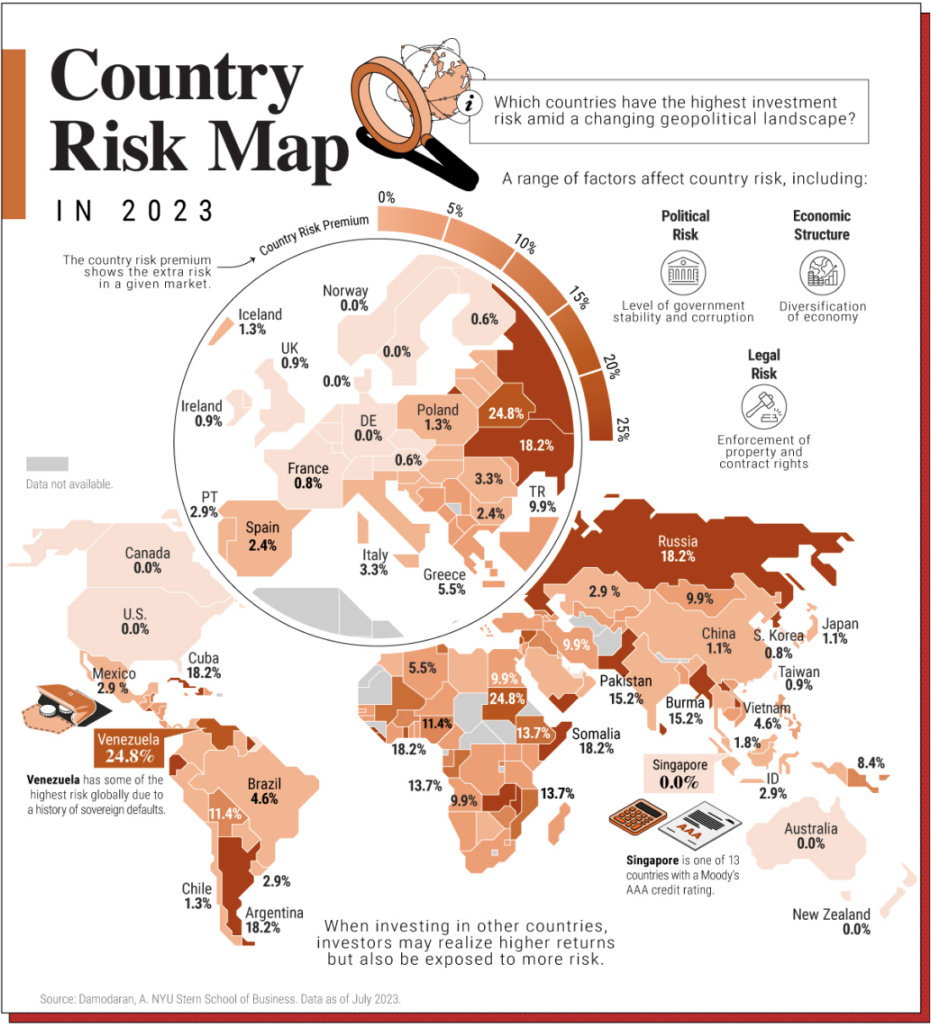

Forecasting the financial and economic outlook can be difficult, especially when global events cause sudden changes. For instance, COVID-19 had a significant impact on the economy, and Russia’s invasion of Ukraine caused political instability, which all happened in the past few years.

As for 2024, growing tensions between the US and China and the most packed global election calendar ever may become the next source of turbulence in the business world. So, investors must be ready to navigate through the uncertain times ahead.

Although there is no magic formula to eradicate all the flaws of today’s world for investors, there is a way to mitigate them – a data room for investors. In our guide, you will discover the game-changing benefits of this technology, get advice on setting up the space for optimal use, find the top data room providers, and see how it can adapt to meet new challenges.

What is a data room for investors?

An investment data room is a highly secure platform that addresses the pain points of investors. It enables them to manage and navigate vast amounts of sensitive information, ensuring that critical details are not missed and that confidential data remains secure against unauthorized access, breaches, and leaks.

The platform also offers various tools to streamline due diligence, providing an organized data room with easy yet secure access. Additionally, an investor data room facilitates smooth collaboration among multiple stakeholders through intuitive communication tools.

Apart from investors, the solution is used by individuals responsible for evaluating and making investment decisions, professionals who help clients navigate complex investments, and decision-makers involved in mergers, acquisitions, and other complex deals to perform startup due diligence, company valuation, etc.

Strategic advantages of data rooms for investors

Discover the software benefits for potential investors and target companies, and explore its advanced features that enhance data access, the due diligence process, and decision-making throughout deals.

1. Information accessibility

Quick access to relevant data with the help of a data room enables investors to react promptly to market opportunities or changes, potentially leading to advantageous investment deals. On the other hand, companies that provide transparent access to sensitive information demonstrate their commitment to openness and accountability, which can strengthen investors’ trust.

✔ What does a virtual data room offer for information accessibility?

- Centralized data storage space. Investors can quickly and securely review essential documents in a single space without navigating multiple online solutions or traveling to physical data rooms.

- 24/7 data access. It allows deal room users to review documents and conduct due diligence at their convenience from any device, regardless of location or time zone.

- Document version control. With this tool, investors keep track of updates in real time and access the latest document versions.

- Multiple file format support. Data room users can view documents of various formats as secure PDFs without additional software.

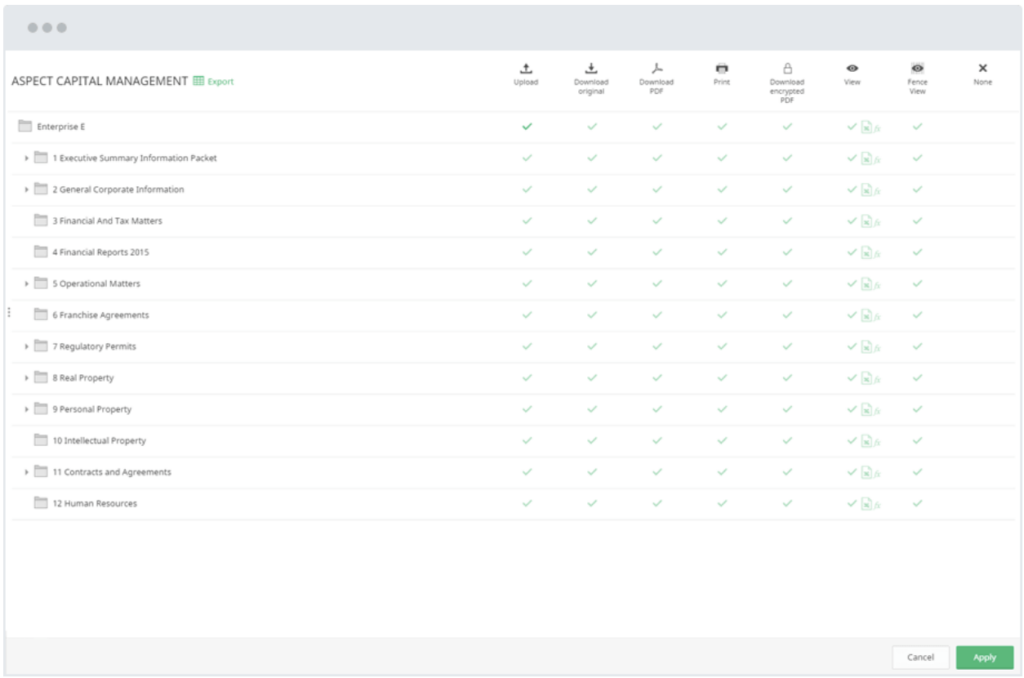

- Granular document permissions. Admins can control access to each file and folder by setting the appropriate permissions, ensuring safe work for investors.

2. Due diligence efficiency

With data rooms, investors understand their investment opportunity better by conducting a thorough and timely due diligence. The procedure helps to increase investor confidence in the transaction while minimizing the chances of any surprises at the last minute. For a target company, in turn, a data room is a way to manage the process in a consistent and organized manner.

✔ What does a virtual data room offer for due diligence efficiency?

- Organized document structure. Investor data rooms automatically generate organized document trees, simplifying navigation and accelerating data search.

- User group setup. A data room enables admins to manage users by dividing them into groups with different data room access levels, which protects and simplifies the procedure.

- Time and IP access restriction. An administrator can restrict access to data from certain IP addresses and during specific periods, ensuring sensitive data security even with multiple participants.

Virtual data protection 256-bit data encryption, dynamic watermarks, fence view, investor access controls, digital rights management, two-step user identity verification, and non-disclosure agreement (NDA) protect the due diligence process from breaches and leaks.

3. Decision-making precision

Accuracy in decision-making is crucial for investors and target companies alike, as it allows for the best possible deal structuring, value recognition, strategic partnerships, sustainable growth, and stability. When decisions are made carefully and accurately, both parties benefit, and the data room software can help achieve this.

✔ What does a virtual data room offer for decision-making precision?

- Real-time updates. All parties are immediately notified of new tasks and users, document uploads, changes, and comments within an investor data room. It allows them to make decisions based on the latest information.

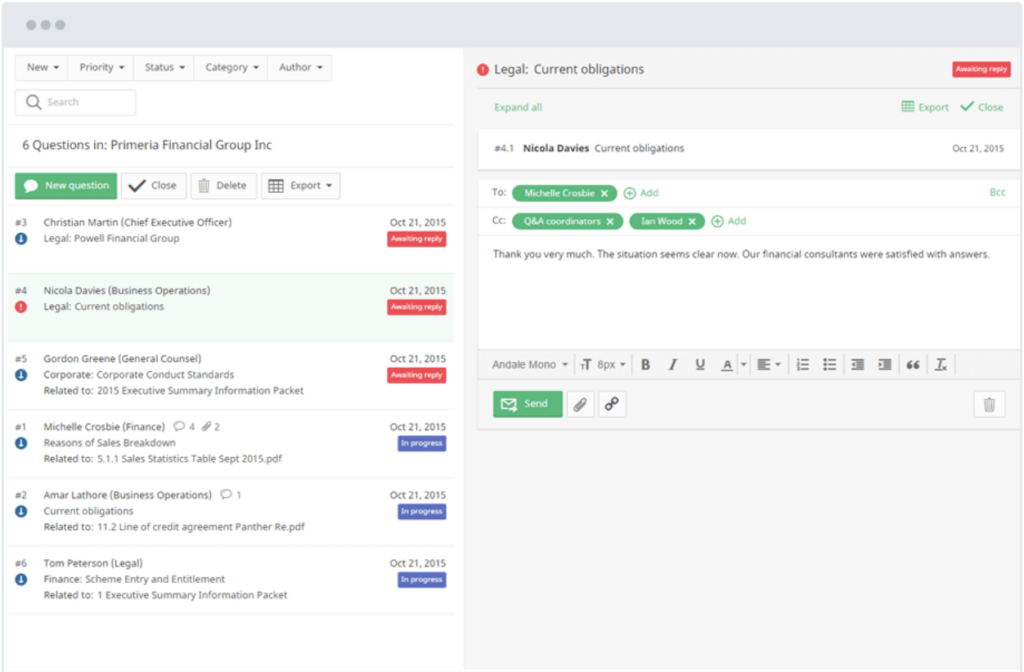

- Investor communication channels. Private and group messaging, Q&A modules, task assignment capabilities, comments, and annotations facilitate collaboration by enabling project coordination and secure data sharing.

- Audit trails and activity monitoring. Investor data rooms keep a detailed log of user activities, including document views, downloads, forwards, and prints. This data is valuable for monitoring due diligence progress and ensuring compliance with regulatory requirements.

- Activity dashboards. You can receive real-time updates on your project progress through easy-to-use data room dashboards. It streamlines data-driven decision-making and enhances deal management.

Next, we invite you to learn from the experts on how to set up a data room for investors that will help you achieve your investment goals.

Building an investor-centric data room

Before compiling the necessary documents, you should learn some effective investor data room practices. This way, you can ensure your workspace is secure, well-organized, and easily accessible. So, improve your chances of success in the fundraising process and investment activities by considering the following points:

1. Create a clear data room structure

A virtual data room must be well-structured to ensure that it is truly useful. Therefore, you should categorize different sections, such as finance, legal, HR, etc., with clear divisions. That will help users to find what they are looking for without confusion.

Get more valuable insights: How to structure a data room?

2. Update data non-stop

Relying on older information can lead to inaccurate conclusions and decisions. So, we recommend updating your documentation to ensure you have a fresh and organized data room and your business has a dynamic and up-to-date face for investors.

3. Perform first-time data room walkthroughs

Guide your investors’ first visit. By showing them around your investor data room, you can ensure they understand the information you have provided and make it easier for them to navigate the workspace. This approach demonstrates a high level of care and helps you stand out from the competition.

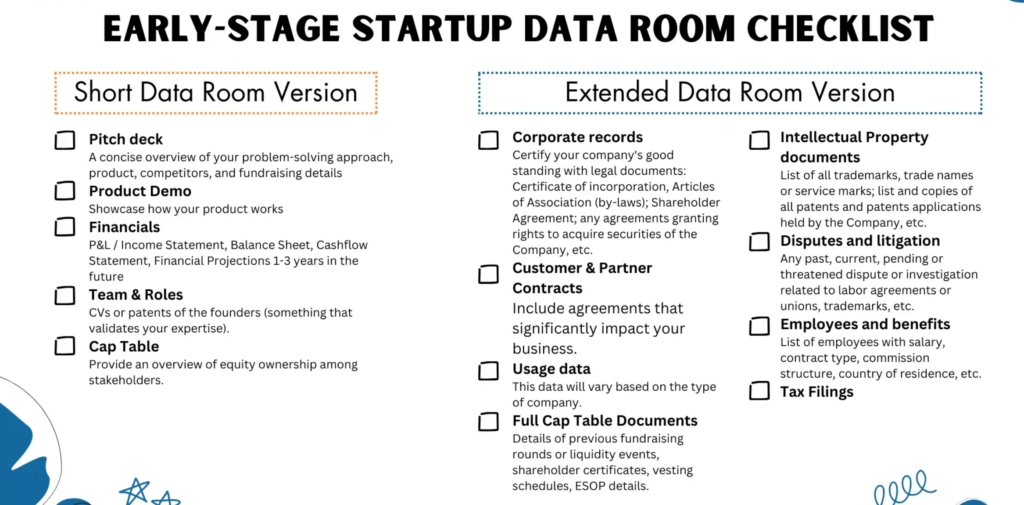

Now, check the list of relevant documents your investor data rooms should include.

What to include in an investor data room

Prospective investors may require different company documents for review depending on deal specifics, business model, and industry. However, typical ones are as follows:

| Business plan and marketing materials |

Business plan (preferably a one-pager) |

|

Teaser document |

|

|

Competitive analysis |

|

|

Pitch deck |

|

|

Investment memo |

|

| Intellectual property |

Intellectual property strategy |

|

Granted and filed patents |

|

|

Trademarks |

|

|

Software license detail |

|

|

Domain name ownership |

|

| Financial statements |

Sources of funds |

|

Uses of funds |

|

|

Income statement |

|

|

Balance sheet |

|

|

Cash flow statements |

|

|

Pro-forma statements for next year |

|

|

Outstanding debt details |

|

|

Tax returns |

|

|

Cap table |

|

|

Profit and loss statements |

|

|

Asset register |

|

|

Financial projections |

|

|

Audited accounts |

|

|

Details of previous raises |

|

| Sales and marketing |

Marketing research |

|

Current sales pipeline |

|

|

Sales processes details |

|

|

Customer churn rate |

|

|

Projected average revenue per customer |

|

|

Customer acquisition cost (if applicable) |

|

| Technology |

Tech stack overview |

|

APIs, integrations, and system architecture details |

|

|

Large integrations details |

|

|

Screenshots of existing products |

|

|

Product backlog export and release map |

|

| Team |

Key management detailed resumes |

|

Employee contracts (with titles and salaries) |

|

|

Consultant contracts (present and past) |

|

| Others |

Press releases |

|

Endorsements |

|

|

Testimonies |

|

|

Compliance documentation |

|

|

Operating licenses |

|

|

Environmental impact assessments |

While knowing how to build an investor data room properly is essential, you should also realize the importance of keeping your content up-to-date. We have already mentioned this point, but it’s worth looking closer.

Keeping investors informed and engaged

Based on our experience, some teams tend to underestimate the vital importance of updating relevant information for investors. Therefore, we are ready to reveal it through the prism of advantages for investors and target companies, which are as follows:

Timeliness — let them seize the moment

Investors require access to the most current information to make decisions and take advantage of emerging opportunities or mitigate risks. A dynamic investor data room, which is regularly updated, ensures they can use the latest information, enabling prompt and wise decisions.

Transparency — give them crystal clear insights

Real-time data allows investors to keep track of their investments and the factors that influence them. This level of transparency strengthens the relationship between them and target companies, as it helps the former to comprehend the driving forces behind decisions.

Risk management — optimize their performance

Investors can proactively perform investment strategy optimization, mitigate potential risks, and protect an investment portfolio within a virtual data room by staying informed about market developments, financial trends, and other relevant factors.

Investor satisfaction — provide the experience of trust and success

Investors appreciate transparency, responsiveness, and access to fresh information. A good data room enhances their overall experience and satisfaction with the fundraising process by giving everything mentioned.

If you are ready to integrate investor data rooms, check out the best data room for investors chosen by experts and trusted by users.

Ideals

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Ansarada

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Citrix

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Intralinks

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Dealroom

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Preparing for future investment challenges

Forbes Finance Council members have shared their insights into the latest financial investment trends for the upcoming year. By staying up-to-date with the market trends and utilizing a virtual data room to their advantage, individuals can make informed and strategic financial decisions in 2024 and beyond.

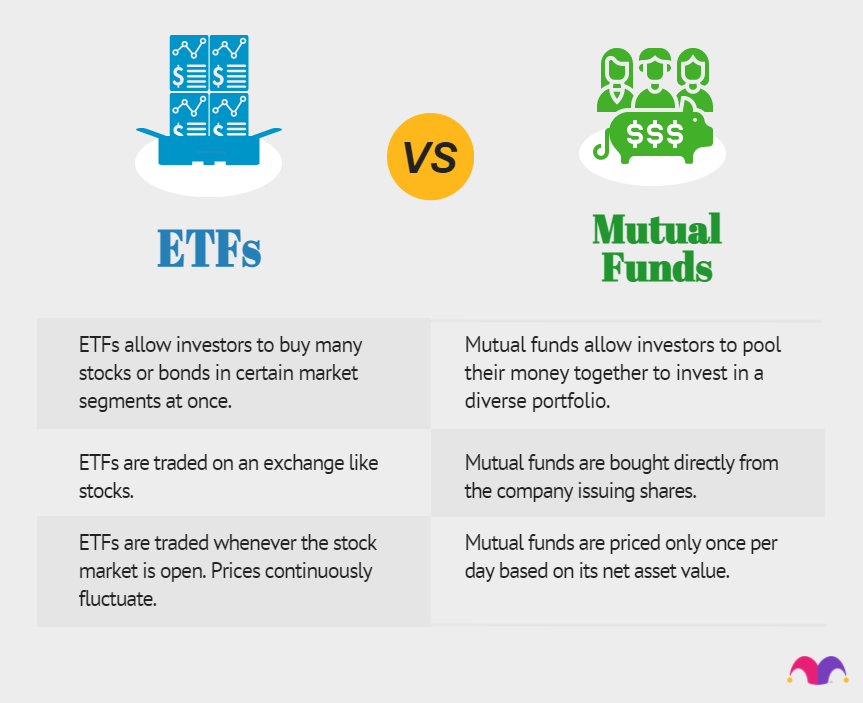

1. Moving from mutual to exchange-traded funds

There has been a discernible shift in investor preferences from mutual funds to exchange-traded funds, with the majority gravitating towards passive ETFs. However, experts believe it would be prudent for investors also to consider active ETFs. These investment vehicles provide a comprehensive suite of benefits, including tax efficiency, transparency, and proper risk management, which are lacking in an index like the S&P 500 due to its high concentration levels.

✔ Data room value

Virtual data rooms provide investors valuable insights from reputable financial institutions and investment professionals. These include research reports, analyst commentary, and expert opinions on active ETFs. With this data, investors can better understand the active landscape, industry trends, and potential opportunities.

Also, unlike traditional mutual funds, active ETFs tout transparency as a central selling point. Data rooms can facilitate transparency by providing access to real-time portfolio holdings, daily NAV calculations, and other disclosure documents.

2. Investing in growing cybersecurity needs

The cybersecurity segment of the technology and industrial sectors is showing impressive progress, with companies demonstrating strong growth in their performance indices. With businesses facing increasing cyber threats, investments in this sector have become increasingly attractive.

Experts say: According to a new forecast from Gartner, Inc., end-users’ worldwide spending on security and risk management is expected to reach $215 billion in 2024, increasing by 14.3% from 2023.

✔ Data room value

The solution helps investors assess the regulatory compliance of a technology startup by providing access to compliance documents, audit reports, and regulatory filings. This way, investors can evaluate the company’s compliance with data protection regulations, cybersecurity standards, and industry best practices to mitigate regulatory risks and ensure responsible investing.

Moreover, a data room facilitates cybersecurity due diligence for investors, giving them full access to penetration testing reports, vulnerability assessments, and cybersecurity incident response plans.

Learn more: What capital raising support can you get from a data room for startups?

3. Focusing on ESG investments and financial literacy

Investors should pay attention to ESG investing and ongoing financial education in the coming year. This way, they can ensure their investments align with personal values and contribute towards positive social and environmental outcomes while aiming for financial returns.

✔ Data room value

Virtual data rooms support ESG investment analysis by providing access to ESG investment research, whitepapers, and case studies. Thus, investors can explore the impact of environmental regulations on business operations, social license to operate, and governance practices on shareholder value.

Furthermore, investors can engage in discussions, share insights, and exchange best practices within a data room.

Whether you create your own data room for M&A transaction support or any other purpose, you pave the way for an exceptional investor experience.

Conclusion

Investors across industries can benefit from virtual data rooms, as they provide a secure and reliable platform for document review, collaboration, and decision-making. With features such as advanced encryption, activity tracking, and access controls, the solution ensures the confidentiality and integrity of sensitive information while allowing multiple parties to work together on complex deals. In addition, virtual data rooms offer a range of tools that can enhance the overall investment process, such as analytics, reporting, and search capabilities.

All in all, a data room is a perfect fit for investors who value efficiency, security, and transparency in their dealings.

Final tip from our experts: Research providers, find the best data room for investors example, and explore the full power of the platform to see how it can benefit your investment strategy.