The real estate industry is poised to change. Almost 70% of commercial real estate executives (CRE) expect returns to decline over the next few years. Driven by transformation demand, real estate M&A activity is expected to surge in 2024. For anyone interested in these implications, this article provides the following:

- Top driving factors for real estate M&A in 2024

- Types of M&A transactions in real estate

- Top real estate M&A challenges

- M&A impact on real estate for 2024 and beyond

- Future outlook for real estate M&A

Keep reading!

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

SmartRoom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

The rise of M&A in real estate

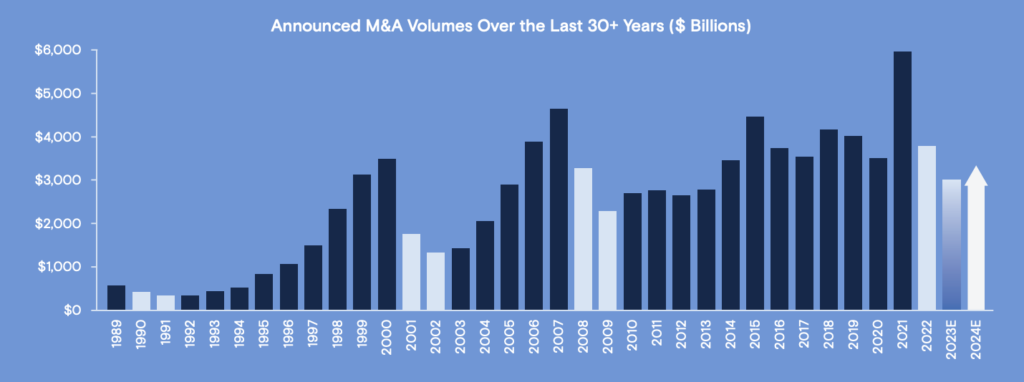

Dealmakers anticipate an M&A uptrend in 2024. Goldman Sachs predicts deal-making volumes to normalize at pre-2018 levels as the Federal Reserve stops rate hikes. Real estate deals, driven by significant post-pandemic market transformations, will likely fit global M&A trends.

Driving factors behind M&A in real estate

Several factors will drive real estate M&A in 2024:

- Business transformation

- Innovations

- Investment activity

Business transformation

CRE businesses pursue transformative and repurposing deals to mitigate poor office sector performance. Most CREs will have negative operating income in 2024 for the following reasons:

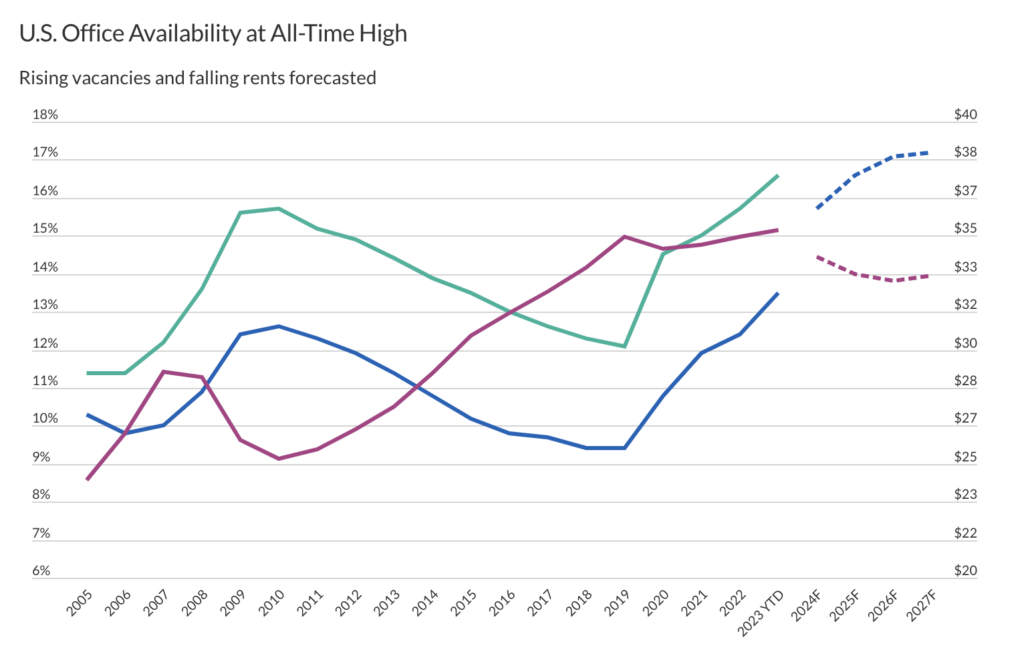

- Low office demand. According to the McKinsey report, remote and hybrid work is already a new norm, with office attendance being 30% lower than before the pandemic. That translates into higher office vacancy rates, peaking at 19.2% in the second half of 2023.

- Negative market expectations. PwC’s survey has revealed that about 70% of executives believe returns will decline in the next five years. Declining housing markets, unstable interest rates, and inflation are among the top contributors.

- Desire for transformation. More real estate companies reconsider their business models. Companies seek operational levers to improve cost structures, from sustainable materials to digital technology, and opt for M&A opportunities.

- More distressed properties. The real estate market will see increasing numbers of distressed properties in 2024. Commercial real estate volumes are the lowest in the last nine years, while maturing debt has reached over $1 trillion. Distressed sales will start in 2024 and continue for at least two years.

Innovations

According to the PwC Real Estate 2024 Outlook, real estate businesses will rely on innovations to combat the financial implications of post-pandemic changes. The key drivers for M&A activity will be the following:

- Climate change opportunities. The global real estate industry emits around 40% of greenhouse gasses. It puts public real estate companies under greater regulatory scrutiny than ever before. SEC’s new climate rules will take effect in April 2024, affecting all public companies.

- Digital innovation. Talent reduction and consumer demands shifting toward digital experiences drive digital transformations in real estate. AI, contactless pay, and other capabilities have become current value drivers for hotels, offices, restaurants, and other properties. According to Deloitte, 60% of retail executives will prioritize digital commerce opportunities in 2024.

Investment activity

More investors want to acquire real estate assets, according to the PwC Real Estate 2024 Outlook. Here are key reasons for real estate investments in 2024:

- Favorable entry point. PwC’s survey-based buy/sell barometer shows pent-up demand for quality assets. Investors expect prices to decrease, creating a beneficial entry before the next appreciation wave.

- Capital relocation. Offices remain unprofitable, and many experts expect asset sales. Institutional investors will relocate capital to more promising real estate sectors, such as industrial facilities and data centers, CBRE’s market analysis says.

Important note: There will be more private credit than private equity investments in 2024 due to regulatory pressure on banks. Private credit lenders will benefit from higher-for-longer interest rates and fewer regulatory concerns.

3 common types of M&A real estate transactions

There are several specific types of acquisitions and mergers in the property sector:

- REIT transactions

- Distressed M&A

- Cross-border transactions

REIT transactions

REIT transactions are mergers, acquisitions, investments, joint ventures, and other transactions performed by real estate investment trusts (REITs).

Real estate investment trusts (REITs) are big players in the real estate industry, with a total market cap exceeding $1.3 trillion. REITs often pursue the following M&A transactions:

- Horizontal acquisitions. The biggest REITs pursue strategic M&A to gain a competitive advantage and access more income-generating properties.

- Property acquisitions & sales. REITs purchase rental properties to stabilize cash flows and generate dividends. Many REITs also sell entire portfolios rather than individual properties to access new opportunities.

- Refinancing. REITs refinance debt to secure more favorable conditions and adjust capital structures.

Distressed M&A

Distressed M&A is buying and selling properties under significant operational and financial challenges. Distressed deals close at bargain prices, beneficial for the acquirer.

Distressed mergers and acquisitions may be the following:

- Repositioning deals. Buyers redesign distressed properties for applications fitting broader strategic objectives.

- Refinancing & restructuring deals. Acquirers restructure the debt of distressed properties, modifying interest rates, payment schedules, and maturity dates. They renovate properties, expecting higher future returns.

- Opportunistic deals. Opportunistic investors acquire heavily discounted properties during market downturns, expecting higher returns in more favorable market conditions.

Cross-border transactions

Cross-border M&A involves real-estate deals between parties in different countries. These transactions include many deal types, from strategic alliances to real estate joint ventures.

Here are the most common cross-border transactions in real estate:

- Diversification deals. Buyers seek portfolio diversification opportunities abroad, purchasing properties or entire real estate portfolios to spread risk.

- Conglomerate deals. Real estate conglomerates purchase properties, companies, and portfolios abroad to access new markets and relocate capital to more performing real estate classes. The point is portfolio expansion, as focusing on one sector involves high risk.

- Carve-out transactions. Buyers acquire subsidiaries for innovation, market expansion, and risk diversification. Carve-out transactions are prevalent in private equity (PE) firms, accounting for one-third of 2023 private equity deals.

Challenges and considerations in real estate M&A

Mergers and acquisitions in real estate will face the following challenges in 2024:

- Complex due diligence

- Deal hesitation

Complex due diligence

M&A transactions in real estate have become increasingly more complex and stretched over time. As of October 2023, deals take 1.5 years to complete, a double increase from two years ago. Drew Murphy, partner and head of real estate at Berkshire Global Advisors, believes challenging due diligence is the primary cause, with the following factors:

- Internal complexities. Market conditions, regulatory challenges, technology complexity, on-site inspections, and insufficient clarity in M&A documents, make due diligence reviews more complex.

- Technology difficulties. Technology-driven real estate deals involve thousands of data points. Data issues and increasingly complex technologies slow down the due diligence process, especially when due diligence teams use disconnected spreadsheets and emails.

- Regulatory scrutiny. The new Department of Justice policy will require buyers to investigate sellers’ compliance matters. In particular, legal experts want companies to disclose regulatory violations six months before the deal and fix such issues within a year post-acquisition. It will put extra pressure on due diligence in property mergers.

| Check our real estate due diligence checklist to reveal key value drivers and optimize Q&A processes. |

Deal hesitation

According to Drew Murphy, the current and future M&A landscape will face ambivalence, with dealmakers waiting for better timing and opportunities. It may lead to inaction. Drawing on our own experience, key reasons for such hesitation may be the following:

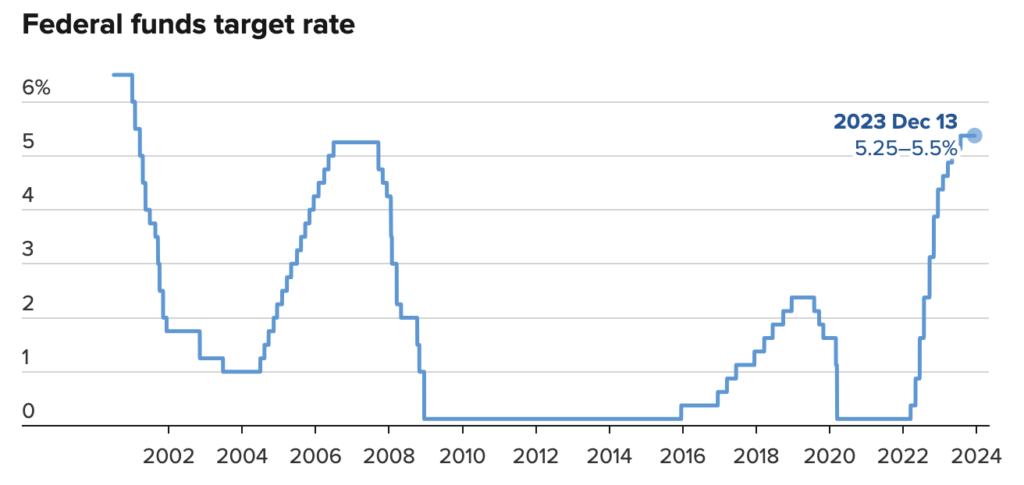

- Asset price uncertainty. Rates are still the highest since 2008, increasing financing costs for properties. At the same time, companies attempt to recover from the pandemic crisis and recent geopolitical events. As a result, both buyers and sellers fail to align expectations.

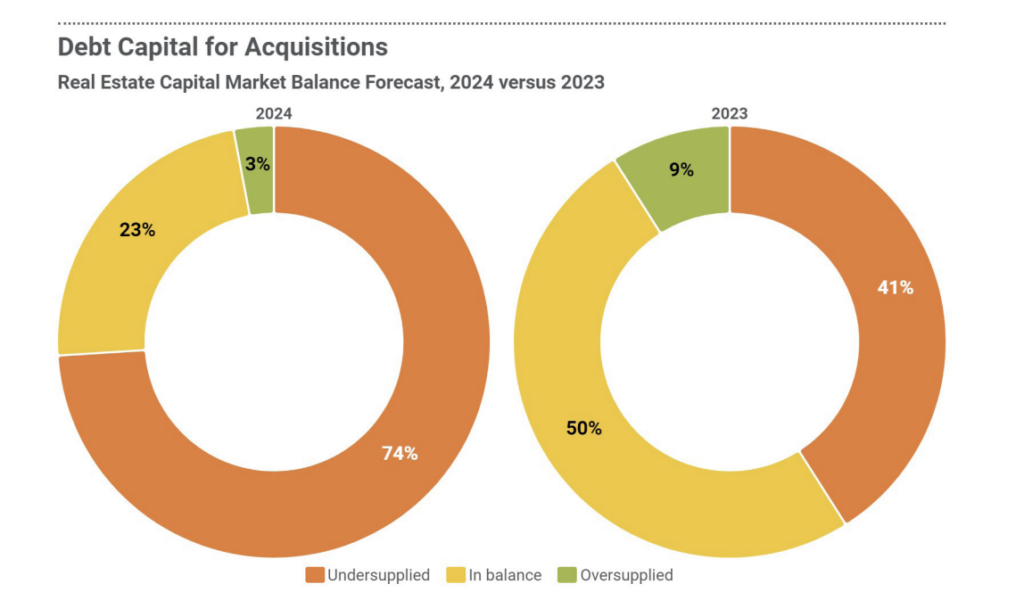

- Capital shortages. Regulatory conditions put pressure on capital reserves, making it difficult for buyers to access debt capital. Up to 74% of Canadian debt capital will be undersupplied in 2024, compared to 41% in 2023, according to the PwC’s Real Estate 2024 Outlook. The U.S. banks face similar challenges.

| Check these questions to ask during acquisition if you hesitate to pursue a long-awaited M&A opportunity. |

Impact of M&A on the real estate market

Real estate acquisition trends will affect the following features of the market:

- Competition

- Prices

- Availability

Competition

Property market consolidation is an inherent consequence of mergers and acquisitions real estate. It will intensify in 2024.

“There is going to be a terrible market consolidation. I do think it’ll be good for the industry.” — Glenn Kelman, CEO of Redfin, a real estate brokerage firm.

M&A activity will transform the real estate competitive landscape in the following ways:

- Less competition. Horizontal and vertical mergers reduce competitors and optimize supply chains. Big companies eliminate smaller independent players, concentrating the market power and contributing to industry consolidation.

- Higher entry barrier. Total dominance by big companies makes it more difficult for new players to enter the market.

M&A puts small and mid-sized real estate businesses under competitive pressure, while big players will benefit from less competition. However, large companies must be cautious of the legal aspects of real estate M&A.

Prices

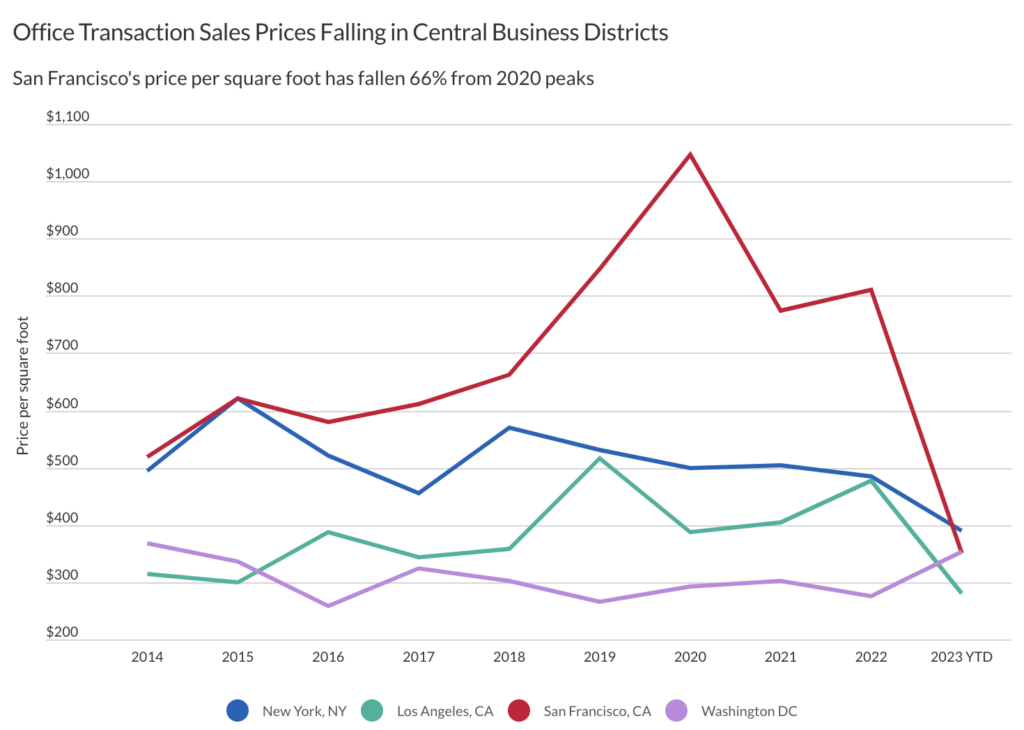

The impact of M&A on property values may be significant. Experts predict the commercial real estate market to plummet by 40% in 2024. As of 2023, transaction sales prices of office buildings fell 66% compared to 2020, according to FitchRatings.

M&A buyers’ expectations put pressure on sellers, leading to decreased prices and adding to the following price dumping factors near-term:

- Low demand. High office vacancy rates devalue such properties significantly.

- High debt. Commercial mortgage debt securities (CMDS) loan delinquencies will double by 2025 as more properties fail to generate profit.

- Distressed properties. Debt maturities and negative profit margins make urgent sellers reconsider their price expectations.

Important note: PwC holds a positive view of commercial real estate mergers, predicting benefits from long-term opportunities.

Availability

M&A activity hasn’t affected availability and vacancy rates for commercial estate. Even the 2021 record high M&A volumes across all industries didn’t result in availability and vacancy shortages.

Office availability rates have increased by 37%, while vacancy rates have soared by 43% since 2019. Also, an anticipated surge in office repurposing deals will have little effect on forecasted vacancy rates.

Future real estate M&A outlook

Here are the key trends characterizing real estate M&A in 2024 from PwC and Deloitte global insights:

- Cybersecurity risk will be the top concern for real estate businesses and M&A professionals, followed by the cost of capital and interest rates. Based on our knowledge, successful dealmakers leverage virtual data rooms advantages to secure confidential data and boost productivity.

- The digital economy will be the best opportunity, followed by single-family rentals and senior housing facilities.

- Data centers, medical offices, manufacturing facilities, and warehouse sectors will be the most prospective for investments and developments in North America.

- More real estate mergers will target innovation opportunities and business remodeling, shifting away from the declining office sector. AI, data analytics, digital property management, and property digitalization deals are expected to rise.

| Check the 10 best virtual data room providers to ensure secure collaboration and shorten deal timeframes. |

Key takeaways

- Innovations, sector transformations, and investment activity will drive real estate M&A in the next 12 months.

- The most common real estate transactions are distressed opportunities, asset purchases, REIT M&A, and cross-border deals.

- Due diligence complexity, regulatory scrutiny, price expectations, interest rates, and undersupplied debt will be the biggest challenges for the industry in 2024.

- Real estate M&A will likely reduce competition and decrease sale prices in 2024.

Real estate businesses will focus on innovation and digitalization M&A opportunities, leveraging AI, data analytics, and data room for real estate.