In 2024, the average cost of a data breach reached $4.88 million, a 10% increase from the previous year. It also takes an average of 277 days to detect and contain these breaches.

Traditional methods like email or physical data rooms can’t keep up with the cybersecurity demands of modern M&A transactions. That’s where virtual data rooms (VDRs) come in.

These collaboration tools not only help mitigate the risk of costly breaches but also ensure regulatory compliance with global M&A data security standards. As the complexity and stakes of M&A transactions grow, VDRs are essential to safeguarding confidential data and ensuring a smooth and secure file sharing process.

Check the best data rooms for M&A

Ideals

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Citrix

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Intralinks

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Venue by DFin

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

Box

- Detailed audit trail

- Built-in redaction

- Dynamic watermarks

- Screenshot prevention

- Auto-notifications

- User access expiration

- Multi-project management

- Auto-reports subscription

What is a virtual data room for M&A?

A virtual data room (VDR) for M&A is a secure online repository designed specifically for storing, sharing, and managing confidential documents during mergers and acquisitions transactions.

A VDR for mergers has largely replaced a physical data room, offering a more efficient, accessible, and secure solution for the confidential data exchange required in M&A deals. VDRs differ from the traditional data rooms and file-sharing platforms by providing:

- Enhanced security: VDRs employ bank-grade encryption, two-factor authentication, and other advanced data room security measures to protect sensitive information.

- Compliance features: They often come with certifications like ISO 27001 and SOC-2, ensuring adherence to strict data protection regulations.

- Granular access controls: Administrators can set role-based access permissions for different users, controlling who can view, edit, download, or print specific documents.

Common use cases of VDRs in M&A transactions include:

- Due diligence: VDRs streamline the due diligence process by providing a centralized platform where all relevant documents are stored and organized, allowing authorized parties to review financial statements, contracts, and other critical information.

- Collaboration: They facilitate real-time communication and collaboration among various stakeholders, including legal teams, financial advisors, and management teams.

- Secure data sharing: VDRs enable the safe exchange of confidential information between buyers, sellers, and their respective advisors throughout the entire M&A lifecycle.

- Document management: They offer efficient tools for uploading, organizing, and managing large volumes of documents, making it easier to keep track of version control and updates.

- Activity tracking: VDRs provide detailed audit trails and reporting features, allowing deal organizers to monitor user activity and document access control.

By utilizing a VDR, companies involved in M&A transactions can significantly enhance the efficiency, security, and transparency of the deal process, potentially leading to faster closings and reduced risks.

How virtual data rooms improve the M&A workflow

Since the original reason for developing the virtual data room was M&A, its entire set of features aims to improve and facilitate financial transactions further. Customers benefit from ultra-secure data protection mechanisms and cost-efficient virtual data room pricing, saving them time and money, together with an advanced platform for cooperation.

Data rooms help protect sensitive data, reduce cost, and improve communication.

Enhanced protection

The level of security offered by most virtual data rooms for mergers and acquisitions is very similar to how financial institutions protect their assets, including the use of bank-grade encryption and account protection features.In fact, virtual data rooms are usually certified with security quality seal such as ISO 27001, SOC-2, and others. Additionally, privacy and security features usually include, among others:

- 2FA account protection

- SSO (single sign-on)

- Granular file access levels

- Dynamic watermarking

- 256-bit encryption

While data rooms can guarantee a banking-grade security, no company in the world is 100% immune to cyber threats. This is why it is essential to conduct a cybersecurity due diligence in M&A before you commit to a deal.

Compliant with internationally recognized security standards, virtual data rooms encrypt all your data and implement the latest cybersecurity practices, from multiple firewalls to two-factor authentication. Besides, with the help of customizable access permissions, you’ll have full control of which third parties see which documents.

Example: In a cross-border M&A transaction, where multiple parties are involved, the use of granular file access levels allows administrators to set different permissions for various stakeholders. For instance, while financial advisors may be allowed to access full financial records, legal teams might only be permitted to view specific contracts. This ensures that confidential information is shared only with relevant parties, reducing the risk of accidental leaks.

Reduced time and cost

When your virtual data room for M&A is available on a pay-as-you-go basis, you don’t have to spend a fortune to maintain a physical data center — not to mention that your buyers save on travel expenses.Besides, VDRs automate a variety of processes, making it much easier and faster to manage documents and handle issues. Unsurprisingly, due diligence data rooms can reduce legal costs by half. Additionally, you can manage several business transactions in a single virtual workspace, saving both time and effort.

Example: In a multi-party M&A deal, the ability to host all documents in a VDR allows buyers to conduct their due diligence remotely, without incurring travel expenses or the need for physical document storage and handling. Furthermore, automated features like bulk uploads and AI-powered document indexing reduce administrative tasks, speeding up the review process and cutting legal costs by as much as 50%.

Improved communication

Data rooms help improve communication in a variety of ways.

First, buyers don’t have to travel to your physical data room — they can simply reach out to you with a question or a request at any time. This allows you to communicate with companies regardless of time and location.

Besides, data rooms offer a slew of functions so you can streamline your communication flow, using resources such as the Q&A, live discussion features, document annotations, and more. To improve your communication before, during, and after M&A, check out these essential merger & acquisition questions to ask.

Example: During an acquisition, a seller can address buyer questions directly within the VDR using the Q&A feature. If a buyer requests clarification on a specific document, the seller can provide responses or additional documents instantaneously, without having to schedule meetings or send lengthy email chains. This not only improves transparency but also accelerates decision-making, helping to close deals faster.

Key security features of M&A virtual data rooms

Virtual data rooms (VDRs) are equipped with advanced security features designed to protect critical data during M&A transactions, addressing various risks associated with handling confidential information. These features make VDRs essential tools for securing the integrity of M&A deals.

Encryption

One of the foundational security measures of a VDR is its encryption protocols. Most VDRs employ AES 256-bit encryption, the same level used by banks and financial institutions, ensuring that data is protected both in transit and at rest.

Additionally, VDRs use SSL/TLS protocols to secure data transfers between users, preventing unauthorized interception or tampering during the transaction process.

Access controls

VDRs provide administrators with granular control over who can access specific documents and what actions they can perform.

User-specific permissions allow administrators to restrict viewing, downloading, editing, and printing of files, while IP address and device-based restrictions add an extra layer of protection by ensuring that access is limited to authorized users, locations or devices.

Multi-Factor Authentication (MFA)

MFA adds an additional layer of security by requiring users to verify their identity using two or more methods, such as a password and a one-time verification code sent to their mobile device. This feature helps prevent unauthorized access, even if a user’s credentials are compromised.

Document protection

VDRs offer a suite of document-level security measures designed to deter unauthorized use and sharing. Dynamic watermarking places visible watermarks on documents that display the user’s identity, discouraging unauthorized distribution.

Additionally, digital rights management (DRM) tools control how documents are used by restricting actions such as copying, printing, or forwarding, while a restricted viewing mode limits the visibility of sensitive content to only certain users.

Activity monitoring and audit trails

VDRs provide real-time data room monitoring and comprehensive tracking of all user activity within the platform. Detailed logs of who accessed which documents, what actions were taken, and when are recorded, offering full transparency.

This level of audit trail documentation is invaluable for maintaining accountability during the due diligence process.

Compliance and certifications

Many VDRs adhere to industry-standard security certifications, ensuring that data handling meets the highest security protocols.Certifications such as ISO 27001 for information security management and SOC 2 for data handling and privacy compliance are critical in reducing risks and maintaining trust during transactions. VDRs also comply with industry-specific standards, such as FINRA for financial industry requirements.

Additional security measures

Other important virtual data room features include two-factor authentication (2FA) for enhanced account protection, single sign-on (SSO) for simplified access, and the use of artificial intelligence to detect anomalies and prevent security threats.

Together, these features ensure a highly secure environment for managing and sharing sensitive information during M&A transactions, significantly reducing the risk of breaches and unauthorized access.

How VDRs accelerate M&A processes and reduce delays

In M&A transactions, VDRs allow for simultaneous document access, enabling multiple stakeholders to collaborate in real time. Features like Q&A sections and document annotations improve communication and speed up the review process.

Beyond this, VDRs provide real-time monitoring of user activity, enabling administrators to quickly resolve bottlenecks. Automation features like bulk uploads and version control further reduce delays by simplifying M&A document management.

Now, let’s see how a virtual data room caters to the needs of each participant to ensure more efficient M&A processes:

- Purchaser: The buyer leads the acquisition, conducts due diligence, and finalizes the deal. VDRs provide purchasers with secure access to confidential documents and real-time notifications to keep them informed of updates throughout the process.

- Seller: Sellers manage and upload critical documents while negotiating the terms. VDRs allow sellers to control access to sensitive information using granular permissions and document watermarking, protecting confidential data.

- Target board of directors: The board represents stockholders’ interests and ensures fiduciary duties are met. VDRs enable board members to securely review transaction documents and maintain an audit trail of their actions for accountability.

- M&A lawyers: Lawyers oversee legal aspects, review contracts, and ensure compliance. VDRs streamline document management for legal teams, offering tools like audit trails and secure access controls to manage compliance and document review efficiently.

- Investment bankers: Financial advisors provide strategic advice, identify buyers, and lead negotiations. VDRs allow investment bankers to securely access financial data for valuation and bidding analysis while maintaining communication with other parties.

- Specialist attorneys: These experts advise on specific legal areas like tax, IP, or labor law. VDRs allow them to access only the documents related to their area of expertise, safeguarding confidentiality and streamlining their involvement in the deal.

- Accountants and auditors: These professionals conduct financial due diligence and verify disclosures. VDRs simplify their review of financial documents and enable M&A collaboration through annotations and secure document sharing.

- Regulators: Regulators ensure compliance with laws and industry standards. VDRs provide them with controlled access to compliance documents, ensuring transparency without exposing unrelated confidential information.

How to prepare the virtual data room for M&A: 3 easy steps

Poor preparation for an M&A deal is a common explanation for why mergers and acquisitions may fail.

That said, a virtual data room purchase is only the first step toward a better deal. It’s equally important to prepare your online workspaces so both parties can work comfortably.

There are a few steps to follow to ensure a well-prepared and cost-efficient cloud solution for your m and a process.

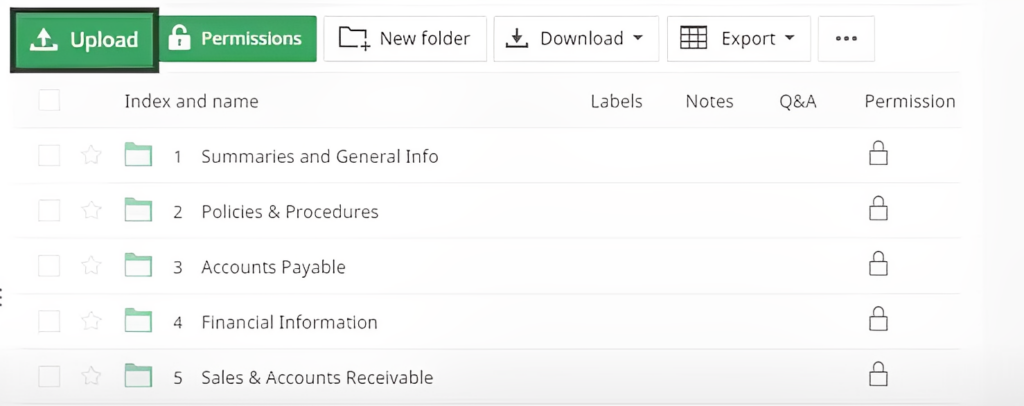

1. Upload your files

A good virtual data room provider makes a big difference, starting from the data room in an M&A preparation process. You should be able to do quick drag-and-drop uploads.

Among the documents that can typically be included for due diligence, you’ll find:

- Basic corporate documentation

- Fixed capital and other securities

- Tax and financial statements

- Assets and property

- Intellectual property

- Significant agreements

- Sales, marketing, and customer data

- Key manufacturers and suppliers

- Customer support

- Regulatory issues

- Disputes or litigation

- Data on insurance

- Employees/HR

- Procedures with related parties

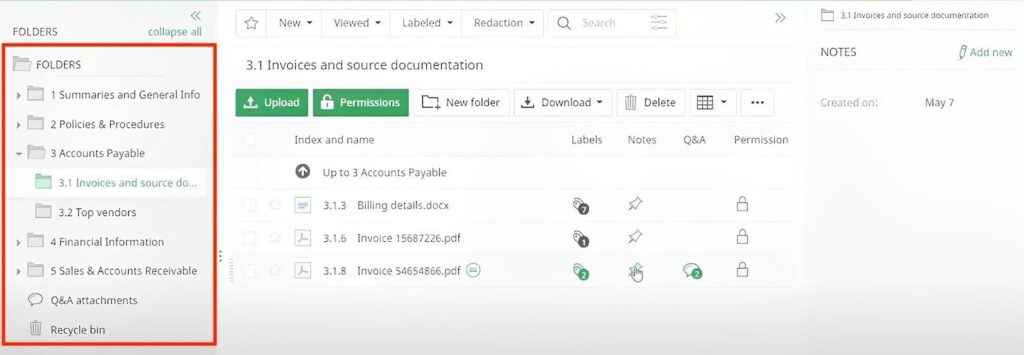

2. Structure the file system

To enable potential buyers or other interested parties to find all the documents they need quickly, make sure your data room is well-structured.

This usually means having all the relevant folders and subfolders set up according to the different areas of your company. You can also set up the access level for each folder, which will be relevant in the next step.

Sometimes it can also be a good idea to have separate folders both for the non-confidential documents required by everyone at the outset of the M&A (including NDAs and such), and a folder with highly confidential files that can be requested by upper management before closing the deal.

Additionally, you should consider granular access level types for groups or individuals accessing these folders and double-check those before inviting them to the data room.

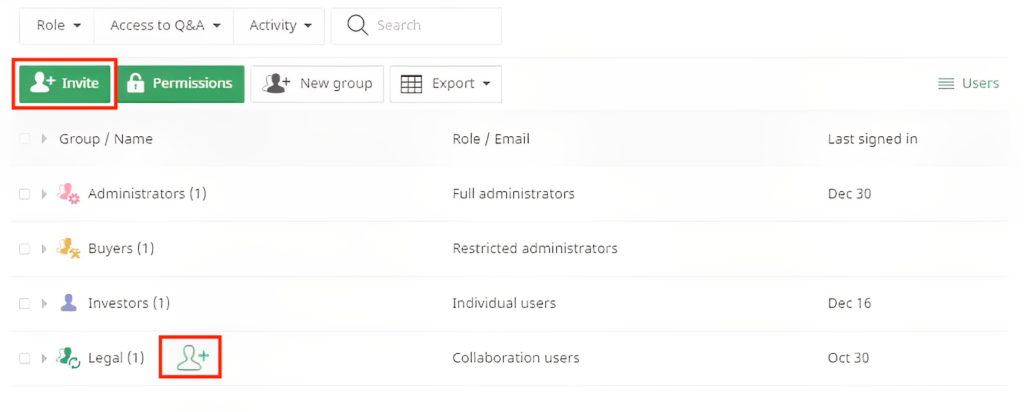

3. Invite the participants to your data room

Once your data room is all set up, it’s time to invite the users. Here you can give users access to different levels of information, as well as control who can view, download, and print which content. This helps streamline the process and prevent potential security breaches.

Selection Help for M&A

Criteria for choosing a data room for M&A

Heed a few tips on choosing a secure online repository, as not all virtual data room solutions are the same. Since each potential user is interested in the best product to meet their needs, there are a few simple things to consider when choosing.

Security features

Though virtual data rooms are known for their enhanced security, the level of protection varies from provider to provider. So, make sure that your VDR offers the full scope of data protection features, like:

- Two-factor authentication

- Multiple levels of access to the confidential documents, including restricted viewing mode when a data room user can see only a part of a document

- Dynamic watermarks that appear on sensitive documents whenever someone views, prints, or downloads them

Security compliance

When choosing your virtual data room provider, make sure:

- They are ISO27001 and SOC2 compliant

- They use physical security, two-factor authentication, and advanced surveillance to protect their data centers

- They regularly assess the reliability of their virtual data room with the help of independent experts and comply with the latest international software development practices

Data room activity reports

Your virtual data room should allow you to track user activity, define the most active groups, and identify the most frequently visited document sections.

A built-in reporting and analysis function like this will help you make mission-critical decisions before it’s too late. For example, if the buy-side representatives spend too much time on certain documents, they probably have concerns that you can address proactively.

Ease of use

A typical M&A transaction implies sharing and reviewing thousands of confidential documents. An easy-to-use virtual data room with diverse data structuring functions can speed up this process significantly. Look for a VDR that offers the following features:

- Support of various file formats

- Multilingual access

- Friendly mobile access

- Scroll-through functionality enabling you to proceed to the following document easily

- Support of many platforms, including iOS and Android

- Bulk invitations

Integrated Q&A

Using email to answer multiple questions from the buy-side entails problems like data leakage risks and possible confusion on who’s seen what. Instead, consider the virtual data room with the Q&A feature.

It will allow you to control the data room Q&A process by sorting questions based on groups, folders, and areas of expertise. You can also generate reports to see what kind of issues users face most often. Based on this information, you can create searchable FAQ lists to avoid answering the same questions.

Customization

A virtual workspace styled with your company’s brand colors and logo will surely set you apart from the competition. Given that, look for a data room with a superior customization feature.

Along with giving you a competitive edge, it will also reduce manual work, enabling you to customize your documents with watermarks, footers, and headers automatically.

M&A is a complex transaction, and to realize it, you need the best virtual data room with most of the characteristics listed above. To simplify the choosing process, consult our top virtual data room providers list.

These features can be found in the best data rooms, such as the ones below. You can also check out our extended list of M&A virtual data room providers.

Practical tips for M&A dealmakers

Now that we’ve gone over the technicalities of setting up a data room, here are a few general tips to keep in mind for your deals.

Build trust

Successful deals require a high level of trust. How do you achieve that? The best answer is transparency.

To that end, make sure both parties are on the same page at all times. If something isn’t clear, don’t be afraid to ask; conversely, be ready to volunteer any information requested by the other side.

Delegate

The urge to micromanage can be a big issue — resist it. If you find yourself out of your depth, delegate to someone who understands the subject at hand better.

This may require bringing lots of other parties into the fold: lawyers, accountants, what have you. But that’s exactly what a data room is for — you can easily invite anyone and give them access only to the areas relevant to the questions you have.

Be mindful of sunk costs

It’s hard to avoid building expectations, especially after significant time and effort has been invested into a deal. But, as can be seen in recent mergers and acquisitions, sometimes, backing out is objectively the best course to follow.

So be aware of the sunk costs fallacy and remind yourself no deal is too good to walk away from.

Key takeaways

Virtual data rooms (VDRs) are essential for managing the complexities of M&A transactions. They simplify the process by allowing key players — buyers, sellers, and advisors—to collaborate efficiently and access documents in real time.

With advanced security features, automation, and real-time monitoring, VDRs help reduce delays and cut costs, making the deal process smoother. For dealmakers, choosing the right VDR ensures faster closings and better protection for confidential data, ultimately leading to more successful transactions.

To find the best data room for your use case, determine the features you need and use a comparison table of the best data rooms for M&A.