Mar 03 ‘23

25 min read

Whether acquiring a new resource, expanding your fund’s investments, or going ahead with an M&A deal, one thing that remains constant is the need for thorough due diligence.

In fact, foremost among the many reasons for failure of mergers and acquisitions is a deficiency in the diligence process. If you don’t fully understand what you’re getting into, chances are it won’t end well.

In this article, we’ll be taking a look at the requirements for a successful due diligence process and how it helps you increase the chances for a successful transaction — minimizing risks, building trust, and addressing key strategic and operational characteristics.

Understanding buy-side due diligence

Buy side due diligence is simply an attempt to answer a key question: What am I buying?

As a potential buyer, you want to determine if the deal in question is a valuable investment of your capital. This requires understanding all of the legal, financial, and operational aspects of the target company — what are its key value drivers, how it is structured, how cash flow intensive it is, its operational costs, and many other similar aspects.

See the big picture?

Essentially, you want to form a complete picture of the company, service, or resource you’re looking to acquire — and that takes proper preparation.

For a realistic valuation of the target firm, and to avoid surprises when it’s too late, you need to consider multiple aspects, including potential weaknesses in a business (and strengths):

- What is the value of the company or resource in question

- What specific benefits will it add to your company

- What are the main aspects to focus your research on (products, financial data, intellectual property, human resources, etc.)

- What are the potential downsides to acquisition

These and other similar questions are broad in nature, but still need to be asked — and clearly answered — if you want to ensure educated decisions throughout the sales process.

Why it’s important to do buy-side due diligence

Just as you wouldn’t take a test without preparing for it, or buy a product without understanding its pros and cons, so, as a private equity firm or hedge fund, you need a full understanding of your target company before starting back and forth negotiations for a potential acquisition.

Proper buy-side due diligence allows you to:

- Acquire a clear picture of the potential problems and liabilities of the target company

- Understand the overall value the company offers

- Map out potential ways to incorporate this value

To get an objective view of the business case in question, you cannot overlook any essential part of the due diligence process.

Good buy-side due diligence will look at all the major elements that define corporate success:

- Company finances

- Market situation (including competitors, etc.)

- Legal and regulatory challenges

- Exposure to risk and profit

It’s important not to omit key drivers of success that often go unnoticed, but can make or break a deal — such as the human and cultural aspects of a company.

Buy-side vs sell-side due diligence: Difference explained

Let’s step back for a moment and take a look at the difference between buy-side and sell-side due diligence.

The buy-side

If a transaction is already on the horizon and we’ve come to the due diligence process, that means there is already interest on the acquiring side. The buy-side will have likely signed an LOI (Letter of Intent) and will now be focused on discovering potential risks or downsides.

Potential buyers are first and foremost concerned with answering the question “Is it a valuable investment?”. To that end, they will put together a diligence team to consider and identify multiple aspects of the business. That includes financial due diligence as well as looking into buy-side commercial due diligence and a myriad of legal aspects — anything, really, from main products and intellectual property to employee benefits and compensation.

In a nutshell, the buy-side due diligence team will be looking at potential risks and downsides. They’ll want to ensure the purchase makes sense and that it happens at the right price.

Sell-side due diligence

Just as the buy-side due diligence looks at risk, sell-side due diligence looks to alleviate any concerns the buy side may have, ensuring transparency and working to avoid surprises further down the line.

But above all, sell side due diligence is about making sure you get the highest price for what you’re offering. Which, we needn’t tell you, is no easy task. There’s a reason why business valuation is its own field of study — knowing the value of your company is both absolutely vital and incredibly difficult.

Sell-side due diligence will require you to:

- Ascertain the value of the company or resource in question

- Make the case for your company’s value to potential buyers

- Work to address buy side concerns and draw in their investment

Now let’s take a look at a couple frequent questions that come our way regarding the due diligence process:

- Is buy-side better than sell-side?

- Are banks buy-side or sell-side?

- Do both processes have to be conducted for every deal?

Is buy-side better than sell-side?

While this is a common enough question, there is no real answer. It’s not a question of buy-side vs sell-side due diligence — each side is only good to the extent it manages to obtain accurate information, moving forward with a clear picture of potential risks and rewards.

Are banks buy-side or sell-side?

Investment banks are typically found on the sell-side of a deal. That’s because one of their functions is helping companies raise and then sell equity capital or debt — typically to large institutional investors such as hedge funds, pension funds, or insurance companies.

Do both processes have to be conducted for every deal?

As a general rule, yes. Both sides can only come to the negotiation table fully prepared if they’ve deployed proper due diligence expertise and understand the ins and outs of the potential transaction.

The process of buy-side due diligence

To ensure a successful due diligence process, it’s best to approach it in an organized and systematic manner. There are some important steps that will help you ensure you identify potential issues and get a broad view of the project:

1. Develop a due diligence plan

2. Put together your due diligence team

3. Conduct legal due diligence

4. Perform buy-side financial due diligence

5. Evaluate operational aspects

6. Identify synergies and integration issues

1. Develop a due diligence plan

Before starting any due diligence activities, take your time to develop a comprehensive plan that outlines the scope of the due diligence, key milestones, and timelines. Base your plan on the specific goals and needs of the acquisition, as well as the type of target company or resource you have your sights set on.

2. Put together your due diligence team

Not only legal experts and dealmakers should be your focus here — look to assemble a team with diverse backgrounds and expertise to conduct the due diligence. Legal, financial, and operational experts, as well as industry-specific specialists, will all be in demand.

Establish a project manager to lead the team and coordinate everyone’s actions into a meaningful whole.

3. Conduct legal due diligence

This step requires you to analyze all of the relevant documentation for the target company — contracts, leases, employment agreements, and so on. This is the moment to find out any regulatory liabilities, lawsuits against the company, and so on.

Legal documents to assess will include:

- Contracts (with customers, providers, employees, etc.)

- Leases

- Lawsuits and other potential legal action against the company

- Intellectual property, including copyrights, patents, and trademarks

- Property and tax liabilities

- Environmental permits and registers

- Representations and warranties

- Organizational documents (articles of incorporation, bylaws)

4. Perform buy-side financial due diligence

Balance sheets, financial statements, tax returns — now is the time to analyze these and many other financial documents. Now is the opportunity to assess the good standing of the company and identify potentially critical risks or opportunities.

A typical (but far from exhaustive) due diligence for investors checklist would include:

- Financial statements

- Tax returns

- Accounts receivable and payable

- Inventory reports

- Capital expenditures

- Debt schedule

- Employee benefits and payroll

- Revenue and sales reports

5. Evaluate operational aspects

Next up, generate a buy-side operational due diligence report. Look into the target company’s operations, including its production processes, supply chain, inventory pipeline management, and other key operational areas — anything that could impact its overall value should go into your buy-side due diligence report.

6. Identify synergies and integration issues

If you’re on the buy-side of a merger or acquisition, this is the time to go over the potential for integration and synergies between both entities. It’s also here that you’ll game out probable or possible issues with the transaction.

Mitigating risks and maximizing value

When it comes to risks, your due diligence team should be able to spot them before a painful deal is concluded. Some are more obvious. Things like:

- Overestimating and overpaying for a company

- Looming legal troubles

- Revolutionary industry changes and/or competitors

- Mismatch between expected and actual synergy

- Security issues during the integration process

To prevent these issues from becoming a deal-breaker in the first place, you need to do your homework. Mitigation strategies include:

- Setting up clear goals and bottom lines in your negotiation

- Creating a task force to map out potentially risky legal scenarios

- Looking at potential industry disruptors and clearly understanding the competition

- Being conservative, but proactive with regards to synergy potential

- Making use of technology to ensure secure transactions and protection against leaks or breaches

How virtual data rooms can improve the buy-side due diligence process

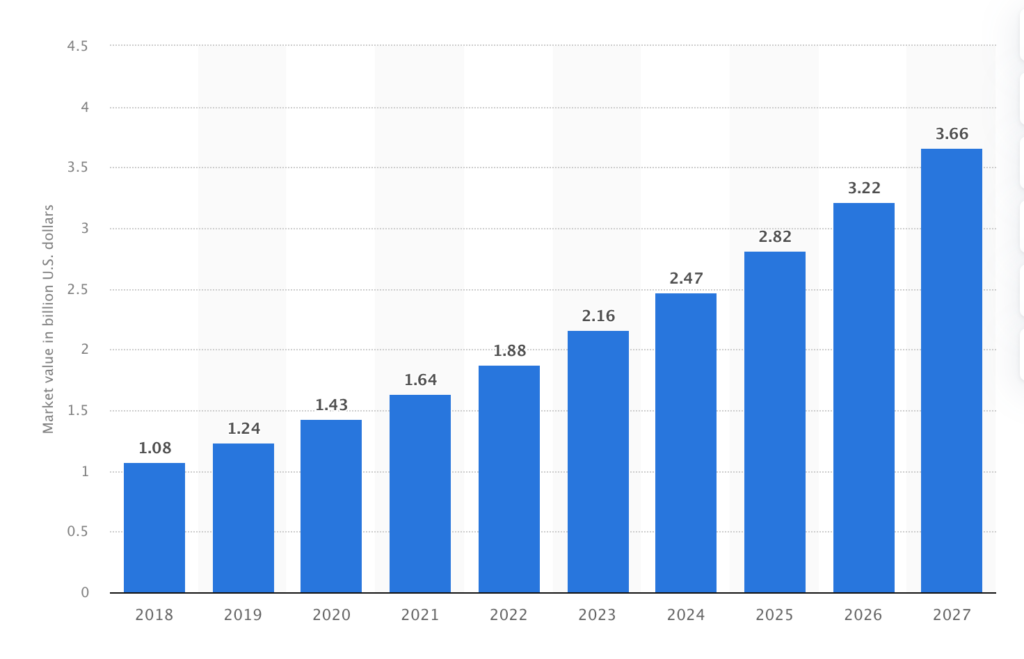

Virtual data rooms (VDRs) turned up as a key player in the deals market over the last decade. Data room providers are set to more than double in value over a 5-year span. And for good reason.

Essentially ultra-safe, ultra functional online databases and collaboration platforms, VDRs are the ultimate solution for sensitive, document-heavy transactions where the need for security is paramount — as is the case with cybersecurity M&A due diligence.

With a virtual data room, teams are able to share documents while retaining control over them; they can collaborate, edit, and sign files; they can schedule meetings and, overall, conduct more efficient, speedier transactions.

If your company isn’t working with a data room yet, it’s time to find yourself a good virtual data room for due diligence.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Key takeaways

As anyone who’s been faced with it knows, due diligence is no easy task. It means research at its most intense — with often the added pressure of rival buyers or short deadlines.

That said, keep in mind there’s always the best way to perform buy-side due diligence, meaning a proper team, a clear understanding of your needs and wants, and good negotiating talent. And last but not least, don’t forget to leverage the proper tools for our brave new digital age — the ubiquitous VDRs.

Category

Due diligenceFAQ

Buy-side due diligence is performed by the party interested in acquiring a company or share — institutional investors, hedge funds, and the like. It focuses on digging up risks and finding valuable prospects in the target company.

Sell-side due diligence, on the other hand, is often the turf of investment banks or startups. Here the main concern may be simply to sell itself well, alleviating investor concerns and obtaining a good selling price.

Both sides are equally important; career-wise, the buy-side is typically related to investing, whereas the sell-side you'll be performing a service for your clients.