Financial due diligence (FDD) is a thorough investigation of the company’s financial performance and history. Together with legal, tax, commercial, IT, environmental, and operational due diligence, financial due diligence is one of the main due diligence types.

The main purpose of the financial due diligence process is to check the financial health of a particular company before merging or acquiring it. This is to ensure the deal is worth it and avoid any possible risks, such as reputational damage or great financial losses.

According to Statista’s survey conducted among M&A practitioners worldwide in 2021, about 26% of respondents attribute a deal success to high-quality due diligence, that’s why it’s essential to know all the pitfalls it can come with.

This article explains what financial due diligence is, describes it’s process, and provides a detailed financial due diligence checklist. Continue reading to learn more!

The role of financial due diligence in M&A

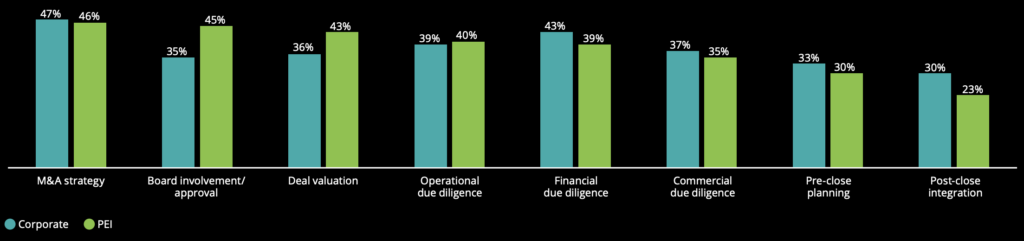

The importance of M&A financial due diligence is hard to overestimate. Deloitte’s 2022 M&A Trends Survey shows that 43% of corporate executives and 39% of private equity investors consider financial due diligence the key factor in achieving a successful M&A deal.

Indeed, based on our observations, decent financial due diligence helps to:

- Identify potential risks that the target company can bring to the current business

- Determine the true company’s value

- Ensure the deal’s viability

- Identify how much debt a company in consideration is currently carrying

- Ensure that the acquiring company has enough resources for the acquisition

- Investigate the company’s growth strategy and prospects

- Identify the quality of the company’s earnings

- Reduce acquisition cost

- Avoid possible extra legal costs

- Minimize the risk of any post-acquisition pitfalls

Buy-side vs. sell-side financial due diligence

Financial due diligence can be performed both on the sell- and buy-side. Let’s briefly describe how the process differs depending on the side of the deal.

Buy-side due diligence is performed by the acquiring firm that plans to purchase a target company. The buyer is usually a private equity firm, pension fund, venture capitalist, family office, strategic investor, sovereign wealth fund, or investment bankers. Buy-side due diligence focuses on investigating the financial health of the target company to ensure it’s suitable for the deal. During the FDD, the buyer gathers data about the target company’s revenue, balance sheet, cash flows, profitability, debt, growth rate, etc.

Sell-side due diligence, on the other hand, is performed by the target company, a seller. The sell-side financial due diligence is a part of the M&A sales pipeline. It’s a kind of internal audit prior to the buyer’s FDD, which allows for identifying gaps and fixing them before the buy-side FDD starts. Essentially, the steps of the FDD process are the same as in the buy-side due diligence, but they’re performed from different perspectives. The key objective behind the sell-side financial due diligence is to ensure that the company is ready for the deal and no pitfalls will appear in the process.

4 stages of financial due diligence

There are basically four main stages of conducting financial due diligence: preparation, research, verification, and analysis.

Let’s briefly review what should be done at each stage.

1. Preparation

Prior to performing financial due diligence, you should ensure that the target company meets the desired criteria and is viable for the potential transaction. Then, gather the responsible team. The team usually includes financial and legal experts and other core personnel. At this stage, the team also prepares a financial due diligence checklist to be used during the process.

2. Research

Once the checklist is ready, either the acquirer passes it to the target company to prepare the required documents, or the seller follows its checklist and gathers all the data the potential buyer might require.

When it’s done, the due diligence process starts. This stage includes a thorough investigation of the company’s financial statements, public documents such as annual reports or SEC filings, and internal documents such as balance sheets. Additionally, potential buyer’s representatives visit the target company’s office, talk to key stakeholders and decision-makers, investigate the company’s management, and engage third-party auditors if needed.

3. Verification

After the main research is done, you need to verify the gathered information. It implies comparing the research results with the actual data presented by the target company. At this stage, an acquiring company discusses the findings and addresses the target company with concerns, questions, or extra requirements if some issues appear.

4. Analysis

The final stage of the FDD is the analysis of all the findings and making the final decision. At this stage, the reviewing company prepares the financial due diligence report. This document states all the issues found during the due diligence, provides a summary of the results, and gives recommendations.

Financial due diligence checklist

So, what should be included in the financial due diligence checklist (FDD)? Based on our experience, it should include the documents and data from the following categories:

- Financial statements

- Financial ratios

- Historical performance

- Assets and liabilities

- Debt and financing

- Tax due diligence

- Contracts and agreements

- Legal matters

- Management and human resources

Let’s now briefly list the main documents from each category.

Financial statements

- Historical financial statements. Review the target company’s income statement, balance sheets, and cash flow statements for the past 5 years.

- Projections and forecasts. Analyze financial projections, budgets, and forecasts for the future.

- Quality of earnings. Assess the sustainability and consistency of earnings.

Financial ratios

- Debt and equity ratios. Calculate leverage ratios and assess the capital structure.

- Return on Investment (ROI). Evaluate historical and projected ROI.

- Price-to-Earnings (P/E) Ratio. Examine the P/E ratio for valuation insights.

Historical performance

- Revenue and margin trends. Evaluate historical revenue growth and margin trends.

- Customer base data. Identify significant customer dependencies.

- Contracts. Review long-term contract commitments.

Assets and liabilities

- Asset valuation. Verify the fair value and condition of assets.

- Liabilities and contingencies. Identify contingent liabilities and warranty provisions.

- Inventory and working capital. Assess inventory valuation methods and working capital adequacy.

Debt and financing

- Debt schedule. Examine the target company’s existing debt structure.

- Debt covenants. Review loan covenants and compliance history.

- Financing agreements. Assess credit lines and terms.

Tax due diligence

- Tax compliance and liabilities. Review tax returns, pending tax disputes, and tax obligations.

- Tax attributes. Assess net operating loss carryforwards and other tax assets.

Contracts and agreements

- Material contracts. Examine key customer, supplier, and partnership agreements.

- Employee agreements. Review employment, non-compete, and non-solicitation agreements.

- Real estate and lease agreements. Assess property leases and any potential liabilities.

Legal matters

- Pending and historical litigation. Identify pending and historical legal disputes and outcomes.

- Intellectual property. Verify intellectual property ownership, protection, and licensing.

- Regulatory compliance. Assess compliance with industry-specific regulations and state, federal, and local laws.

Management and human resources

- Management team data. Evaluate key management qualifications and retention plans.

- Board and governance structure. Review the board of directors, shareholder agreements, and corporate governance practices.

- Employee benefits and pension plans. Review employee benefit programs and pension obligations.

| Note: Explore how to successfully conduct a post-merger integration with our post-merger integration checklist. |

Red flags to watch for during FDD

Inadequate financial due diligence can result in missing certain important points and, thus, a deal failure, like it was with Hewlett-Packard and Autonomy deal in 2011.

- Context: Hewlett-Packard acquired Autonomy for $11 billion in 2011. However, just a year later, HP sued Autonomy’s founder and CEO claiming the company “artificially inflated reported revenues, revenue growth, and gross margins” which resulted in a great decline in earnings.

Such an unfortunate example discloses the importance of careful financial planning and due diligence. To minimize such unlucky outcomes, watch out for these red flags when you conduct a financial analysis of a company in consideration:

- Off-balance sheet financial instruments. These include unused commitments, letters of intent, or weakening working capital trends.

- Various signs of accounting schemes. This is, for example, about the cookie jar accounting that can lead to a distorted perception of the real financial records and the company’s operations.

- Complex and difficult-to-understand financial statements. This can be a sign of a company hiding some unfavorable financial information.

- Frequent changes in accounting procedures. This can be a sign of concealing certain accounting details or operations as well.

Conducting financial due diligence with a virtual data room

According to PwC’s 2023 M&A Integration Survey, 34% of respondents see technology as a key enabler for transformation and a major transaction objective. This number speaks volumes about the importance of modern technologies in the deal-making world.

But modern technologies are not only a key transformation tool, they’re also of great help during the M&A process itself. Deloitte states that various modern technologies such as AI can significantly help increase efficiencies across the M&A life cycle, and a virtual data room is one of such tools.

Due diligence virtual data room is a secure way to store and share large volumes of confidential and sensitive data during financial due diligence. To ensure that, modern providers take serious security measures and offer dedicated features such as watermarking, fence view, in-built redaction, and granular access permissions.

Dive into the details of the top 5 virtual data rooms, including the features that make them ideal for secure file sharing and compliance.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

| Tip: Learn how to choose the best due diligence software among the top providers in our dedicated article. |

Key takeaways

Financial due diligence is a financial audit of a company’s records that gives a thorough understanding of its financial health and current performance.

The financial due diligence meaning for the deal is essential. Through reviewing the target company’s financials, a reviewing company can ensure the deal’s viability, identify potential risks, spot hidden financial problems that can influence future company performance, and minimize risks of possible extra costs or legal problems.

Financial due diligence can be performed both by the sell-side and the buy-side. Using our checklist significantly streamlines the review process and helps to ensure nothing is missed.