Mar 27 ‘24

19 min read

Tax due diligence (TDD) is the third most relevant DD stream alongside legal and financial, according to the EY 2023 EUW B&I Barometer. Developing tax structures, gauging tax optimization opportunities, and avoiding pitfalls are some of the most complicated tasks in the M&A lifecycle.

We have prepared a comprehensive guide with the checklist to help M&A buyers and investors navigate due diligence complexities. In this article, you will learn the following:

- 3 strategies to use a tax due diligence checklist effectively

- 3 key considerations during tax due diligence

- The place of tax due diligence on the M&A timeline

- 3 effective tax due diligence strategies

- 7 tax-evading red flags

As a bonus, we’ll offer you technology considerations for effective tax due diligence. Without further ado, let’s dive in.

Defining tax due diligence

Conducting tax due diligence means thoroughly examining all tax aspects of the target company before a business transaction.

Acquiring companies and investors seek the following objectives with tax due diligence:

- Financial risk assessment. Identify and categorize different tax obligations of the target company and discuss tax implications, exposures, and potential liabilities. DD helps acquirers minimize unforeseen tax risks and avoid post-merger tax issues.

- Tax compliance. Understand the tax jurisdictions of the target company and develop compliance considerations for the merged entity. Make informed decisions about the deal structure based on tax obligations and liabilities.

- Post-merger integration. Understand how to merge and optimize legal tax structures, extract anticipated tax benefits, and reduce tax risks during post-merger integration.

How does tax due diligence impact deal valuation?

Tax due diligence may impact deal valuation in the following ways:

- Negotiation leverage. The acquiring company may use due diligence findings to negotiate a lower price or insist on specific indemnities to compensate for post-deal tax expenses.

- Tax integration adjustments. Due diligence may reveal additional costs associated with multijurisdiction tax reporting requirements, records consolidation, payroll alignment, etc.

- Deal structure adjustments. Due diligence findings may influence the preferred deal cost structure. Thus, asset purchase may be preferable if the buyer wants to minimize tax liabilities.

Let’s illustrate the asset valuation tax impact with the case study (fictional).

| Scenario: Company A acquires Company B for $100 million. |

| Tax DD findings |

| Company A finds that Company B has ambiguous R&D tax deductions during tax liability analysis. Supporting documentation has many inconsistencies, and its eligibility may be uncertain. Upon the transaction, the acquiring company risks inheriting an additional $10 million in target company’s tax liabilities. There is a 50% probability of penalties from the government. |

| Outcome |

| Company A decides to reduce the deal price by 75% of the potential $10-million tax liability ($7.5 million). During pre-closing negotiations, Company A reduces the final purchase price to $92.5 million to cover post-merger tax liabilities. |

The acquisition tax due diligence checklist

The tax due diligence checklist should encompass many areas, from tax records and attributes to commitments and audits. The table below contains a sample checklist categorized by tax due diligence areas.

| Tax due diligence area | Sample due diligence checklist |

| Tax records |

☐ Review of foreign financial accounts |

| Tax commitments |

☐ Tax warranties and representations |

| Tax contingencies and liabilities |

☐ Uncertain tax positions |

| Tax exposure identification |

☐ Issues in historical M&A tax strategies |

| Tax attributes |

☐ Net operating losses (NOLs) |

| Tax audits |

☐ Overall audit readiness |

| Tax compliance |

☐ Jurisdiction of the target company operates in |

How to use a tax preparer due diligence checklist effectively?

Based on our observations, DD checklists become more effective when combined with the following practices:

- Prioritize high-risk areas that require immediate attention. These may be complex, time-consuming areas such as international compliance.

- Distribute responsibilities on the checklist. Tax due diligence may be data-intensive, and it’s advisable to assign several teams to process various tax areas more efficiently.

- Leverage cross-functional collaboration. Ensure tax DD teams regularly share findings and minimize research overlapping. Coordinate various DD streams to ensure data consistency and accuracy.

3 key considerations during tax due diligence

Acquirers have to consider the following data aspects during tax due diligence:

- Availability. Evaluating tax records for the past five years is highly recommended. It helps buyers assess the target’s historical performance and estimate related risks and opportunities.

- Consistency. Investigate contradictions in tax information to minimize accounting issues. As much as 27% of accounting mistakes result from data errors. It may create a snowball effect of discrepancies and tax issues.

- Validity. Ensure tax records and attributes align with supporting documents, such as balance sheets, income statements, cash flow statements, or purchase agreements. Timely revealed validity issues provide negotiation leverage and protect from tax exposures in the post-merger phase.

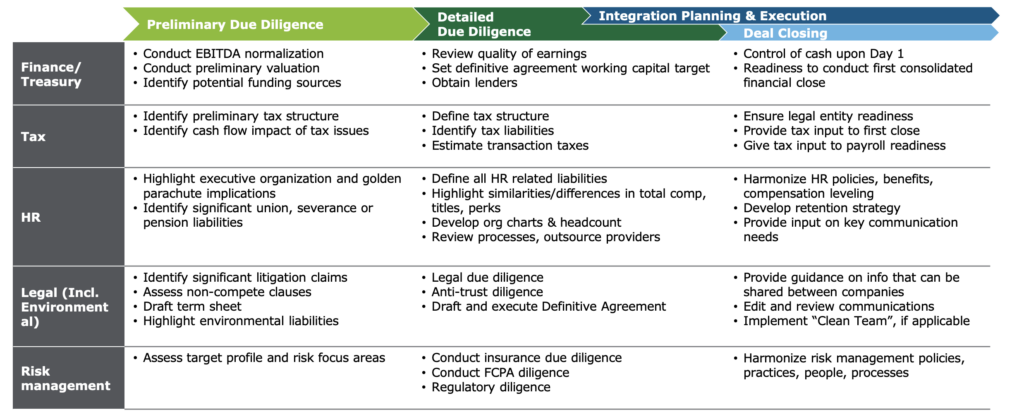

Tax due diligence on the M&A timeline

Experienced acquirers start investigating various aspects of the target company after signing a letter of intent. It’s the time when deal parties agree on the deal structure and sign warranties & representations and NDAs. Successful acquirers also initiate tax due diligence simultaneously with other functional DD areas for a 360-degree view of risks and opportunities.

“When business leaders ask me the ideal time to get the tax department involved in integration planning, I tell them ‘When you sign the letter of intent.’” Pam Beckey, partner, Deloitte Tax LLP and leader of its Post-Merger Integration practice.

Acquirers can focus on the following areas during tax due diligence alongside risk assessments:

- Tax structuring. Consider the transaction’s tax structure and estimate the tax impact for the buyer and seller. Determining a set-up in tax basis helps to predict the tax payable post-transaction.

- Tax planning. Consider the impact and timeline of adopting accounting methods. It’s a crucial step for dealmakers with different tax accounting systems. Acquirers should also consider tax controversy management practices after the transaction.

3 strategies for effective tax due diligence

Tax due diligence plays a crucial role in the increasingly complex regulatory environment and is integral to successful deals. According to Bain & Company’s 2023 M&A survey, nearly 40% of respondents indicated high-quality due diligence as the main success factor.

Meanwhile, over 60% of deals fail because of poor due diligence. Companies pursuing successful deals can leverage several tax due diligence strategies to minimize risks and improve integration outcomes.

Emphasize integrated due diligence

Successful acquirers and the world’s best consulting firms recommend integrated due diligence as a holistic view of the target company’s risks and opportunities.

The integrated approach detects indirect tax considerations across diligence areas, such as financial statements, operations, and human resources. It provides more accurate information on the acquisition target than isolated, one-dimensional DD findings.

“Integrated due diligence is the only way to really understand how pulling a lever in one area of the business will affect assumptions in another.” Bain & Company.

The integrated approach to tax due diligence should cover the following aspects:

- Strategy. Understand how tax risks and opportunities align with the acquisition’s strategic goals. Consider recent tax developments to understand the long-term tax impact on the merged entity.

- Operations. Understand how tax liabilities affect planned operational synergies and economies of scale. Explore tax reduction opportunities while planning operational integration.

- Business excellence. Consider tax implications of integrating sales channels and extending products and services. Minimize double taxation and other commitments while merging IT systems and human resources.

| 🔸 Check our operational due diligence framework to interconnect operational tax implications. |

Conduct a thorough tax history evaluation

Countries lose over $427 billion yearly due to tax abuse. Many companies rely on tax havens and sometimes deliberately evade taxation, especially in the real estate market.

Therefore, it’s crucial to thoroughly review the target company’s tax history. Records for the past several years will help you understand how your target complies with tax regulations. It will also help you spot several red flags indicating tax abuse.

| Red flag | Explanation |

| Frequent amendments in tax returns | Possible attempts to manipulate financial information |

| Inconsistent provisions in different tax records | Systematic inconsistencies may indicate deliberate attempts to hide money laundering activities |

| Unnecessarily complex corporate structure | Possible attempts to distract authorities, auditors, and corporate buyers from fraudulent activities |

| Consistent business losses | Possible attempts to evade taxes by offsetting taxable income |

| Tax filing delays | Possible attempts to hide money-laundering activities |

| Cash-intensive transactions | Over-reliance on cash transactions may indicate underreporting and tax evasion |

| Frequent changes in auditing services | Frequent changes in accounting and auditing services may indicate attempts to conceal tax reporting inconsistencies |

| 🔸 Check our real estate investment due diligence checklist to spot more taxation red flags in real estate targets. |

Involve external advisors

Tax due diligence may be much more complex than other types of due diligence. According to Financial Executives International, TDD may take up to 60 days.

Since nearly all due diligence areas carry specific tax implications and exposures, acquirers should rely on external vendors. As much as 60% of mergers and acquisitions involve third-party advisors, according to the M&A study on 100,544 U.S. acquisitions.

Professional services help develop the industry’s best due diligence requirements and identify many more issues, especially cross-border tax implications. Sell-side parties, especially startups, develop due diligence readiness checklists for smooth transactions as well. However, the study reveals it’s not advisable to hire more than one advisory service.

| 🔸 Discover nine components of the startup due diligence checklist for successful transactions. |

Using technology to simplify tax due diligence

Digital capabilities have long been accelerating M&A activities. According to Accenture’s study, digital tools help acquirers unlock an additional $30 million in deal value and save up to three months on M&A activities, including due diligence. Thus, automated due diligence software, such as virtual data rooms (VDRs), ensures a holistic approach to target investigations and deliver the best outcomes with the following features:

- Secure environment. Leading DD software employs encrypted connection, role-based access, multi-factor authentication, and document protection features against data abuse.

- Robust data capabilities. Data room users can upload, download, share, and automatically PDF-convert unlimited files. Our findings indicate that users benefit from automated file indexing, full-text search, built-in redaction, and file labeling.

- Limitless collaboration. Lading DD software offers Q&A workflows with subject-matter experts and auto-forwards, which reduces communication delays and overall administrative load on the DD team.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

SmartRoom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

The bottom line

- Experienced acquirers initiate tax due diligence after the letter of intent and carefully examine business functions for tax commitments, exposures, and liabilities.

- An acquirer should carefully inspect the target’s tax records for validity and consistency. It’s preferable to examine historical tax records.

- Successful buyers approach tax due diligence as part of the broader process and coordinate their efforts across different due diligence streams. Companies can digitize due diligence with virtual data rooms for better security, accountability, and transparency.

Category

Due diligenceUser checklistsFAQ

Common tax due diligence issues are limited data availability, inconsistencies in tax records, and invalid tax information. Acquirers should carefully check targets for red flags, such as inconsistent records, overdue tax filings, and frequent amendments in tax records.

The tax return due diligence checklist should be continuously updated and revised during the due diligence process. Dealmakers frequently exchange checklists and update checklist items.

The tax due diligence checklist during acquisition should include tax records, commitments, attributes, exposures, liabilities, audits, and compliance documentation. TDD should be multidimensional and explore interdependencies with other DD streams.