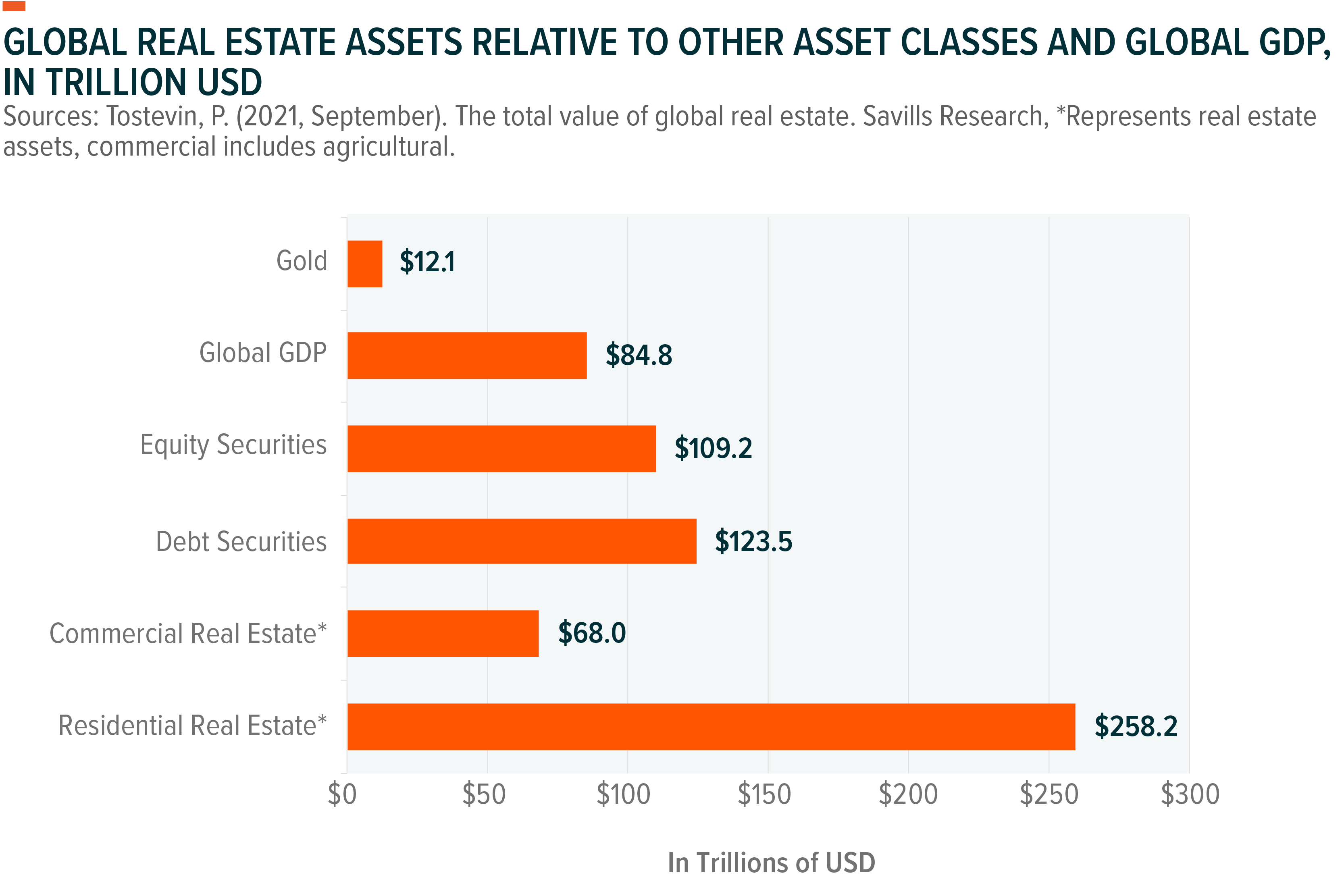

Real estate is the largest industry the world has ever seen, with nearly $340 trillion in global assets. To put it into perspective, the value of all gold ever mined is $12.1 trillion, or just 4% of the total value of all real estate in the world.

Aside from gold, real estate is nearly four times as valuable as the global GDP and worth more than all global equities and debt securities combined.

With so much potential in the industry, it is no wonder why so many people are interested in investing in real estate — whether you are a first-time investor or an experienced real estate mogul, there is an opportunity for you in this sector. And to enhance this opportunity, a real estate deal data room has been created!

What challenges can a commercial real estate data room streamline? Who relies on this solution? What defines a good data room real estate? The answers and other valuable insights are in our guide below!

Understanding real estate transactions and the need for data rooms

Our findings indicate that real estate professionals face numerous challenges in their daily work, despite the lucrative and rewarding nature of the industry. Among these challenges, real estate data security and regulatory compliance are the top concerns that persist regardless of the economic or geopolitical climate.

Data confidentiality is paramount in real estate. Agents handle sensitive information, such as personal and financial data, and must take necessary measures to protect their client’s privacy and secure property transactions. Failure to do so can result in severe consequences for the client and the agency.

| You may also wonder: Is email a secure way to send documents? |

Moreover, the real estate industry is heavily regulated, and strict rules and regulations must be followed to conduct business ethically and legally. This way, real estate agents must comply with all applicable laws and regulations to avoid legal repercussions.

Virtual data rooms are an excellent way for real estate professionals to store and manage their data in compliance with the law. They provide a secure, central repository for all documents related to a real estate transaction, allowing professionals to easily access, track, and manage documents.

The role of real estate data room in file sharing

Real estate deal room is undeniably advantageous as it provides optimal control over document access. Only authorized parties are granted access based on their need-to-know, ensuring utmost security for sensitive information such as pricing and intellectual property during contract negotiations.

In addition, online workspaces allow for efficient document management through folder and subfolder organization, making it a breeze to locate specific documents even when dealing with large volumes of data.

Finally, data rooms guarantee regulatory compliance by providing a safe platform for storing and sharing real estate documentation, which is crucial in the real estate industry. For instance, VDR real estate vendors use encryption protocols to ensure data hosting and sharing are secure and compliant with industry standards.

To summarize, the platform offers protected file sharing for real estate firms, streamlined document management, and regulatory compliance. This way, it becomes an indispensable tool for companies in the real estate sector.

What real estate professionals use virtual data rooms?

Data rooms bring value to a variety of real estate project management activities as they streamline the way real estate professionals manage buyers, ensure the access security of documents during due diligence, and supply limitless handy tools for accelerating deals and maximizing value. Below are the data room user categories that utilize the technology the most.

1. Investors

For investors, a data room is a unified platform for portfolio management, opportunity scouting, and real estate due diligence. It is also a space to communicate with asset managers that service their projects and partners from joint ventures.

And investment advisors and consultants use a real estate investment data room to manage deals, exchange sensitive information, and source prospective real estate projects for their clients.

2. Auditors

A data room makes it easier for real estate specialists to access the necessary file folders and address pressing financial matters faster. Additionally, the real estate auditors can communicate with property managers and request additional information without having to be on-site.

Insight: Data rooms features such as multiple levels of access rights allow to manage users across several projects and mitigate investment risks by reducing the chance of data leaks and unsolicited visitors.

3. Brokers

Data room technology allows brokers to easily manage and track multiple projects simultaneously. Depending on their service offer, brokers can use the digital space to negotiate with potential buyers, find experts to manage commercial real estate procedures, review documents, and more.

Brokerage experts know that a timely supply of documents is vital to the success of real estate deals, and data rooms enable them to retrieve and operate with confidential data as fast as possible.

4. Lawyers

Legal professionals employ virtual data room solutions for a variety of projects. The software can be used to organize meetings with partners, facilitate contract review, and secure access to confidential documents.

Insight: Besides offering secure data storage, virtual data rooms also come with diverse communication solutions such as chatting, video conferencing, and commenting on documents in real time.

5. Clients

While industry experts utilize the virtual data room instruments to service and manage real estate projects, their clients turn to data rooms for very similar reasons. Depending on the customer’s type and intentions, they can purchase data room software to oversee their internal projects, access and review potential deal data, and provide access to partners in joint ventures.

With a well-structured data room, managing multiple projects and numerous documents is very easy, which offers limitless opportunities across all segments and industries.

What defines a good data room real estate

While almost every virtual data room will offer the basic tools for working with company data, not all solutions are equally suitable for your case. To select a data room provider for your projects, consider the following aspects.

Provider’s expertise in real estate

The experience of dealing with confidential data within the real estate industry translates into understanding the overall mechanics and supplying tools for process improvements. A provider that dealt with real estate procedures in the past will know how to cooperate with anyone from corporate investors to private buyers and, consequently, offer insights and directions for your project.

Software features

A virtual data room for real estate projects has to offer sufficient tools that will let you manage documents, develop a branded user interface, secure data storage from unauthorized visitors, and supply insightful data analytics. The tools that play a particularly substantial role in secure file sharing and organizing documents include:

- Broad file type support

- Dynamic watermarks

- Multiple-factor user authentication

- Download, screenshot, and print restrictions

- Details user activity tracking, and others.

- Support team

A functional and responsive support team is an indicator of a professional data room provider. Even the most advanced virtual data room might have occasional bugs and inconsistencies, which need to be immediately addressed, so the real estate documents aren’t compromised.

Insight: The support team is essential during the initial stages of virtual data room usage. They will assist you in setting up a data room and train you and your employees on the specifics of using the tool with the most optimal outcome.

ROI

Successful deal management and asset management come at a price. Besides the overall effort and resources, the cost of the virtual data room must also be accounted for during real estate projects.

The key here is to link the value of any particular data room to the price you will pay. To do this effectively, evaluate how many documents and people will circulate your real estate project, as well as what tools you will need in the process. This way, a small broker firm will aim for a cheaper, less-equipped solution, while large and enterprise-level companies will require full functionality with maximum capacity.

Now we invite you to check out and compare TOP-5 data room providers. Based on our experience, they are the best-suited for real estate requirements.

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Real estate projects that rely on virtual data room software

The real estate virtual data room service is based on the principles of data security and efficient real estate collaboration online. This means that data rooms open many doors for every aspect of real estate project management.

Insight: Real estate data room users have tools that help them manage all kinds of projects, from straightforward real estate transactions to complex, multi-stage due diligence.

Real estate due diligence

Property due diligence process is a lengthy procedure that consists of several equally-crucial stages. Such as:

- Potential buyers reviewing property characteristics, licenses, and possible issues

- Partners discovering solutions to communicate due diligence documents

- Third-party real estate projects experts such as auditors or inspectors coming in to contribute their opinion

- Lawyers participating in detailed contract review, etc.

A virtual data room with a thought-out, logical structure of folders and subfolders will allow the smoothest and most agile decision-making. Moreover, you can simplify the collection of diligence documents using the data room due diligence checklist. Therefore, investing sufficient effort into logical layout should be your priority.

Asset management

Asset managers often have to track multiple projects simultaneously, which calls for a centralized space to compose asset portfolios, oversee joint ventures, facilitate real estate due diligence, and initiate acquisition projects.

Insight: Some virtual data room companies offer a portfolio templating service, which visibly streamlines how you manage financial documents and other files.

Investment management

Investors with extensive real estate portfolios approach business with utmost caution and concentration. A virtual data room can allow individual and institutional investors to manage and monitor multiple projects, quickly retrieve specific documents, mitigate real estate investment security risks, and, in some cases, maintain identity security during the due diligence phase.

Real estate portfolio management

A virtual data room is an ideal space to structure real estate documents such as construction documents and audit summaries, track users during key deals, and make strategic decisions.

Insight: Data room portfolio management is the best way to see your assets as elements of a bigger picture and diversify accordingly.

Bankruptcy and restructuring

The real estate specialists that service bankruptcy and restructuring projects demand instant access to many documents, including anything from property info to the full archive of regulatory documents. And just like with many other due-diligence-reliant processes, security and convenience are the most important factors in such cases.

Key takeaways

While in the past, most real estate deals were done in person, which was time-consuming and expensive, now they are going online. Thus, you can streamline remote real estate transactions and make them more cost-effective. Why don’t you go for it?