No time to read? Get a quick AI summary

There is great optimism about technology, media, telecom (TMT) mergers and acquisitions (M&A) in 2025. As per PwC, 76% of TMT CEOs who recently made acquisitions are planning more deals in the next three years.

The TMT M&A sector thrives on rapid innovation, high-value intellectual property, and complex cross-border operations, making traditional data management dangerously inadequate.

Virtual data rooms (VDRs) have become essential infrastructure, enabling TMT companies to securely execute transactions, navigate overlapping regulations (FCC/GDPR/SEC), and protect sensitive assets like 5G designs or unreleased content. This guide explores how purpose-built VDRs safeguard confidential information while accelerating deal velocity in a secure environment.

What is a virtual data room for TMT?

A virtual data room (VDR) is a fortified online platform for managing and exchanging confidential documents during sensitive business processes. Within the Technology, Media, and Telecommunications (TMT) sector, these platforms become indispensable operational hubs. They address the sector’s distinct demands:

- Safeguarding high-value, sensitive information, like proprietary algorithms, unreleased media content, or 5G network designs

- Managing vast volumes of technical documentation, including API specifications and user data analytics

- Ensuring compliance across overlapping regulatory regimes (FCC, GDPR, SEC, and content licensing laws)

TMT VDRs provide structured support throughout critical activities:

Telecommunications due diligence

VDRs centralize complex technical assets, such as source code repositories, spectrum licensing portfolios, or content distribution agreements. Secure data room due diligence enables controlled access for investors or acquirers. Enhanced security features, like dynamic permission settings, ensure that only authorized individuals access sensitive files.

Coordination & closing

As transactions progress to execution, VDR features like version control track real-time updates to software licensing terms or software documentation. Secure Q&A modules facilitate direct, efficient communication between bidders and technical teams, while immutable audit logs document every interaction. This is essential for proving compliance during telecom regulatory reviews or media rights negotiations.

Post-merger integration (PMI)

Post-closing, VDRs enable secure document sharing and knowledge transfer. They house critical integration materials: cloud infrastructure configurations, subscriber database schemas, or content library metadata. Role-based access ensures only relevant personnel (e.g., network engineers, not marketing teams) handle sensitive digital assets, accelerating operational continuity.

Daily operations

VDR platforms extend into core TMT workflows. They act as centralized vaults for secure storage and ongoing IP portfolio management, where features like dynamic watermarking and remote shred protect patents, trade secrets, and financial information.

During regulatory audits, pre-built compliance reports and activity trails simplify evidence gathering. Partner collaborations, such as shared API development or content syndication, are secured through granular, time-bound access controls without exposing backend systems.

Unique challenges in TMT document management

TMT requires handling information assets that are exceptionally high-risk, high-volume, and legally intricate. Standard document management systems falter under pressures unique to this dynamic industry, where intellectual property leakage or compliance missteps can derail billion-dollar deals or trigger regulatory penalties.

Intellectual property protection

Intangible assets, such as proprietary algorithms, unreleased software builds, raw content libraries, or patented network designs, represent 90% of the value of S&P 500 companies. For TMT companies, protecting these requires granular, context-aware security, such as ensuring that only semiconductor engineers access chip blueprints or restricting unfinished film reels to post-production staff.

Exponential data volume and complexity

A single telecom merger may involve millions of data points, such as network schematics, API documentation sets, user data logs, and spectrum license histories. Media acquisitions face terabytes of unedited footage and distribution agreements. This demands infrastructure capable of organizing, indexing, and enabling efficient search across heterogeneous technical formats without compromising speed.

Regulatory overwatch

TMT operations span jurisdictions with conflicting mandates. Because of this, maintaining compliant, auditable trails across various regulatory regimes, particularly in cross-border TMT deals, becomes operationally burdensome. For example, GDPR’s “right to be forgotten” clashes with the Federal Communications Commission’s (FCC) 18-month call record retention requirements.

Hyper-sensitivity of technical specifications

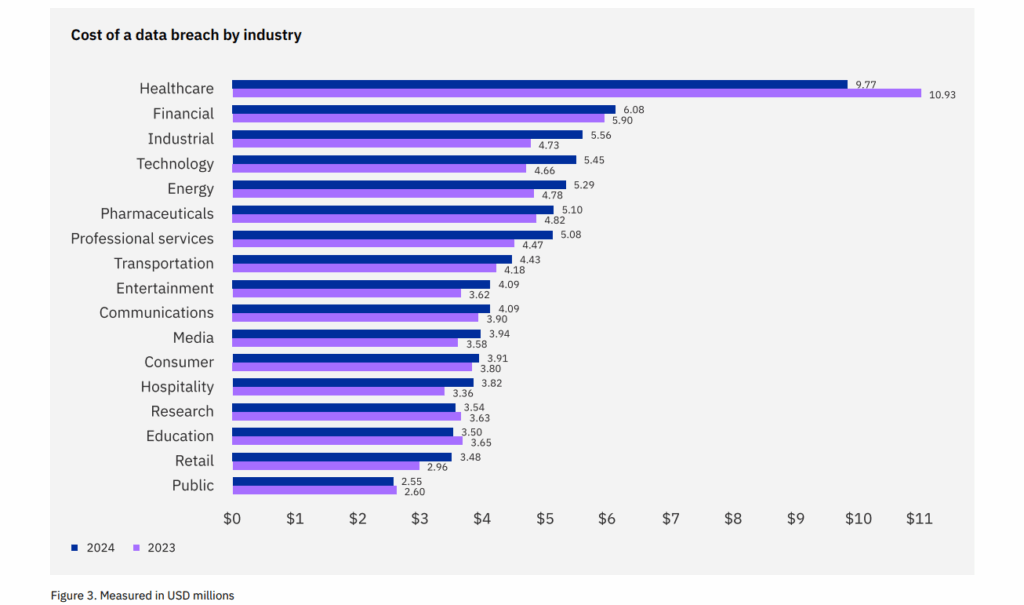

Leaked 5G infrastructure diagrams or cloud security configurations create competitive and operational risks. In 2024, the average cost of a data breach in the technology sector reached $5.45 million per incident, which is nearly 12% higher than the global average of $4.88 million, according to IBM’s Cost of a Data Breach Report 2024.

Source: IBM’s Cost of a Data Breach Report 2024

Sensitive data, such as media pre-release content or AI training datasets, requires stricter controls than standard NDAs. Access must be time-bound, role-based, and dynamically watermarked, especially when third-party vendors or regulators review materials.

Multi-layered licensing entanglements

Managing rights for software (SaaS, APIs), media (streaming media, syndication), or telecom (spectrum, tower leases) involves labyrinthine agreements with nested clauses. A single error in version control during renegotiation can invalidate terms or trigger litigation, demanding meticulous tracking of obligations and expirations, not to mention the basic cost of contracting.

“Large organizations manage, on average, 350 contracts a week, each costing anywhere from a few thousand dollars to tens of thousands of dollars to create,” said John Knox, EY APAC Law Leader.

Key features of TMT-optimized virtual data rooms

Leading VDRs deliver specialized capabilities that streamline TMT due diligence, licensing deals, and post-transaction integration while mitigating sector-specific risks.

Advanced data security & access control

Granular security protocols are critical for protecting sensitive documents like 5G network designs or proprietary algorithms. Here are the advanced security features of data rooms that support granular access to data:

- Dynamic permissions. Role-based access restricts users to folders, files, or even page-level data. This prevents unauthorized exposure of high-value IP during cross-functional collaborations.

- Information rights management (IRM) encrypted downloads. MS Office files (Word, Excel, PowerPoint) are downloaded with plugin-free encryption, blocking screenshots, editing, or saving changes locally.

- Blocked view & watermarking. Blocked view masks documents except where a user hovers their cursor, deterring camera-based theft during due diligence. Dynamic watermarks imprint user IDs on viewed files, tracing content leaks.

Intelligent document management

TMT transactions involve massive volumes of evolving technical data, requiring AI-driven organization and control:

- AI-powered redaction. Automatically detects and redacts PII (emails, SSNs) or sensitive terms across patents or contracts.

- Version control with audit trails. Tracks iterations of licensing agreements or API specs, storing dozens of versions per document. Ensures global teams reference the latest network diagrams during telecom mergers, avoiding errors from obsolete files.

- Optical character recognition (OCR) and bulk processing. Converts scanned technical documents into searchable text, enabling keyword searches across thousands of files.

Audit readiness & compliance

Virtual data rooms meet stringent FCC, GDPR, and export control requirements by maintaining immutable audit trails and access records demanded by regulators:

- Project locking. Freezes document structures during audits or deal closure while allowing controlled viewing. Preserves data integrity for SEC filings or spectrum license transfers, with unlock rights restricted to authorized admins.

- Activity logs. Tracks every action (such as views, downloads, redactions) and exports to Excel for audits. Provides telecom firms proof of compliance during FCC inquiries by documenting access to customer proprietary network information (CPNI) data.

- Automated retention policies. Enforces deletion schedules for expired user data per GDPR. Media companies can auto-purge obsolete subscriber records, avoiding penalties for non-compliant storage.

Efficient collaboration & workflow

Global TMT deals require seamless coordination between technical, legal, and finance teams. A technology sector data room meets these needs with the following features:

- Structured Q&A modules. Assigns roles (drafters, experts, approvers) to manage due diligence queries, routing questions to experts. Prevents bottlenecks in M&A timelines with centralized, auditable threads.

- AI translation. Translates documents, such as contracts or patents, across 100+ languages in real-time. Accelerates cross-border transactions by eliminating manual reviews of localization clauses.

- Data storage analytics. Tracks usage by file type (e.g., video assets vs. code repositories) and forecasts capacity needs. Helps TMT companies optimize costs during content library acquisitions.

🔎 Additional reading: Explore the factors contributing to virtual data room costs in our comprehensive VDR pricing breakdown.

TMT industry use cases for virtual data rooms

Virtual data rooms enable secure, auditable workflows across mergers, partnerships, and compliance activities while addressing sector-specific vulnerabilities in intellectual property (IP) and technical assets. Here are the most common data room use cases in the TMT industry:

- M&A transactions. Securing complex due diligence activities such as telecom spectrum license transfers, media consolidations, and technology IP portfolio reviews with AI redaction and watermarking.

- Capital raising. Streamlining investor activities such as tech startup funding rounds, telecom infrastructure financing, and IPO documentation management with project locking and Q&A workflows.

- Partnership development. Facilitating collaborative activities such as media streaming negotiations, joint AI development projects, and cross-border spectrum sharing agreements through IRM encryption and time-bound access.

- IP safeguarding. Protecting sensitive operations such as patent litigation discovery, source code repository management, and unreleased media asset storage with remote shred and activity auditing.

- Regulatory response. Automating compliance activities such as GDPR data purges, FCC access reporting, and cross-border data sovereignty enforcement through retention policies and geo-specific hosting.

🔎 Additional reading: Data room for investors checklist: A list of essential due diligence documents.

Scripps Media Case Study

E.W. Scripps, a major U.S. broadcaster with 60 stations, used Ideals VDR for more than four years to manage acquisitions, divestitures, and joint ventures during its strategic pivot from radio to TV expansion. Key needs included:

- Secure sharing with competing bidders during radio station sales

- Granular permissions for documents/folders

- Separate Q&A forums per transaction

- Archived compliance proof for regulators

Ideals enabled parallel deal execution, including Katz Networks ($302 million), Triton ($150 million), Cordillera stations, and ION Media ($2.5 billion), with real-time storage alerts and one-click archives. Senior Program Manager Marc Loeffler confirmed teams “felt very comfortable” with Ideals’ security during high-stakes transactions.

Regulatory compliance in TMT virtual data rooms

Non-compliance risks in the TMT sector involve massive fines. For example, in early 2025, the FCC imposed a $4.5 million penalty on VoIP/API provider Telnyx LLC for inadequate safeguards against illegal robocalls impersonating the Commission on its network.

Virtual data rooms prevent such violations and provide the infrastructure to manage overlapping global mandates while protecting sensitive technical and customer data. Key regulations impacting TMT include:

- GDPR/CCPA. Governs data privacy for EU/California users, requiring strict consent management and breach notification.

- FCC Title II & CPNI Rules. Mandates telecoms to safeguard customer network data and retain call records for at least 18 months.

- Export controls (EAR/ITAR). Restricts sharing encryption source code or 5G tech with sanctioned entities.

- SEC disclosure laws. Enforces transparency in IPOs/M&A for tech firms, including risk factors and financial audits.

- Content licensing standards. Varies by country (e.g., the EU’s DSM Directive), demanding geo-specific rights documentation.

How VDRs enforce audit-ready compliance

- Preemptive data localization. Enforce regional data residency (e.g,. EU-only storage for GDPR), preventing cross-border data transfer violations.

- Automated retention policies. Auto-purge obsolete subscriber data or expired contracts per FCC/GDPR timelines, eliminating manual oversight gaps.

- Real-time breach mitigation. Instant remote shred of downloaded documents halts data leaks during audits or cyber incidents.

- Granular access to journals. Immutable logs prove “least privilege” adherence (e.g., only engineers accessed 5G specs), satisfying SOX/FCC audits.

- Regulatory template libraries. Pre-built workflows for GDPR data subject requests or FCC regulations accelerate evidence compilation.

Choosing the right VDR provider for the TMT industry

Selecting a virtual data room provider for technology, media, and telecommunications mergers demands rigorous evaluation beyond basic security. Vendors must address sector-specific complexities like IP volatility, cross-border compliance, and technical asset sensitivity.

Prioritize platforms engineered for high-volume technical data, real-time collaboration across global stakeholders, and auditable adherence to regulations like GDPR or FCC mandates.

TMT VDR selection checklist

| Category | Critical Criteria |

| Cybersecurity Compliance |

|

| Data Protection |

|

| Document Governance |

|

| Regulatory Tools |

|

| Collaboration |

|

| Infrastructure |

|

Based on these critical requirements, the following virtual data room providers offer robust solutions for TMT industry transactions, balancing advanced features, compliance readiness, and sector-specific functionality:

Ideals VDR

Ideals VDR serves more than two million leaders globally. This leading VDR provider delivers military-grade security, robust compliance capabilities, and AI automation to complex TMT transactions.

Best features

- Eight levels of granular access permissions

- IRM security

- Audit readiness project locking

- Automated Q&A workflows

- Built-in multi-purpose due diligence checklist

- AI translation in 100+ languages

- AI-powered document redaction

- Activity log with version monitoring and over 70 trackers

Compliance

- SOC 1/2/3, ISO 27001, GDPR, HIPAA, PCI DSS

- Data hosting in nine locations

Pricing

- 30-day free trial

- Tiered pricing

- Scalable storage

- Prorated overages

- Unlimited users

Customer support

- 24/7 customer support with 30-second response time

- Multilingual support in 50+ languages

- Live training with an expert

- Dedicated project manager

Datasite

Datasite facilitates high-volume M&A transactions globally, with particular strength in complex telecom and media deals that require rigorous compliance controls.

Best features

- Advanced deal analytics

- Built-in sell-side due diligence checklist

- Q&A module with approval workflows

- AI search

- AI redaction

Compliance

- SOC 2 Type 2, ISO 27001, ISO 27017, ISO 27018, ISO 27701, GDPR, CPRA, APP

Pricing

- Free demo

- Per-page pricing

- Flat-rate overages

- Unlimited users

Customer support

- 24/7 customer support

- Multilingual support in 20+ languages

- Strategic consulting services

Intralinks

Intralinks serves over six million users globally, supporting M&A professionals with multi-faceted compliance options and robust collaboration capabilities.

Best features

- IRM security

- Reporting templates

- AI redaction

- Buy-side AI-assisted due diligence

- Zoom integration

Compliance

- SOC 2 Type II, SOC 3, ISO 27001, ISO 27701, CCPA, GDPR, HIPAA

Pricing

- Free demo

- Per-page pricing

- Flat-rate overages

Customer support

- 24/7 customer support

- Multilingual support in 140 languages

- Dedicated project manager

Dealroom

Dealroom offers powerful M&A lifecycle management tools, particularly helpful for investment bankers, venture capitalists, and legal teams in the TMT industry.

🔎 Additional reading: Explore the benefits of an investment banking data room in our dedicated article.

Best features

- Project room templates

- Due diligence & integration task trackers

- Approval workflows

- AI-powered contract analysis

Compliance

- SOC 1, SOC 2 Type II, GDPR, HIPAA/HITECH, FISMA, FINRA, PCI DSS,

Pricing

- 14-day free trial

- Tiered pricing

- Unlimited storage

- Unlimited users

Customer support

- 24/7 customer support

- Dedicated success manager

Key takeaways

- TMT M&A acceleration demands specialized security. As much as 76% of acquisitive TMT CEOs plan new deals, but IP leaks cost tech firms $5.45M/breach.

- Using a data room for TMT companies is critical. AI redaction, IRM encryption, and dynamic watermarking protect 5G designs, media content, and source code.

- Compliance automation prevents massive penalties. Auto-retention policies and geo-specific hosting address FCC/GDPR compliance, while audit logs prove CPNI compliance.

- Provider selection requires TMT validation. Prioritize ISO 27001/SOC 2-certified platforms with telecom/media transaction experience and terabyte scalability.