No time to read? Get a quick AI summary

A well-planned strategy decides the outcome of a game. Similarly, a virtual data room can make or break a deal.

The right platform keeps documents organized, ensures compliance, and makes collaboration seamless. The wrong one leads to security risks, inefficiencies, and unexpected costs.

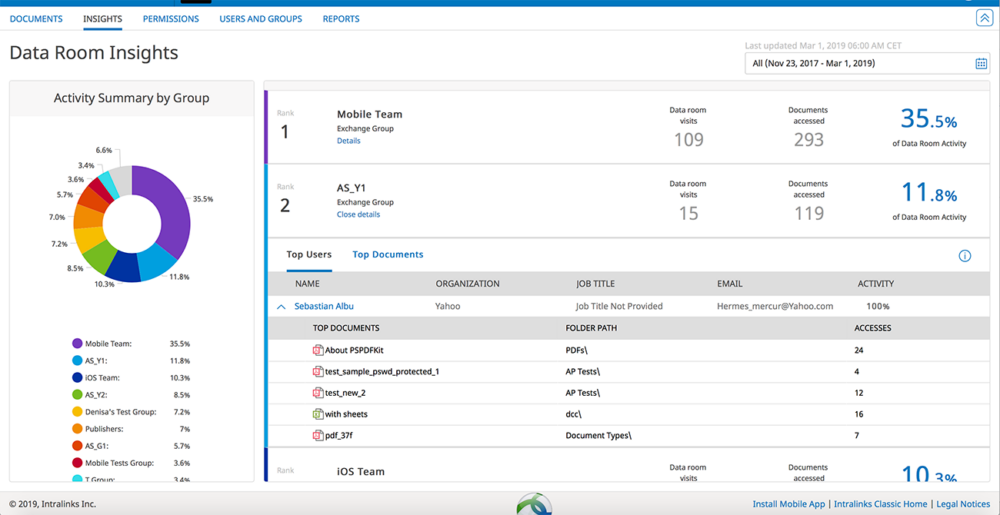

Intralinks has long been a leading VDR provider, recognized for its security, compliance, and features. However, other platforms may offer more secure, user-friendly, and modern solutions as competition intensifies.

So, what are Intralinks’ strengths? Where does it fall short? And which virtual data room alternatives might be a better fit? Read and explore the top Intralinks competitors to choose a game-changing solution for your next deal.

What is Intralinks virtual data room software and why look for alternatives?

Intralinks data room offers a feature-rich virtual data room for strengthening security, accelerating deals, and improving team productivity. As a leading provider of secure data sharing and collaboration tools, the provider supports M&A, capital raising, and other complex financial transactions requiring secure enterprise file management.

Here are the main reasons why companies choose this provider:

- First, the software enables instant access to deal documents for unlimited buyers worldwide, expediting the bidding process and reducing time spent on due diligence.

- Second, with encrypted storage, regulatory-compliant processes, and granular access controls, Intralinks provides a highly secure environment for confidential transactions. In particular, its information rights management tools protect sensitive data in transit and at rest.

Finally, AI-assisted redaction, drag-and-drop uploads, and integrated Q&A tools eliminate manual inefficiencies to streamline workflows and enhance transaction efficiency.

However, some businesses still choose Intralinks alternatives. Why? The main reasons are as follows:

1. Pricing concerns

While the provider has established itself as a trusted name, Intralinks pricing raises concerns for cost-conscious businesses. An M&A associate in banking mentioned that Intralinks’ variable fee structure may lead to significant discrepancies between the initial budget and the final invoice, creating challenges for cost management. Also, an analyst in investment banking noted that while Intralinks is considered the best virtual data room provider, it comes with the downside of being the most expensive option.

2. Technical barriers

Additionally, Intralinks has occasional technical glitches and lacks seamless integration with modern browsers. An analyst in financial services reported repeatedly having to disable Flash every time they logged in, and despite following the instructions, the Chrome browser wouldn’t remove the prompt. Other problems included the inability to assign questions with comments in Q&A and issues with downloading an index, where text for file names failed to appear.

3. Usability struggles

Besides, compliance officers and IT managers often face challenges navigating the platform. A co-founder and partner in the computer software industry shared that Intralinks only added to the stress of due diligence. The users encountered bugs and found the interface clunky and unnecessarily complicated for administrators and users, making the experience far more complex than expected.

So, if you are considering Intralinks or alternatives, explore the options below to compare their key features and strengths.

10 key competitors of Intralinks virtual data rooms

The Intralinks competitors list below highlights their key use cases, ratings, and features, offering insights into how other solutions compare to Intralinks:

1. Ideals

Best for: M&A, due diligence, fundraising, initial public offering, corporate restructuring, legal compliance management, intellectual property protection, and real estate transactions

Capterra score: 4.8 (308 reviews)

G2 score: 4.7 (593 reviews)

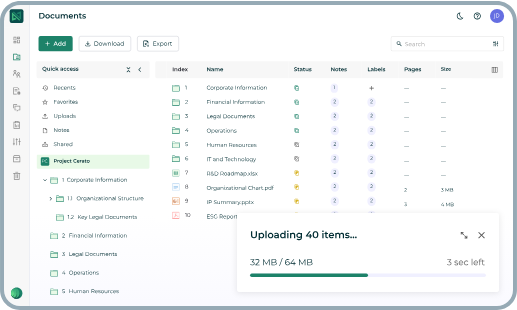

Since 2008, Ideals has transformed the virtual data room market with an easy-to-use platform, robust data protection, secure document management tools, and immediate customer support. Trusted by over a million users globally, including investment bankers, advisors, and real estate professionals, the provider prioritizes customers and their user-friendly experience. Moreover, Ideals is one of the most secure data room providers to consider.

| Pros | Cons |

| ✔️ User-friendly interface ✔️ Perfect for due diligence and M&A ✔️ Secure data storage ✔️ Customizable permissions ✔️ Great collaboration features ✔️ Responsive and professional support | ✔️ Pricing could be more flexible |

Unlike Intralinks, Ideals includes the following features:

- Bank-grade data encryption

- Top-level flash drive protection

- IP address-based access restrictions

- User access expiration

- 8-level granular access control

- Fence view to prevent screenshots

- Built-in Excel viewer with formulas

- Document labels for easy organization

- 15-language intuitive user interface

- 13-language technical support

- Preparation/trial period

- 30-second chat response time

2. Ansarada

Best for: M&A, due diligence, initial public offerings, fundraising, and post-deal integration

Capterra score: 4.7 (114 reviews)

G2 score: 4.6 (160 reviews)

With 17 years of experience, Ansarada has supported businesses across 180 countries, facilitating over $1 trillion in M&A deals and procurement. Their technology streamlines GRC processes, ensuring governance and order in all aspects of business for exceptional results.

| Pros | Cons |

| ✔️ Ease of use ✔️ Good data hierarchy ✔️ Ease of uploading/deleting documents ✔️ Advanced index tool ✔️ Strong customer service | ✔️ Expensive for what you get ✔️ Sometimes laggy |

Unlike Intralinks, Ansarada includes the following features:

- IP address-based access restrictions

- 12 data hosting locations

- Full-text search with OCR

- Workflow automation in VDR

- Subscription to automatic reports

- 14-day free trial

- Unlimited prep area for advisories

3. Datasite

Best for: M&A, due diligence, investor relations, and financial reporting

Capterra score: 4.7 (112 reviews)

G2 score: 4.5 (240 reviews)

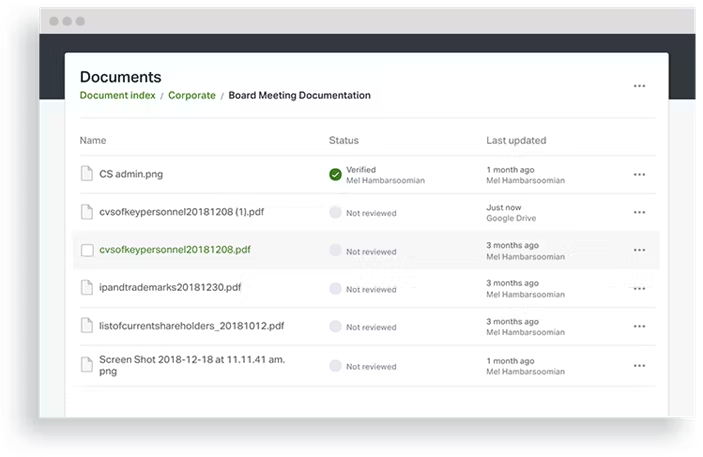

Designed for deals of any size, Datasite streamlines task tracking, Q&A, and advanced data analytics in VDR, ensuring smooth collaboration. With its intuitive platform, the platform enables secure file transfer and effective execution of due diligence, saving time and providing protection at every stage of the process.

👁️🗨️ Learn more about Datasite vs Intralinks

| Pros | Cons |

| ✔️ Multifunctional ✔️ Advanced security protocols ✔️ Regular update notifications ✔️ Quick document management ✔️ Ability not to enter password everytime you log in | ✔️ Pricey ✔️ The viewer for Excel files is difficult to use ✔️ Occasional bugs |

Unlike Intralinks, Datasite includes the following features:

- Strong flash drive security

- 5-level granular access control

- 14-language technical support

- Subscription to automatic reports

- Preparation/trial period

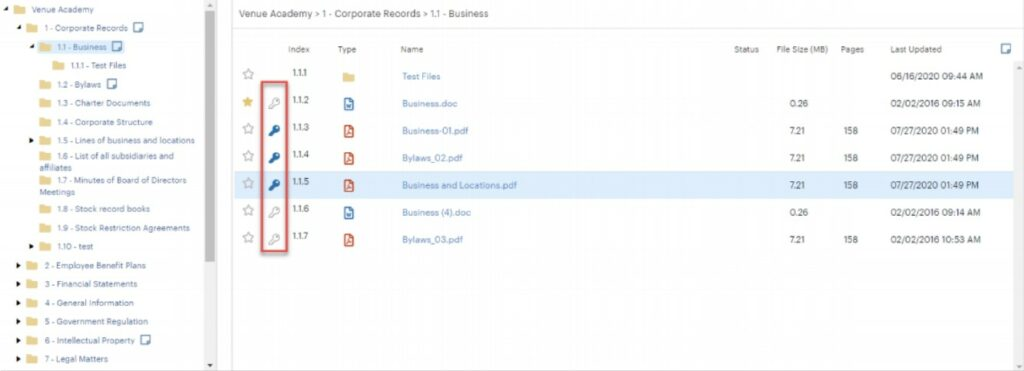

4. Donnelley Venue

Best for: M&A, regulatory compliance management, and regulatory filings

Capterra score: 5.0 (2 reviews)

G2 score: 4.0 (1 review)

Donnelley Venue virtual data room software is developed by Donnelley Financial Solutions Inc., a global leader in risk and compliance solutions. The platform provides specialized expertise, enterprise software, and data insights for all stages of transactions and investments. As markets change, regulations shift, and technology progresses, the company offers solutions for confidence during critical moments.

| Pros | Cons |

| ✔️ Intuitive and user friendly ✔️ Highly adapted to the dynamics of a transaction ✔️ Effective for assigning permissions and workflows during M&A activity | ✔️ High cost ✔️ Limited functionality |

Unlike Intralinks, Donnelley Venue includes the following features:

- 5-level granular access control

- OCR full-text search

- 10-language user interface

- 9-language technical support

- 4 free flash drives

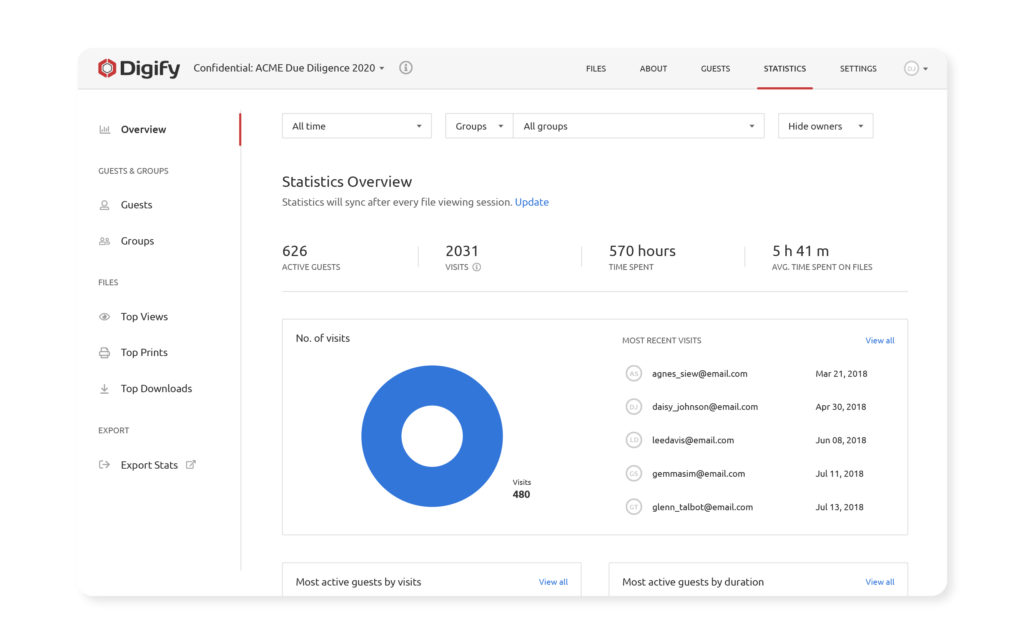

5. Digify

Best for: M&A, due diligence, audits, fundraising, and intellectual property protection

Capterra score: 4.8 (171 reviews)

G2 score: 4.7 (63 reviews)

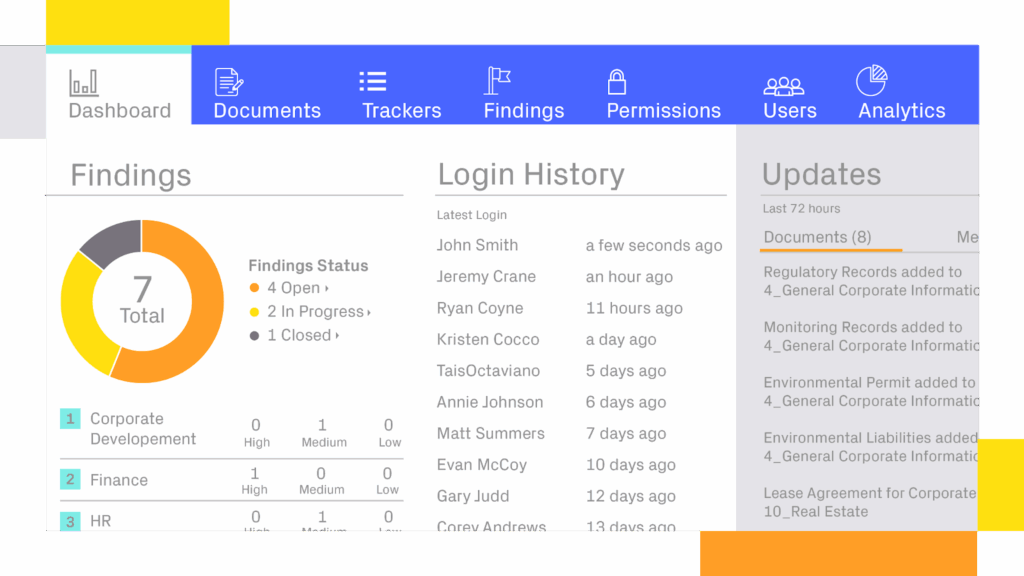

Digify is a cloud-based document security solution featuring robust access control in VDR, document encryption tools, and tracking functionality. In addition, the platform offers file analytics, customizable watermarks, and permission management for printing and downloads. ISO 27001 certified, Digify is trusted by professionals worldwide for secure document sharing and data management.

| Pros | Cons |

| ✔️ Ease of setup ✔️ Ability to drag and drop large numbers of files from a computer ✔️ Helpful to see viewer data and stats during due diligence | ✔️ High cost ✔️ Document-level permissions could be more detailed |

Unlike Intralinks, Digify includes the following features:

- 6-level granular access control

- User access expiration

- Screenshot prevention

- 7-day free trial

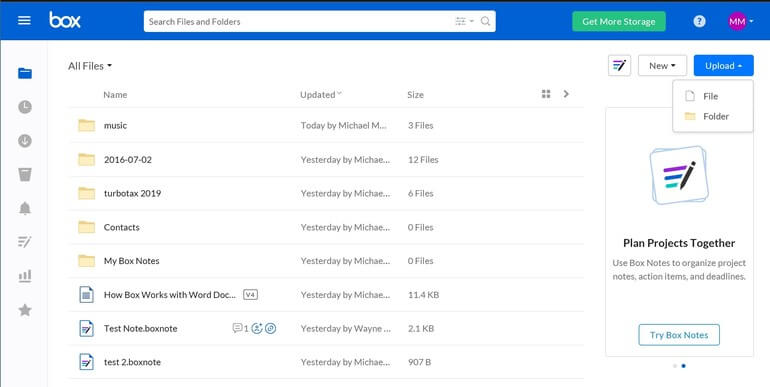

6. Box

Best for: M&A, due diligence, fundraisings, bankruptcy, and clinical studies

Capterra score: 4.4 (5 572 reviews)

G2 score: 4.2 (4 974 reviews)

Box is a secure, user-friendly platform that helps users streamline the entire content lifecycle, from file creation and collaboration to e-signatures, classification, and retention. With over 1,500 integrations, the solution enables seamless workflows across various applications. Trusted by more than 100,000 organizations, Box has been recognized as a leader by major industry analysts.

| Pros | Cons |

| ✔️ Complete cloud software with high reliability and security ✔️ Customizable layouts and folders ✔️ Sharing files with short links | ✔️ The admin functionalities are hard to navigate ✔️ The workspace is pretty generic |

Unlike Intralinks, Box includes the following features:

- 9 data hosting locations

- Subscription to automatic reports

- Full-text search with OCR

- Document labels

- File merging

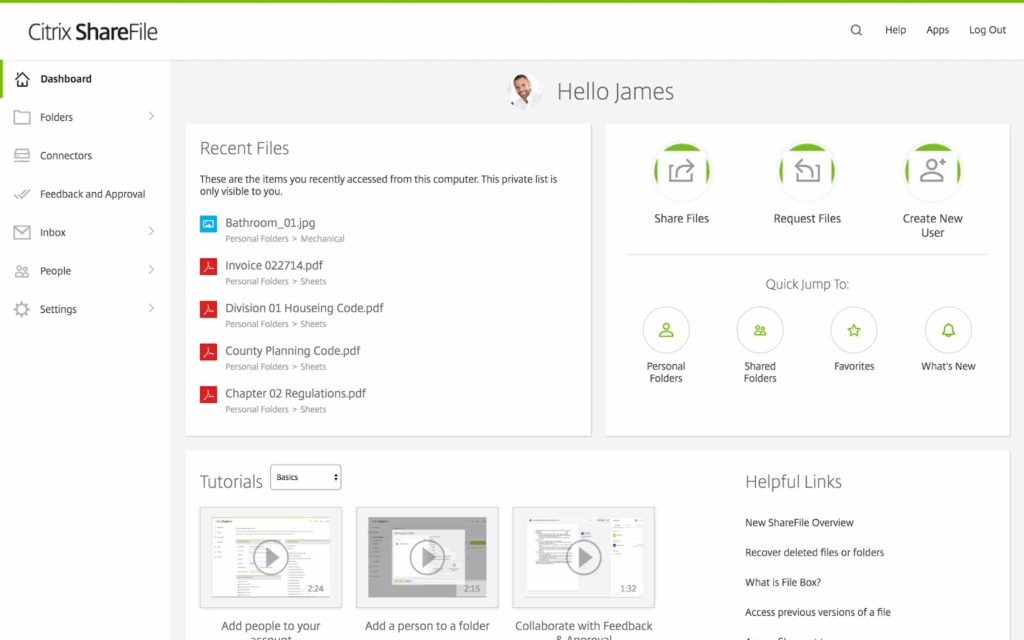

7. Citrix ShareFile

Best for: M&A, board management, real estate transactions, and collaboration

Capterra score: 4.6 (22 reviews)

G2 score: 4.2 (34 reviews)

Citrix ShareFile virtual data room provides secure corporate file sharing and user access management for finance, accounting, legal, and healthcare. It enables business mobility through secure, personalized workspaces, offering instant access to apps, desktops, data, and communications. The platform also features white-labeling options, allowing businesses to customize the interface with logos and colors to reinforce brand identity.

| Pros | Cons |

| ✔️ Simple setup and administration ✔️ Easy data sync ✔️ Good for due diligence | ✔️ Pricey if you need a large amount of storage ✔️ No tagging feature |

Unlike Intralinks, Citrix ShareFile includes the following features:

- 7-level granular access control

- User access expiration

- IP address-based access restriction

- Built-in Excel viewer with formulas

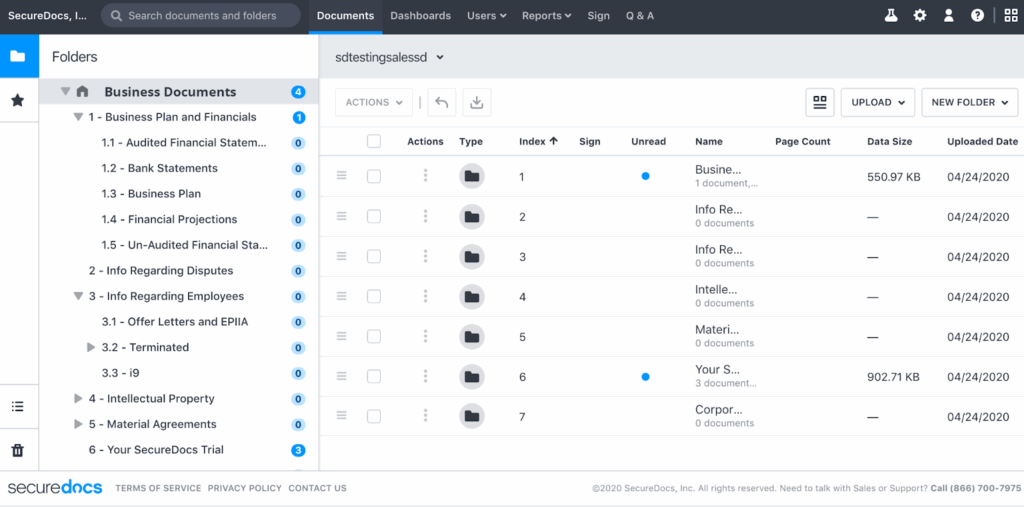

8. SecureDocs

Best for: M&A, strategic partnerships, fundraising, initial public offerings, and corporate document storage

Capterra score: 4.9 (161 reviews)

G2 score: 4.8 (38 reviews)

SecureDocs offers a straightforward, cost-effective, and secure online data room for storing, sharing, and managing sensitive corporate documents. The data room features a quick setup, unlimited users and documents, and 24/7 support.

| Pros | Cons |

| ✔️ Easy to manage multiple data rooms ✔️ New documents notifications ✔️ Helpful reporting capabilities | ✔️ Not able to copy documents between data rooms ✔️ Data export may take time |

Unlike Intralinks, SecureDocs includes the following features:

- EU-US DPF compliance

- E-signature integration

- Advanced data search

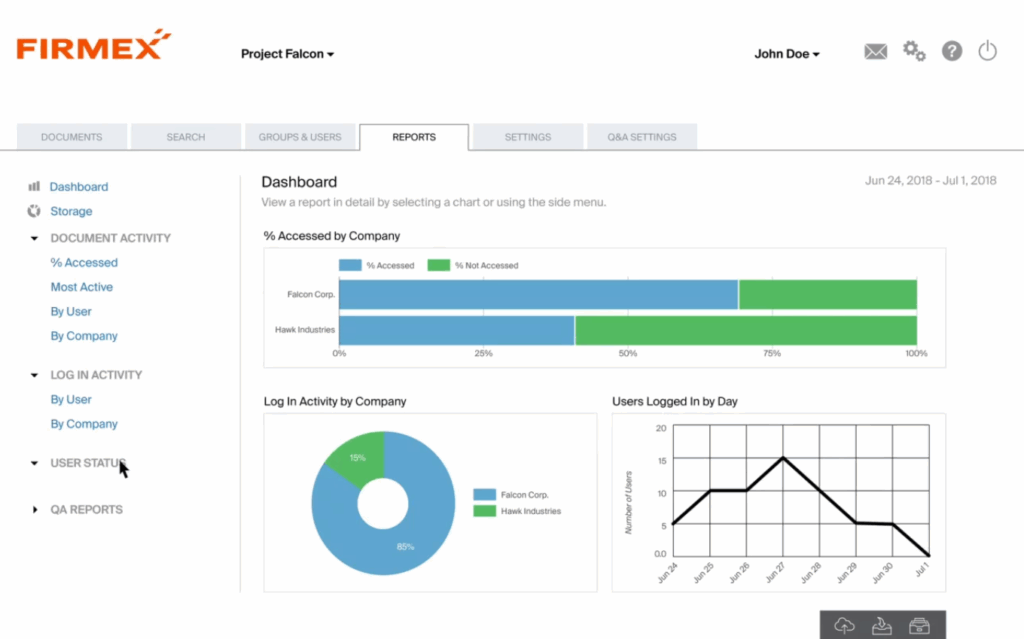

9. Firmex

Best for: Fundraising, M&A, large-scale government and infrastructure projects, and financial audits

Capterra score: 4.8 (328 reviews)

G2 score: 4.6 (70 reviews)

With over 20,000 new data rooms opened annually, Firmex helps thousands of businesses manage sensitive projects securely. Known for its robust security and industry-leading customer service, Firmex offers flexible pricing with unlimited data room subscriptions or per-use transaction options. The platform is SOC 2, GDPR, and HIPAA compliant, featuring SSO, API integration, and redaction tools for better control over critical documents.

| Pros | Cons |

| ✔️ Easy of use ✔️ Implementation of innovative features ✔️ Excellent customer service | ✔️ Some of the features could be easier to find ✔️ Search function could be improved |

Unlike Intralinks, Firmex includes the following features:

- 6-level granular access control

- Strong flash drive security

- 14-day trial period

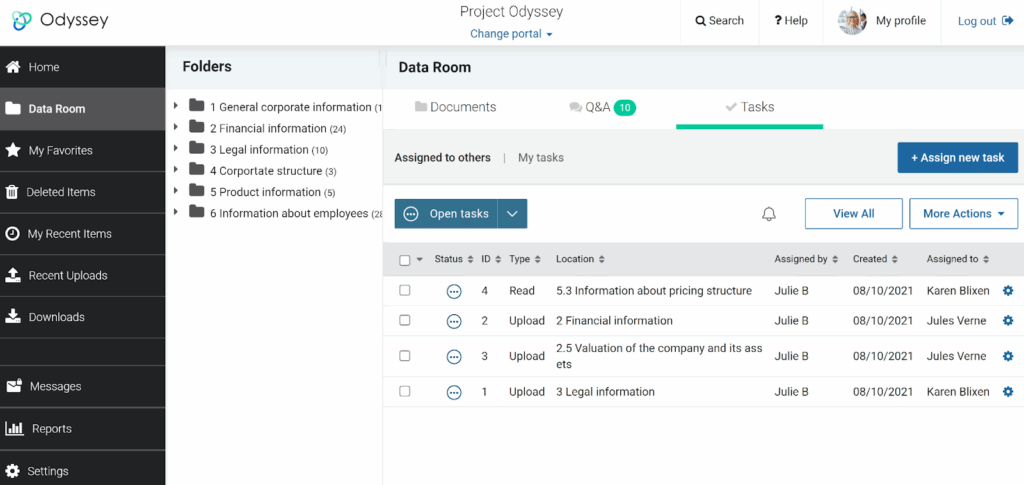

10. Admincontrol

Best for: M&A, due diligence, strategic partnerships, corporate fundraising, and litigation

Capterra score: –

G2 score: 4.6 (4 reviews)

Admincontrol data rooms provide an intuitive platform for sharing confidential documents and conducting Q&A rounds. With user-friendly features, the software ensures seamless collaboration and effective workflows for all parties involved. Also, Admincontrol is one of the leading cloud-based data rooms in the Nordics.

| Pros | Cons |

| ✔️ User-friendly ✔️ E-signature tool | ✔️ Not all aspects are intuitive for admins |

Unlike Intralinks, Admincontrol includes the following features:

- 5-level granular access control

- Full-text search with OCR

- File merging

- 14-day trial period

Choosing the best data room solution takes more than just comparing their key features and user reviews because providers also vary in pricing. So, we break down the cost and value for money of Intralinks and its competitors below to help you make an informed decision.

Cost comparison and value proposition: Intralinks vs. competitors

Here is a comparison of leading virtual data room providers, outlining their pricing models, scalability, pricing details, and what users say about them:

| Provider | Pricing model | Scalability | Pricing | What users say |

| Intralinks | per user | high data volume and user capacity | contact sales | 🔸 often more expensive than other providers 🔸 competitors may offer similar features for less |

| Ideals | subscription-based | customizable and scalable features | contact sales | 🔸 more affordable than other solutions 🔸 easy to choose a plan for specific needs and budget |

| Ansarada | per month | ai-powered scalability | starts from $479 | 🔸 free access to all features until the first guest user is invited 🔸 pricing options and systems may be unclear |

| Datasite | per page | enterprise-level scalability | contact sales | 🔸 pricing plans are reasonable 🔸 a good amount of storage for the cost |

| Donnelley Venue | per feature | high data volume support | contact sales | 🔸 good value for money |

| Digify | per month | scalable for small to mid-sized projects | starts from $130 | 🔸 affordable price 🔸 add-ons could be priced more competitively |

| Box | per user | highly scalable for businesses of all sizes | starts from $17,30 per user/month | 🔸 flexible pricing plans 🔸 fair pricing |

| Citrix ShareFile | per user | scalable for businesses of all sizes | starts from $16 per user/month | 🔸 could be costly for users requiring a large amount of storage |

| SecureDocs | flat-fee | simple and scalable for SMBs | starts from $400 | 🔸 competitive pricing 🔸 missing advanced features compared to more pricey providers |

| Firmex | per month | scalable for small and large transactions | contact sales | 🔸 fixed pricing structure 🔸 high cost-effectiveness |

| Admincontrol | subscription-based | suitable for SMBs and corporations | starts from €300 | 🔸 no reviews about pricing |

Selecting the right virtual data room software depends on your scalability, pricing, and functionality needs. Therefore, evaluate the options carefully based on the size and complexity of your projects.

Key takeaways

- Intralinks data rooms offer strong security, compliance features, and AI-assisted workflows, making them a trusted choice for M&A and financial transactions. However, occasional glitches, usability challenges, and pricing concerns affect the user experience.

- The best Intralinks alternative is Ideals, which delivers better data security, improved usability, and advanced data and user management tools.

- While Intralinks is expensive for some users, competitors offer more flexible and cost-effective pricing structures, such as subscription-based models or flat fees, making them attractive for businesses with budget constraints.

Financial transactions are like a high-security site with restricted access. So, manage your site properly and control who gets in!